Insurers should review their tax-exempt holdings

Insurance companies have been allocating away from tax-exempt bonds in response to lower corporate tax rates and rich tax-exempt valuations.

This reduction has largely been passive, with cashflows from tax-exempt holdings reinvested into taxable fixed income. However, two years of headwinds for property/casualty insurers has left many with tax loss carryforwards, and that may warrant a more active approach.

In our view, switching from tax-exempt to taxable municipals, thus largely retaining municipal market exposure, is a particularly attractive way to help enhance yields while retaining the benefits of municipal bonds.

Tax-exempt income has been losing its appeal to insurers

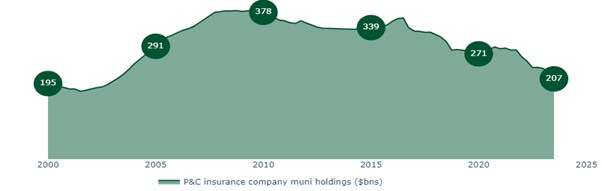

P/C municipal bond holdings (a large proportion of which are tax-exempt) have fallen from a peak of $380 billion to $207 billion, the lowest since the start of the millennium.

P/C insurers have been allowing their tax-exempt holdings to fall

Source: Federal Reserve, February 2023

The calculus for tax exempt income changed with the Trump administration’s Tax Cuts and Jobs Act. The legislation did two things. The obvious one was to reduce the corporate tax rate from 35% to 21%. It also eliminated the ability of municipalities to issue tax exempt bonds for “advanced refunding” of previously issued debt.

The second element gave municipals fewer reasons to issue bonds (pandemic-era federal aid would later compound this effect). The partial result of lower supply was to push tax-exempt municipal bond yields below attractive thresholds for most P/C insurers. The ratio of tax-exempt yields to Treasury yields has averaged 73% over the last three years, but the tax benefits only generally become attractive for insurers at the 83% level.

But the reallocation effort has been a slow one. Many insurers have been content to let their tax-exempt holdings mature rather than actively sell them given their aversion to realizing losses.

Weak operating results have further eroded the benefits of tax exemption

P/C insurers have faced a perfect storm of profitability challenges over the last two years from inflation, climate related disasters, higher interest rates and rising reinsurance costs.

The industry’s combined ratio rose above 100 in 2022 for the first time since 2017 and S&P projected it stayed there in 2023. Things may subsequently improve but we expect reinsurance costs will remain a challenge.

Profitability may be challenged for some time

Source: S&P Global, June 2023. Any projections or forecasts contained herein are based upon certain assumptions considered reasonable. Projections are speculative in nature and some or all of the assumptions underlying the projections may not materialize or vary significantly from the actual results. Accordingly, the projections are only an estimate.

Insurers that were cautious about selling before might want to reconsider now, particularly as we think the losses realized from selling the bonds may not be as debilitating as they first appear.

Selling tax-exempt bonds may pay for itself

We have found that switching from tax-exempt municipals to taxable municipals and other instruments such as mortgage-backed securities, if carefully managed, can potentially result in a yield pickup up of 2% to 3% on those holdings. In our experience, this has improved investment income as much as 40bp to 50bp at the total portfolio level. Of course, we must caveat that past performance is not a guide to future performance.

Taxable municipal bonds offer everything insurers appreciate about the tax-exempt municipal market, such as high credit quality and an admirable default track record through recessions (the market recorded an average 10-year default rate of only 0.2% during the last seven recessions compared to global corporates, at 10.4% according to Moody’s).

Although selling tax-exempt bonds will likely mean crystallizing losses, for the clients we have worked with, the “payback period” from the extra yield can be as short as six to 12 months. The payback period can also be managed – selling tax-exempt bonds does not need to be an all-or-nothing decision. Insurers that feel “stuck” with their tax-exempt allocations may have more flexibility than they realize to reduce their allocations.

Kerry O’Brien is head of insurance portfolio management, Insight Investment. Contact her at [email protected].

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Kerry O’Brien is head of insurance portfolio management, Insight Investment. Contact her at [email protected].

Some states could see home insurance increases as high as 23%, study finds

Black Americans financially stressed, but optimistic, study finds

Advisor News

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

More Advisor NewsAnnuity News

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News