Indexed, MYGA annuities set Q1 sales record, says Wink

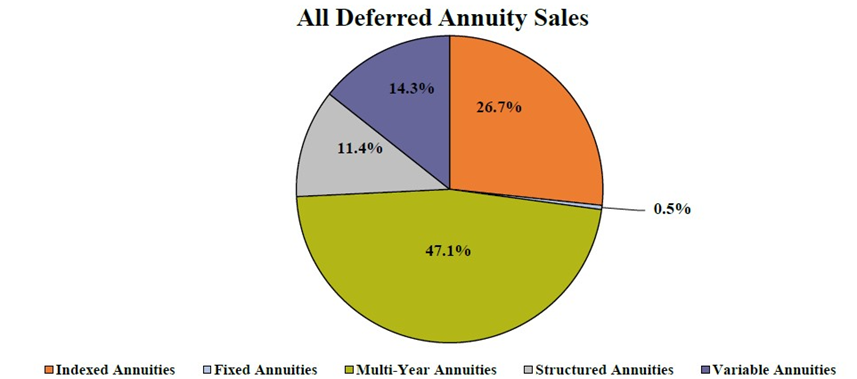

Annuity sales are on a hot streak. In fact, indexed and multi-year guaranteed annuities set an all-time sales record in the first quarter of 2023, with deferred annuity sales at $84.7 billion, up 6.8% compared to the previous quarter, and up a whopping 41.9% compared to the same period last year. Deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and multi-year guaranteed annuity product lines.

Those numbers, compiled by Wink Inc.’s sales and market report, put Athene USA as the number one carrier overall for deferred annuity sales, with a market share of 10.2%. Corebridge Financial was second, while Massachusetts Mutual Life Companies, New York Life, and Allianz Life rounding out the top five carriers in the market. Athene’s MYG 5, was the top selling deferred annuity for all channels combined in overall sales.

The one lagging product was variable annuities, which recorded flat sales in the first quarter and were down more than 34% from a year ago.

“I just keep saying this,” said Sheryl Moore, CEO of both Wink, Inc., and Moore Market Intelligence. “Variable annuity sales likely have never been lower. Until the market turns around, the sales declines will continue.”

Wink’s numbers pretty much track those of LIMRA’s Individual Annuity Sales Survey earlier this month, which pegged total first quarter annuity sales at $92.9 billion, a 47% increase from the prior year. This would represent the highest quarterly sales ever recorded, according to LIMRA’s preliminary results. LIMRA predicts total annuity sales will top $300 billion in 2023 for the second consecutive year.

A perfect storm of faltering stocks and bonds, fears of recession, inflation, and rising interest rates has investors running to what they see as safer havens of annuities, which can offer guaranteed income streams.

“In ugly times, people get concerned about safety,” said Lee Baker, a certified financial planner and founder of Apex Financial Services, based in Atlanta, and a member of the Consumer News and Business Channel’s (CNBC) Advisor Council.

While there are many types of annuities, they mostly belong to two categories of investment or quasi-pension plan offerings. Issued by insurance companies, they provide a hedge against wildly swinging markets or the chances one might expend all their savings in retirement.

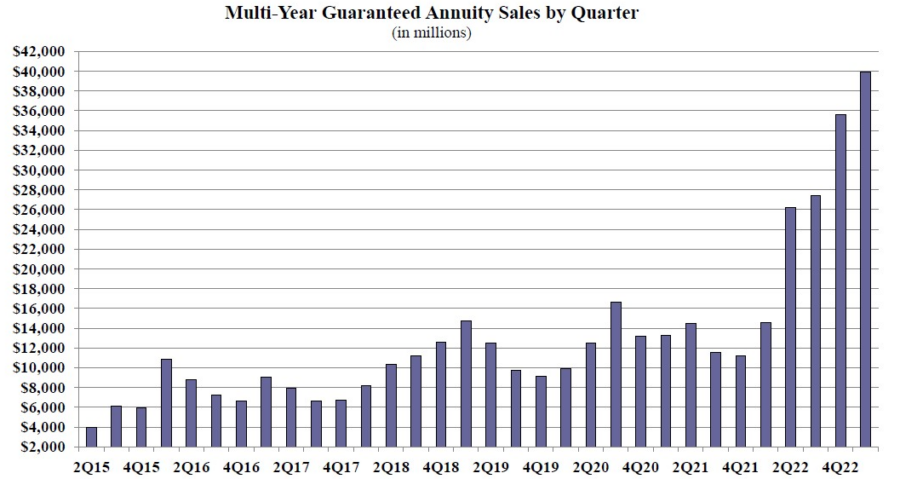

The single biggest sales of annuity products was in the multi-year guaranteed annuity (MYGA) category, which recorded sales of nearly $40 billion in the first quarter, according to Wink, an increase of 12% compared to the previous quarter, and up 173% compared to the first quarter last year. MYGAs have a fixed rate guaranteed for more than one year. The first quarter marked the greatest MYGA sales have been since Wink started tracking sales of the products in 2015.

“As long as CD rates remain so low, relative to annuity rates, you can count on indexed and MYG annuity sales being high,” said Moore.

Indexed annuity sales for the first quarter were $22.6 billion; up 4.4% when compared to the previous quarter, and up 35.5% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of external indices, such as the Standard and Poor’s 500.

While increasingly popular, annuities aren’t right for everyone, financial mangers caution. For one thing, the older one is when they contract the annuity, the higher the rates will be compared to one purchased at a younger age. They also lack some flexibility as they are locked in at time of purchase and cannot be moved to take advantage of rising interest rates. Financial planners also note that situations change while annuity rates are fixed and cannot be adjusted for changing income needs. Annuity income is also taxed at marginal rates of 22% to 35% for middle-income households.

“Higher interest rates have made annuities an attractive option for investors since they offer a steady and secure source of income over time, making them especially appealing to baby boomers retiring today who are looking to supplement their fixed sources of income,” Eric Hutter a financial professional and host of the Eric Hutter Safe Money And Income Radio Show, told annuities.com. “Additionally, with more and more baby boomers reaching retirement age every day, there is a continual need for investments that can provide long-term security. These elements have come together to drive record-high fixed annuity sales and propel total annuity sales beyond what was once thought possible.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Empowering African American agents to remain in the game

Unlocking the power of FIAs in a secure retirement plan

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

More Annuity NewsHealth/Employee Benefits News

- Researchers from Boston University Report Findings in Managed Care (Unexplained Pauses In Centers for Disease Control and Prevention Surveillance: Erosion of the Public Evidence Base for Health Policy): Managed Care

- New Managed Care Study Results Reported from University of Houston (Impact of Adjuvant GLP-1RA Treatment on the Adherence of Second-Generation Antipsychotics in Nondiabetic Adults): Managed Care

- New Findings on Managed Care Reported by Lane Moore et al (State Disparities in Medicaid Versus Medicare Reimbursement for Hand Surgery): Managed Care

- New Kentucky House GOP budget fixes insurance issue, ups education spending

- Missouri and Kansas families pay nearly 10% of their income on employer-provided health insurance

More Health/Employee Benefits NewsLife Insurance News