Social Selling

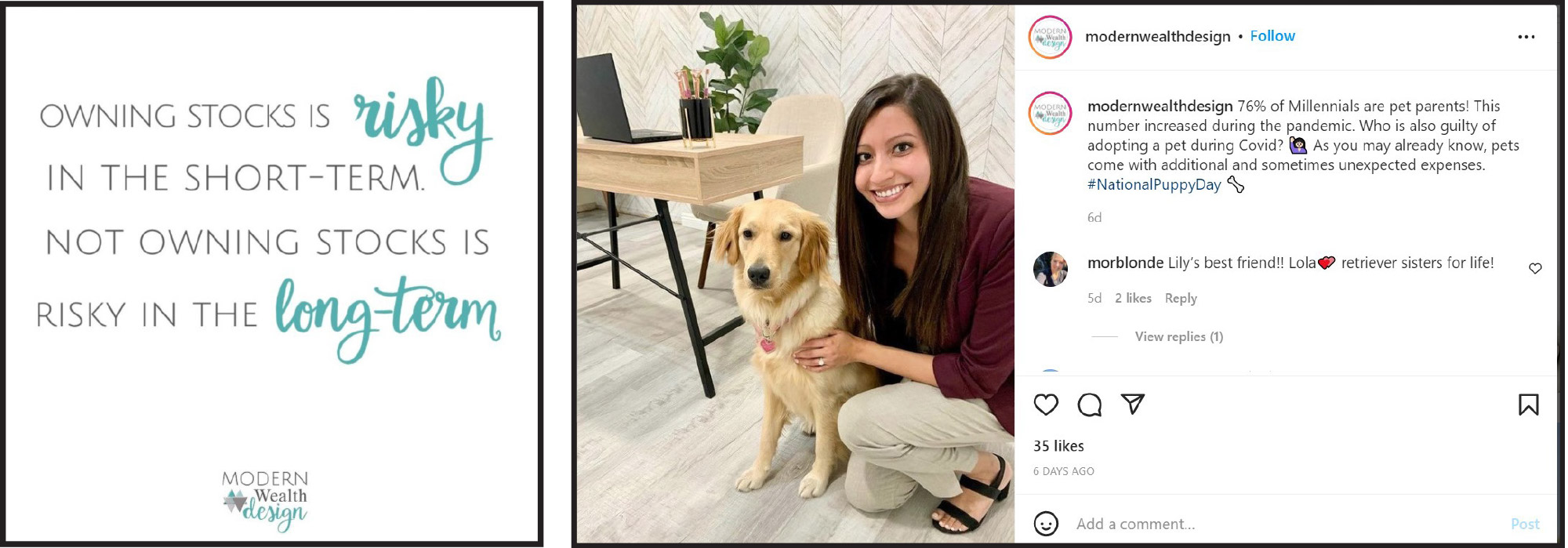

Feb. 20 was National Love Your Pet Day, and that inspired Nicole Letarte to post a photo of a friendly faced dog on her company’s Instagram feed.

It’s one example of how she and her team like to use Instagram and Facebook to have a little fun while getting their practice in front of prospects and clients on two different ends of the age spectrum.

Letarte is a fee-based financial planner with Modern Wealth Design in Irvine, Calif.

Her team has found success using Instagram to attract young professionals as clients.

Meanwhile, she uses Facebook as the vehicle for discussing issues such as Social Security claiming strategies and long-term care with those who are approaching retirement age.

Advisors such as Letarte are finding that social media is no longer just for sharing photos of what their children are doing or for spouting off their opinions on the issue of the day. They are using platforms such as Instagram, Facebook and LinkedIn to position themselves as thought leaders and provide relevant content to prospects and clients.

Instagram is a better platform than Facebook to turn millennials into clients, Letarte said, while Facebook is more of an informational platform for the older generation of existing clients.

“We have had quite a few people direct message us on Instagram and tell us they want to schedule a meeting. So we send them the link to schedule something directly on our calendar,” she said. “And more than 80% of those who schedule the meeting move forward with a financial planning fee.”

Letarte calls Instagram “the Modern Platform” aimed at younger clients and prospects, while Facebook is “the Design Platform” for older clients with more complex planning needs.

“On our Modern Platform, we focus more on young professionals, millennials,” she said. “We focus on goal planning, buying a home, how much they should save for retirement, starting a family, things like that. Our Design Platform is for pre-retirees or those who are already retired. We focus more on Social Security, pension analysis, long-term care and elder retirement assets.”

Letarte plans a calendar of social media posts about a month in advance and estimated it takes her about five hours a month to create and schedule the posts. She said her goal is to post something on social media twice a week.

Some of her firm’s social media posts are personal — stemming from her team’s life experiences.

For example, on March 1, National Wedding Planning Day, she posted a photo of her and her husband from their wedding in Jamaica last year. “We talked about if you’re thinking about getting married, we can help with a plan to save for the big day.”

Posts such as this one get clients and prospects engaged, Letarte said. “We had people comment on that post and even ask us questions.”

Another post on the increase in travel prices inspired her to ask followers to describe the best place they had ever visited on vacation. “It’s fun to get people to interact and comment and tag each other — and just engaged with our posts.”

Many of her team’s posts attempt to put a face to the firm, Letarte said, showing photos of team members participating in various activities, celebrating birthdays or announcing team members’ accomplishments. “We try to make our followers feel as though they’re really getting to know us, rather than following another financial page that is trying to give them financial advice.”

But other posts relate to “fun facts,” such as holidays like National Puppy Day or some other specially designated day. “Sometimes we can tie that into a piece of financial advice or sharing a fun fact about our team,” she said.

Letarte advises someone who wants to plan a social media strategy to begin with considering the type of theme they want to convey throughout their posts. “We have a color scheme that we use that is consistent with the colors on our website, and we keep everything consistent with our branding,” she said. “And you need to develop a schedule for posting information so that you aren’t putting things up there at the last minute.”

Although her firm’s social media strategy has led clients her way, Letarte said her favorite part of using Instagram and Facebook is that clients see a personal side of the team.

“The biggest compliments we’ve received from our clients is that they really get to know us. So when they feel like they know us, they trust us more.”

A Vast Global Reach

Social media platforms once were considered entertainment but are now essential parts of a successful business marketing strategy. Take a look at how much social media dominates our collective communication.

» About 330 million people are active on Twitter every month.

» About 500 million tweets are sent every day, which amounts to more than 200 billion tweets per year.

» 1.22 billion people use Instagram monthly.

» 59% of U.S. adults use Instagram daily, and 38% of those daily visitors log on to the platform multiple times per day.

» LinkedIn has nearly 800 million users in more than 200 countries. The platform is also home to more than 57 million companies.

» Two new members join LinkedIn every second.

» An average of 1.62 billion users visit Facebook every day. That means just under a quarter of the entire world population is a daily active Facebook user.

» In 2021, 400 users signed up for Facebook every minute.

» 1.3 billion people use YouTube, and YouTube gets more than 30 million visitors per day.

» Almost 5 billion videos are watched on YouTube every day, and 300 hours of video are uploaded to YouTube every minute.

With so many people tuned in to social media and getting their information from online platforms, why wouldn’t an advisor want to have a social media presence? But using social media as a prospecting tool takes planning and strategy, according to those who coach advisors in the art of social media sales. A “throw it all against the wall and see what sticks” mentality won’t work.

A Plan Is The First Step

The first step toward successfully developing a social media selling strategy is creating a plan. The second step is realizing that different platforms have different purposes and attract different audiences. That’s the word from Peter Dziedzic, president and general counsel of Life Insurance Strategies Group in Boston.

Dziedzic helps companies in the high-net-worth life insurance space build their brand identities and design their messaging. He also coaches advisors on using social media.

An effective social media strategy begins with figuring out your personal brand and being consistent with how you present that brand on social media, he said.

“I saw a statistic that said 56% of consumers make a decision on whether they will work with you or buy from you before they even send you an email, send you a text or pick up the phone,” he said. “So, you need to be out in those digital spaces. But you also need a consistent look and feel and a consistent message on social media.”

Before you create a single social media post, Dziedzic advised, you must determine your practice niche. “Are you an employee benefits person? A life insurance person? What are your top two strengths?”

After identifying these things, he said, the next step is to define your customer. “Are you seeking individual clients? Or are you looking to reach centers of influence where someone will refer clients?”

Finally, Dziedzic said, you must determine the problem you solve for clients and how you solve that problem.

“These are the things you must figure out before you begin doing anything on social media,” he said.

After that preliminary work is done, the next part of social media selling is determining the time and resources you want to spend on it, Dziedzic said.

“Think about how frequently you will be posting. And think about what your content will look like. Will you post quick little hits or will you link to white papers? Will you post photos or videos?”

The next step in social media selling is to decide which platforms are best for reaching your target audience and accomplishing your goals, Dziedzic said.

“LinkedIn is the social media platform where businesspeople talk about business, so that’s definitely a place to start,” he said. “Facebook isn’t a great place for businesses to post, unless you’re paying for a sponsored post.”

Instagram has become a “second website” for many businesses, Dziedzic said, and is a good platform to reach the under-45 crowd, of which Dziedzic is a member.

“When I hear of a restaurant or a business, I go to their Instagram page before I go to their website,” he said. “So having an Instagram presence is important to the extent that it becomes a validator for you, especially for that younger client who uses Instagram to make sure you’re legitimate.”

So you determined your niche market, your ideal client, the problem you want to solve for them, and what platforms you want to use in order to get that social media message across. What’s next? Having a strategy to deliver your message consistently, Dziedzic said. Posting on LinkedIn once a week, the same day each week, is a good place to start.

“Consistent messaging over a long period of time is what helps to build the kind of thought leadership and brand awareness you want. You’re talking to people so you can keep yourself top of mind, so that when someone has a life insurance question, for example, they say, ‘I’m going to call Pete. I see him posting about life insurance topics all the time. That guy knows what he’s talking about.’ That’s what you’re trying to do here.”

If you’re concerned about whether you’ll have enough content to post regularly, Dziedzic recommends taking your existing marketing communications — such as blog posts and newsletters — and adapting them for social media. “You can take a blog post or a newsletter article, break it down into four smaller parts, and create a series of weekly LinkedIn posts that will take you through a month,” he explained.

Consistent posting also boosts social media algorithms, leading to your posts being seen more frequently and building a bigger audience. It all can have a spillover effect on other business communication, Dziedzic said.

“We assist some of our clients with their marketing, and we’ve seen that posting consistently on social media leads to higher open rates on their emails. People are used to receiving a certain type of information from advisors who are on social media consistently, and when they see that email from you, they are more likely to open it as well.”

All Strategies Are Not Created Equal

A social media strategy is actually several different strategies — with a different game plan for each different platform you plan to use. That’s the advice Cameo Roberson gives her clients. Roberson is a business coach, operations strategist and managing partner at Atlas Park Consulting in Sacramento, Calif.

“I don’t think it’s wise to apply a Twitter strategy to your LinkedIn profile, or an Instagram strategy to your Twitter profile,” she said.

Twitter is like a town hall meeting, Roberson said, “with everyone sharing relevant information in quick bites, and then others see it and engage with it.”

Facebook “is more like your grandmother’s living room,” she said. “You have people talking about family and different events. And what you say on Twitter is not necessarily what you would share on Facebook and vice versa.”

LinkedIn “is more of the professional face of individuals and their companies, where conversations tend to be more professional in nature,” Roberson said. “Instagram is more for sharing photos or video clips of things that are going on in your world.”

Roberson said she frequently uses Facebook “to be social selling, but not direct selling.

“I’m showing myself as a subject matter expert in groups where I know my ideal clients hang out,” she explained. “What I will do is listen to the conversations that people are having about advisory practices. And then I will comment, maybe share some insights, some tips and strategies for that poster to be able to take.”

This strategy accomplishes several things, she said. “It humanizes me as someone who can help people. I’m not trying to sell them; I’m answering their question. This helps to establish credibility in terms of the advice that I can give and then also helps to build the know, like and trust factor. And this is something that happens over the course of time.”

Instagram is a way for advisors to show a more personal side of themselves, Roberson said.

“You can share things about your business, but you will want to confine your posts to images, photos or short videos. And don’t write long paragraphs,” she said.

Tweets are limited to 280 characters, which imposes its own set of restrictions on those who post on Twitter. “If you’re able to share short quotes or something impactful or even a video, Twitter will be the place for that,” Roberson said.

Social media selling “is a long game,” Roberson said.

“A big mistake I see people make is when they post one item on social media and they think they immediately will get a client out of it. Then, when they don’t see that immediate return on investment, they don’t want to do it anymore. But if you keep posting on social media, eventually you will see a return.”

Roberson said that social media success boils down to figuring out what your strategy is, committing to it, getting the right content, consistently posting, and doing your follow-up.

Thought Leadership Through LinkedIn

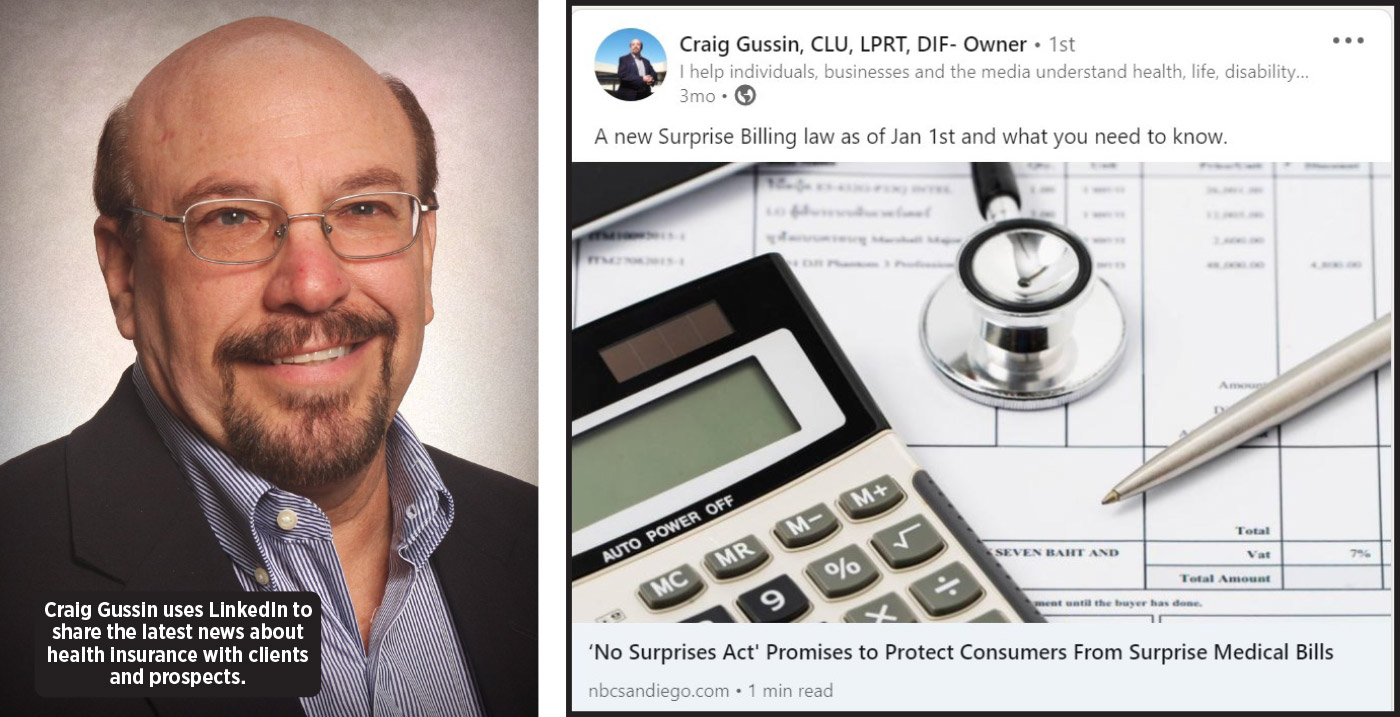

Posting regularly to LinkedIn is a great way to position yourself as a thought leader, Craig Gussin found. He is president and CEO of Auerbach & Gussin Insurance and Financial Services and the RWR Insurance Agency in Carlsbad, Calif.

Gussin actually has two LinkedIn presences and a different profile photo for each one. For his Auerbach & Gussin profile, he has a headshot and is wearing a jacket but not a tie. For his RWR Insurance profile, he is posing while standing up. The two different photos represent the two different areas that each business serves. Auerbach & Gussin concentrates on health insurance and employee benefits while RWR works with agents who plan to retire and transition out of their practices.

Health insurance is in the news frequently, and Gussin uses LinkedIn to share the latest health-related news with his clients. Gussin also is active in a number of industry associations, including the National Association of Health Underwriters, and he shares the information he obtains from his association connections as well.

Gussin’s LinkedIn posts give him more credibility, he said. “People look at your profile and everything you post, they read everything about you and they think, ‘This guy belongs to all these industry organizations and he knows what’s going on out there.’”

He said he wants to share his knowledge of the industry’s hot-button issues as well as open a dialogue with clients.

“I think that’s what social media is all about — sharing information with others and letting your clients know you are here for them if they have questions,” he said. “It’s marketing yourself in such a way to the consumer or to other agents that they look to you as somebody who can help them.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Orchestrating A Plan — With Cody Garrett

EBRI: Financial Wellness Efforts Lead To Increased Retirement Plan Assets

Advisor News

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- An Application for the Trademark “HUMPBACK” Has Been Filed by Hanwha Life Insurance Co., Ltd.: Hanwha Life Insurance Co. Ltd.

- ROUNDS LEADS LEGISLATION TO INCREASE TRANSPARENCY AND ACCOUNTABILITY FOR FINANCIAL REGULATORS

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

More Life Insurance News