Indexed annuity products set record of $25.1B in Q2, Wink finds

Indexed annuity sales roared even higher during the second quarter, according to the Wink Sales & Market Report, setting an all-time quarterly record.

“With rates being as strong as they are, it is no surprise that indexed annuity sales are setting records all over the place,” said Sheryl Moore, CEO of both Wink, Inc., and Moore Market Intelligence.

Q2 indexed annuity sales were $25.1 billion, up 11.3% compared to the first quarter, and up 28.3% compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

This was a record-setting quarter for indexed annuity sales, topping the prior first quarter 2023 record by 11.3%, Wink said.

Noteworthy highlights for indexed annuities in the second quarter include Allianz Life ranking as the No. 1 seller of indexed annuities, with a market share of 15%. Athene USA continued in the second-ranked position, while Corebridge Financial, American Equity Companies, and Sammons Financial Companies rounded-out the top five carriers in the market, respectively.

Allianz Life’s Allianz Benefit Control Annuity was the No. 1 selling indexed annuity, for all channels combined, for the fourth consecutive quarter.

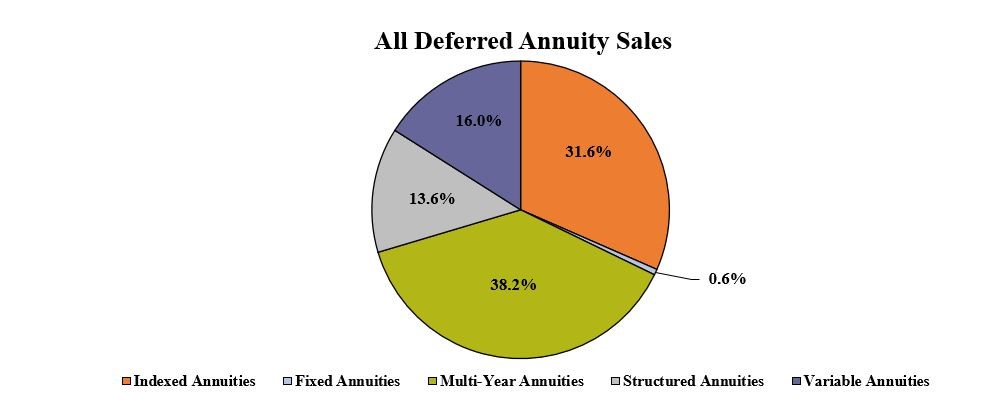

Total second-quarter sales for all deferred annuities were $79.7 billion, down 5.9% compared to the previous quarter and up 9.6% when compared to the same period last year. All deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and multi-year guaranteed annuity (MYGA) product lines.

Noteworthy highlights for all deferred annuity sales in the second quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 8.7%.

Allianz Life moved into second place, while Massachusetts Mutual Life Companies, Equitable Financial, and Corebridge Financial rounded out the top five carriers in the market, respectively. Athene’s Athene MYG 5, a MYGA, was the No. 1 selling deferred annuity, for all channels combined, in overall sales for the second consecutive quarter.

Total second quarter non-variable deferred annuity sales were $56.1 billion, down 10.7% when compared to the previous quarter and up 21.3% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the second quarter include Athene USA ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 12%. Massachusetts Mutual Life Companies held onto second place while Corebridge Financial, Allianz Life, and New York Life completed the top five carriers in the market, respectively.

Athene’s Athene MYG 5 a MYGA, was the No. 1 selling non-variable deferred annuity, for all channels combined, for the quarter for the second consecutive quarter.

Total second-quarter variable deferred annuity sales were $23.6 billion, up 8.1% when compared to the previous quarter and down 10.8% when compared to the same period last year. Variable deferred annuities include structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the second quarter include Equitable Financial ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 19.5%. Jackson National Life continued in the second-place position, as Lincoln National Life, Brighthouse Financial, and Allianz Life concluded the top five carriers in the market, respectively.

Equitable Financial’s Structured Capital Strategies Plus 21, a structured annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales.

Traditional fixed annuity sales in the second quarter were $503.3 million, up 31.4% when compared to the previous quarter, and up 3.8% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the second quarter include Global Atlantic Financial Group ranking as the No. 1 carrier in fixed annuities, with a market share of 16.9%.

EquiTrust ranked second, while Modern Woodmen of America, National Life Group, and CNO Companies completed the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined, for the twelfth consecutive quarter.

Multi-year guaranteed annuity (MYGA) sales in the second quarter were $30.4 billion, down 23.7% when compared to the previous quarter, and up 16.3% when compared to the same period, last year. MYGAs have a fixed rate guaranteed for more than one year.

Noteworthy highlights for MYGAs in the second quarter include Athene USA ranking as the No. 1 carrier, with a market share of 13.9%. Massachusetts Mutual Life Companies maintained the second-ranked position, while New York Life, American National, and Corebridge Financial rounded-out the top five carriers in the market, respectively. Athene’s Athene MYG 5 product was the No. 1 selling multi-year guaranteed annuity for all channels, combined for the second consecutive quarter.

Structured annuity sales in the second quarter were $10.8 billion, up 11.8% as compared to the previous quarter, and up 2.7% compared to the same period last year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the second quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 26.6%. Brighthouse Financial ranked second, while Allianz Life, Prudential, and Lincoln National Life completed the top five carriers in the market, respectively. Equitable Financial’s Structured Capital Strategies Plus 21 was the No. 1 selling structured annuity, for all channels combined, for the fifth consecutive quarter.

“Interest in structured annuities is so high right now,” Moore said. “We have even had a new entrant introduce this product in the direct response channel.”

Variable annuity sales in the second quarter were $12.7 billion, up 5.1% as compared to the previous quarter, and down 19.8% compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the second quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 18.8%. Equitable Financial ranked second, while New York Life, Nationwide, and Lincoln National Life finished out as the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the eighteenth consecutive quarter, for all channels combined.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

Finances are straining Americans’ confidence, survey says

Succession planning the family way

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News