Structured annuity sales soar higher in strong Q3 market, Wink reports

Structured annuities sold strong yet again in the third quarter, Wink, Inc. reported, showing that the unique products have more room to run.

Also known as registered indexed-linked annuities, structured annuity sales in the third quarter were $11.4 billion, up 6% compared to Q2 and up 12.5% over Q3 2022. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

“Structured annuities sales set another record this quarter and will do so again for 2023,” Sheryl J. Moore, president of Moore Market Intelligence and Wink Inc., said. “I am projecting that structured annuity sales will top variable annuity sales by next quarter.”

Noteworthy highlights for structured annuities in the third quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 26.6%. Allianz Life ranked second, while Prudential, Brighthouse Financial and Lincoln National Life completed the top five carriers in the market, respectively.

Equitable Financial’s Structured Capital Strategies Plus 21 was the No. 1 selling structured annuity, for all channels combined, for the sixth consecutive quarter.

Total third quarter sales for all deferred annuities were $78.6. billion, Wink said. Sales were down 1.4% when compared to the previous quarter and up 8.5% when compared to the same period last year. All deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and multi-year guaranteed annuity product lines.

Noteworthy highlights for all deferred annuity sales in the third quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 8.5%. MassMutual moved into second place, while Equitable Financial, Corebridge Financial and Allianz Life rounded out the top five carriers in the market, respectively.

MassMutual Stable Voyage 3-Year, a MYGA, was the No. 1 selling deferred annuity, for all channels combined, in overall sales for the quarter.

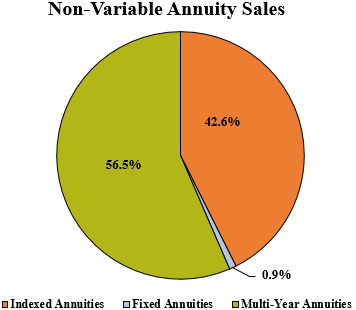

Total third quarter non-variable deferred annuity sales were $54.7 billion. Sales were down 2.3% when compared to the previous quarter and up 12.1% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the third quarter include Athene USA ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 11.9%. MassMutual held onto second place while Corebridge Financial, Global Atlantic Financial Group and American Equity Companies completed the top five carriers in the market, respectively.

MassMutual Life Stable Voyage 3-Year was the No. 1 selling non-variable deferred annuity for the quarter, for all channels combined.

Total third quarter variable deferred annuity sales were $23.8 billion. Sales were up 0.8% when compared to the previous quarter and up over 0.9% when compared to the same period last year.

Variable deferred annuities include structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the third quarter include Equitable Financial ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 19.4%.

Jackson National Life continued in the second-place position, as Lincoln National Life, Allianz Life, Brighthouse Financial concluded the top five carriers in the market, respectively. Equitable Financial’s Structured Capital Strategies Plus 21, a structured annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales for the second consecutive quarter.

Indexed annuity sales for the third quarter were $23.3 billion. Sales were down 7.2% when compared with the previous quarter, and up 11.2% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Noteworthy highlights for indexed annuities in the third quarter include Athene USA ranking as the No. 1 seller of indexed annuities, with a market share of 11.4%. American Equity Companies moved into the second-ranked position, while Allianz Life, Corebridge Financial, and Sammons Financial Companies rounded-out the top five carriers in the market, respectively.

Allianz Life’s Allianz Benefit Control Annuity was the No.1 selling indexed annuity, for all channels combined, for the fifth consecutive quarter.

“Indexed annuities couldn’t top last quarter’s record sales, but expect sales to set a record for 2023," Moore said.

Strong indexed annuity sales

Traditional fixed annuity sales in the third quarter were $495.9 million. Sales were down 1.4% when compared to the previous quarter, and up 9.8% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the third quarter include Modern Woodmen of America ranking as the No. 1 carrier in fixed annuities, with a market share of 17.0%. Global Atlantic Financial Group ranked second while EquiTrust, CNO Companies, and Western-Southern Life Assurance Company completed the top five carriers in the market, respectively.

Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined, for the thirteenth consecutive quarter.

Multi-year guaranteed annuity sales in the third quarter were $30.9 billion. Sales were up 1.6% when compared to the previous quarter, and 12.9% when compared to the same period, last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the third quarter include MassMutual ranking as the No. 1 carrier, with a market share of 15.9%. Athene USA took the second-ranked position, while Global Atlantic Financial Group, Corebridge Financial, and New York Life rounded-out the top five carriers in the market, respectively.

MassMutual's Stable Voyage 3-Year product was the No. 1 selling multi-year guaranteed annuity for all channels combined for the quarter.

Variable annuity sales in the third quarter were $12.3 billion, down 3.4% as compared to the previous quarter, and down 7.8% as compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the third quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 19.3%. Equitable Financial ranked second, while New York Life, Nationwide, and Lincoln National Life finished out as the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the nineteenth consecutive quarter, for all channels combined.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

5 tips to boost long-term care insurance sales

Proposed change to Medicare Advantage agents’ compensation draws fire

Advisor News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Advisor gives students a lesson in financial reality

- NC Senate budget would set future tax cuts, cut state positions, raise teacher pay

- Americans believe they will need $1.26M to retire comfortably

- Digitize your estate plan for peace of mind

More Advisor NewsAnnuity News

- Augustar generates industry buzz with 24% premium bonus on its FIA

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- GBU Life introduces Defined Benefit Annuity

- EXL named a Leader and a Star Performer in Everest Group's 2025 Life and Annuities Insurance BPS and TPA PEAK Matrix® Assessment

- Michal Wilson "Mike" Perrine

More Annuity NewsHealth/Employee Benefits News

- Krishen Iyer Sets Sights on a For-Profit Company

- UnitedHealth Group stock drops 22%, erasing $100B in market value

- UnitedHealth Group stock drops 22%, erasing $100B in market value, on lower earnings outlook, higher costs

- UnitedHealth Group stock drops 20% as it chops earnings outlook on higher medical costs

- No Waivers Needed for TRICARE Prime Users Outside Drive-Time Standard

More Health/Employee Benefits NewsLife Insurance News

- Citizens Inc. (NYSE: CIA) is a Stock Spotlight on 4/17

- IUL sales: How to overcome ‘it’s too complicated’

- Closing the life insurance coverage gap by investing in education

- MIB Group introduces first e-signature platform specifically for life insurance

- $184.2M financing secured for Seagis East Coast industrial portfolios

More Life Insurance News