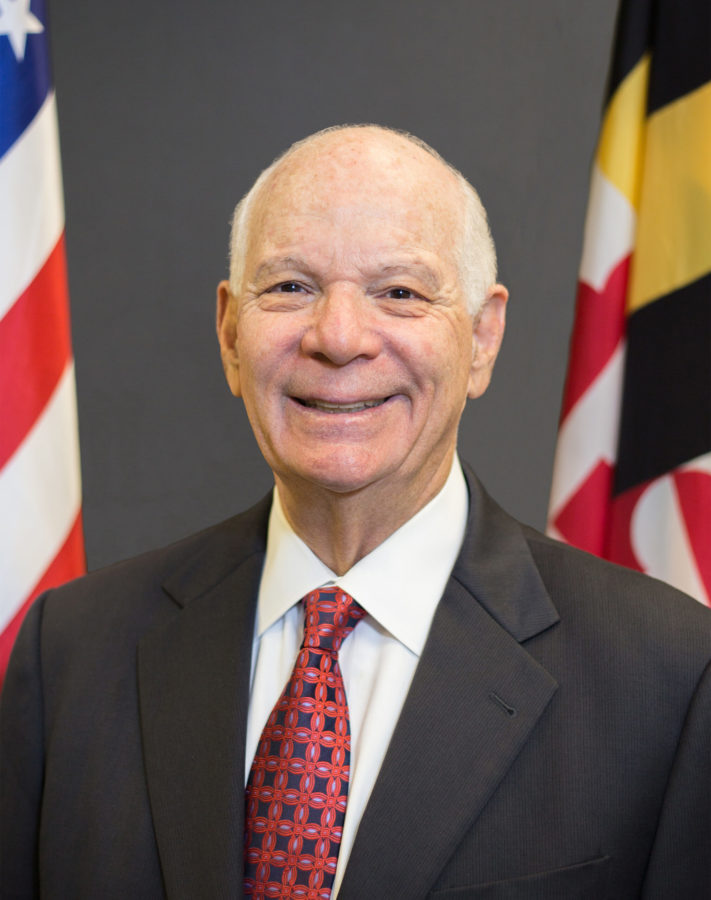

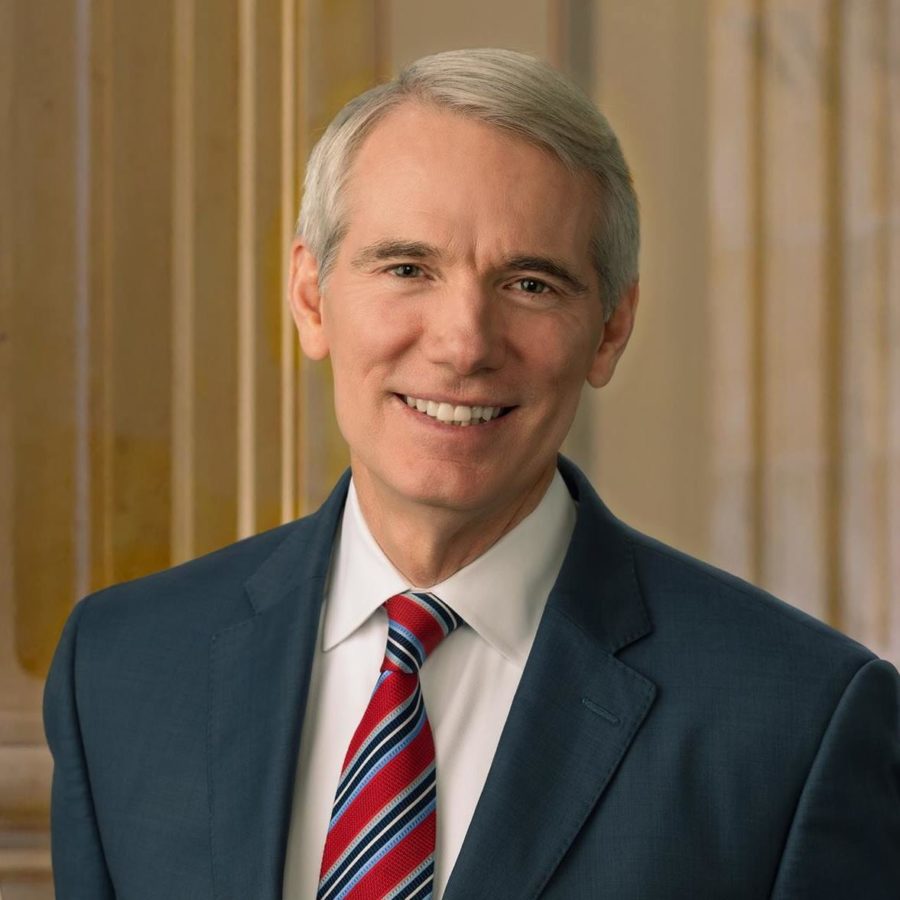

Senators Cardin, Portman receive financial retirement industry award

During a recent EBRI Retirement Summit in Washington, D.C., U.S. Senators Ben Cardin (D-MD) and Rob Portman (R-OH) received the 2021 Ray Lillywhite Award for their lifetime work in enhancing Americans' economic and retirement security.

The Ray Lillywhite Award celebrates contributions by individuals who have had distinguished careers in the retirement and investment management fields and whose outstanding service has enhanced Americans' economic security. The award is presented by EBRI as merited by individual and group excellence and is named after Ray Lillywhite, a pioneer in the pension field who for decades guided state employee pension plans.

“It is a privilege to present U.S. Senators Ben Cardin and Rob Portman with the 2021 Ray Lillywhite Award,” said Lori Lucas, president & CEO, EBRI. “The senators have shown tireless dedication and have been inspirational in their advocacy and leadership to advance policies to improve the retirement system for workers and retirees. Their longtime efforts have been directed to increasing the pension and savings rate for Americans and opening opportunities for more Americans to access the retirement system.”

Cardin is chairman of the Senate Committee on Small Business and Entrepreneurship and is a Senate Committee on Finance member. Among his ongoing efforts to address retirement security, Cardin is particularly focused on providing more opportunities for small business employees to save for retirement by encouraging employers to offer workplace retirement options.

“It is an honor to receive this year’s Ray Lillywhite Award,” said Cardin. “I have spent my career working with Senator Portman to improve the retirement security system in this country. We can and must do more to ensure all Americans have access to the tools they need to live a dignified life in retirement.”

Portman and Cardin have worked on retirement security issues for decades and sponsored numerous retirement saving and pension bills, including major portions of which were incorporated into comprehensive legislation that was enacted into law.

These include the Pension Protection Act of 2006, which among other things removed barriers preventing companies from automatically enrolling employees in defined contribution plans. It also made permanent several pension provisions from the Economic Growth and Tax Relief Reconciliation Act of 2001, including the increased individual retirement account contribution limits and increased salary deferral contribution limits to a 401(k).

Most recently, Cardin and Portman championed the Retirement Security and Savings Act of 2021, which is more commonly referred to as SECURE 2.0.

Women working to strengthen retirement

EBRI’s presentation of the awards comes at a time when many Americans are working to strengthen their retirements and secure a sound financial future. For example, new research released from HerMoney and the Alliance for Lifetime Income reveals that over two-thirds (68 percent) of women see a U.S. recession ahead. However, in these uncertain times—when just two percent say they doubt or don’t believe a recession is imminent—women are doubling down to secure their financial futures.

The fifth chapter of the “State of Women in 2022” study looked closely at women’s economic outlooks and reveals some of the trade-offs they’re willing to make to remain in control of their financial futures. The survey finds that despite a cloudy outlook, 92 percent of women plan to maintain, or even increase, their contributions to retirement accounts, including 401(k)s or IRAs.

“Despite believing a recession is on the horizon, women aren’t letting that interfere with their long-term financial goals,” said Jean Chatzky, Alliance for Lifetime Income Fellow and HerMoney CEO. “Not only do women say that they will stay committed to saving for retirement, two-thirds plan to ‘double down’ on their investments and adopt a now-is-the-time-to-buy mindset.”

According to the survey, a notable majority of working women are ready to make short-term sacrifices in the name of their financial futures:

- •Eyes on the end game: Seventy percent of working women would prefer to max out their annual 401(k) contribution than use $20,500 toward a short-term goal.

- Savings over shopping sprees: Four out of five working women would prefer to max out their annual IRA contribution (80 percent) than purchase a $6,000 luxury item or experience (20 percent).

In general, working women say the top trade-off they make to be able to save for retirement is limiting purchases of luxury goods (79 percent). Millennials are the most likely to make other sacrifices. They’re significantly more likely to limit memberships and subscriptions (61 percent) and make housing trade-offs (48 percent) than Gen Xers and Baby Boomers.

Upon reaching retirement age, the vast majority of working women say they would prefer to delay Social Security to increase their benefit over time (85 percent) than to take Social Security right away (15 percent).

“Our research finds that most women, especially as they age, prefer to have a portfolio that generates retirement income they can count on,” said Jean Statler, CEO of the Alliance for Lifetime Income. “An overwhelming 83 percent of working women would choose a portfolio with reliable retirement income over a risky portfolio with potential for higher returns—jumping even higher, to 88 percent, among Baby Boomers. Women have told us time and time again that they prioritize saving and have peace of mind when they know they have enough protected income to last throughout retirement.”

The online study was conducted from October 4 to October 17, 2022, among over 1,100 women who are members of the HerMoney community. They range in age from 18 to over 75, most are college-educated and are employed full-time. Nearly two-thirds are married or partnered.

The Alliance for Lifetime Income is a non-profit organization that creates awareness and educates Americans about the value and importance of having protected lifetime income in retirement.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

After a disappointing 2022, expect a ‘wild ride’ next year, says investment strategist

RetireOne and Nationwide partner to distribute menu of advisory annuity solutions

Annuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- One Bellevue Place changes hands for $90.3M

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

More Life Insurance NewsProperty and Casualty News

- Too little, too late, too weak: Critics react to proposed insurance legislation

- Q&A on revised FEMA flood insurance maps

- Commercial auto insurance eligibility for nonbusiness owners: A 50-state overview

- How Selma Residents Are Safeguarding Wealth with Precious Metals Amid Economic Recovery

- W. R. Berkley Corporation Names Erin Rotz President of Berkley Fire & Marine

More Property and Casualty News