Some states could see home insurance increases as high as 23%, study finds

More homeowners insurance increases are expected this year, with a potential 6% nationwide increase expected, and with some states possibly seeing as much as a 23% increase, according to the latest Home Insurance Projection report from Insurify.

These estimated increases come on the heels of a 20% rate hike over the past two years. With a 6% average national increase, the average national rate would be $2,522 annually, according to Insurify.

The sustainability of local insurance markets in states like Florida are at risk due to vulnerability to hurricanes and other natural disasters. “It’s possible that the highest-risk areas will become uninsurable,” said Betsy Stella, vice president of Carrier Management and Operations at Insurify. “However, where there’s demand, typically a supplier will appear. The question will be, at what cost?”

Here are some top findings based on the analysis of historical data and current trends by Insurify:

- Home insurance costs are projected to increase the most in Louisiana (+23%), Maine (+19%), and Michigan (+14%) by the end of 2024.

- Six of the 10 most expensive cities for home insurance are in South Florida.

- American homeowners are unprepared for flood risks, with at least 60% reporting they don’t have flood coverage in an Insurify survey.

- One in four U.S. homeowners say climate change has affected their home’s value.

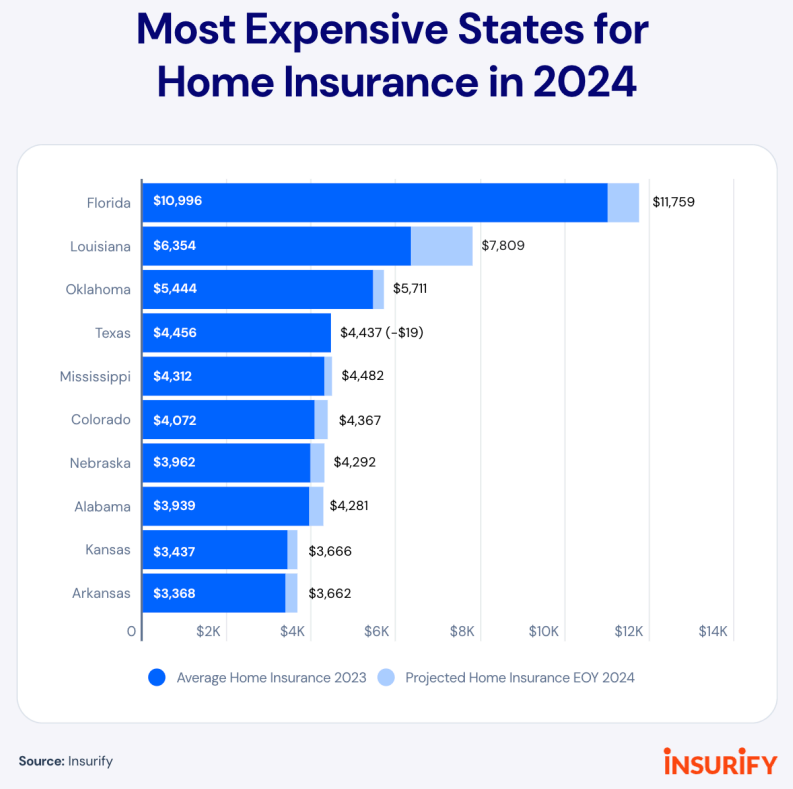

- Florida homeowners pay the most for home insurance, with an average annual rate of $10,996 in 2023. Insurify predicts costs will increase an additional 7% in 2024 to $11,759.

Home insurance costs vary widely by state. Vermont residents pay the least, with an average

annual rate of $918 compared to $10,996 in Florida. Here’s how much homeowners pay across

the country.

The states with the highest home insurance costs are prone to severe weather events. Florida,

Louisiana, Texas, Arkansas, and Mississippi are vulnerable to hurricanes. Texas, Colorado, and

Nebraska face a growing wildfire risk. Nebraska, Texas, and Kansas are at high risk for

tornadoes, being located in an area nicknamed Tornado Alley

In Louisiana, where rates are nearly three times the national average, home insurance costs

could rise an additional 23% in 2024, pushing the average premium above $7,800.

Severe weather risks have long influenced rates in Louisiana, but the effects of climate change

are catching up to states with historically lower-than-average rates, like Maine. The Maine

Climate Council projects a 1.5-foot relative sea level rise (SLR) by 2050. Coastal storm impacts

will increase 10 times in frequency with just one foot of SLR.

North Carolina and South Carolina homes see similar destruction from hurricanes, severe

storms, and flooding. Multiple coastal counties in both states are at a “Relatively High” risk of

natural disasters, according to FEMA’s National Risk Index. Western states, including Utah,

Montana, and Nevada, face a growing wildfire risk.

Rising building repair costs also contributed to rate increases. Connecticut saw year-over-year

residential reconstruction costs increase by 4.1%, according to Verisk’s Q1 2024 360Value

Quarterly Reconstruction Cost Analysis. Rebuild costs in Michigan and Illinois went up more,

with yearly increases between 5.6% and 6.4%.

Fla. home insurance rates jump to $11K per year

The average home insurance rate in Florida was $10,996 in 2023. Insurify’s data science team

predicts an additional 7% increase this year, making the projected average rate $11,759 by the

end of 2024.

Nine in 10 (91%) Florida residents are concerned with current homeowners insurance rates,

and 59% believe their personal finances are worse than a year ago, according to a November

2023 poll by independent polling company Cygnal.

Costly natural disasters drive up rates and make it difficult for insurers to maintain profitability in Florida, but multiple factors fuel the state’s insurance industry crisis.

The insurance crisis in Florida has escalated over the past several years. More than a dozen home insurance companies have declared insolvency since 2019. Farmers Insurance stopped covering Florida, and major insurers have non-renewed policies for high-risk homes. Hurricane Ian further propelled the insurer exodus, causing $112.9 billion in damage — $109.5 billion in Florida. The 2022 hurricane was the third costliest to hit the U.S. and the most destructive in Florida’s history, according to the National Oceanic and Atmospheric Administration (NOAA).

When insurers can’t cover the cost of natural disasters, reinsurance steps in. Reinsurance,

essentially insurance for insurers, is a significant factor in the Florida home insurance crisis.

“Insurers rely on reinsurance coverage to cede some exposure to losses,” said Betsy Stella,

vice president of carrier management and operations at Insurify. “Reinsurance coverage has

become difficult to secure in Florida, and reinsurance rates have skyrocketed. Reinsurers are

subject to the same factors that impact underlying coverages: an increased number and severity

of natural disasters, inflationary pressures, and labor and materials shortages.”

Insurance fraud and legal system abuse also contribute to high rates in Florida, an Insurance

Information Institute (Triple-I) brief reported. The state’s residents make 9% of all homeowners

insurance claims in the U.S. but account for 79% of lawsuits over claims filed, according to the

Florida Office of Insurance Regulation (OIR).

The Florida legislature has introduced measures combatting two major factors behind the

insurance crisis — legal system abuse and misuse of assignment of benefits (AOB). Some new

legislation, including Senate Bill 7052, increases consumer protections.

Recent proposals have suggested tying home insurance balances to unpaid mortgages,

allowing homeowners to buy insurance policies that match the unpaid mortgage principal rather

than the home’s replacement cost value. Nearly 64% of American homeowners in the Insurify

survey said they would consider it for lower rates.

While the idea could lower premiums, homeowners would be vulnerable to life-changing

financial losses. For instance, if someone insures a $300,000 home for a remaining principal of

$150,000, they take on the risk of being unable to rebuild the home if a natural disaster causes

more than $150,000 in damage.

Cities with the most expensive insurance

Six of the 10 most expensive cities for homeowners insurance are on the South Florida coast,

and all have average annual rates above $11,000. Five of the six Florida cities have a “Very

High” risk of natural hazards, according to FEMA’s National Risk Index.

The Louisiana and Mississippi cities among the 10 most expensive for home insurance are also

near the water and mostly have “Relatively High” FEMA risk ratings.

Methodology

Insurify data scientists turned to their real-time database of insurance quotes from partner

carriers, as well as aggregated rate filings from Quadrant Information Services, to determine the

state of home insurance in 2024.

Unless otherwise stated, rates in this report represent the average annual cost of an HO-3

insurance policy for homeowners with good credit and zero claims within the past five years

covering a single-family, frame house with the following coverage limits: $300,000 dwelling,

$300,000 liability, $25,000 personal property, $30,000 loss of use, and a $1,000 deductible.

Insurify gathered Quadrant rates in representative ZIP codes in the 10 largest cities in every

state. Statewide costs reflect the average rate for homeowners across these ZIP codes.

Survey results come from an Insurify survey of more than 700 homeowners with active home

insurance policies conducted in February 2024. In this survey, Gen Z included ages 22–27,

millennials accounted for ages 28–43, and Gen X spanned ages 44–59

Most HSA owners taking distributions but few are investing

Insurers should review their tax-exempt holdings

Advisor News

- The silent retirement savings killer: Bridging the Medicare gap

- LTC: A critical component of retirement planning

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- Otsuka Medical Devices/Otsuka Pharmaceutical: Paradise Ultrasound Renal Denervation System for the Treatment of Resistant Hypertension, Now Covered by Insurance and Commercially Available in Japan

- After enhanced Obamacare health insurance subsidies expire, the effects are starting to show

- CommunityCare: Your Local Medicare Resource

- AG warns Tennesseans about unlicensed insurance seller

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

More Health/Employee Benefits NewsLife Insurance News

- Baby on Board

- Kyle Busch, PacLife reach confidential settlement, seek to dismiss lawsuit

- AM Best Revises Outlooks to Positive for ICICI Lombard General Insurance Company Limited

- TDCI, AG's Office warn consumers about life insurance policies from LifeX Research Corporation

- Life insurance apps hit all-time high in January, double-digit growth for 40+

More Life Insurance News