Second Quarter Deferred Annuity Sales Up 10-40%, Wink Reports

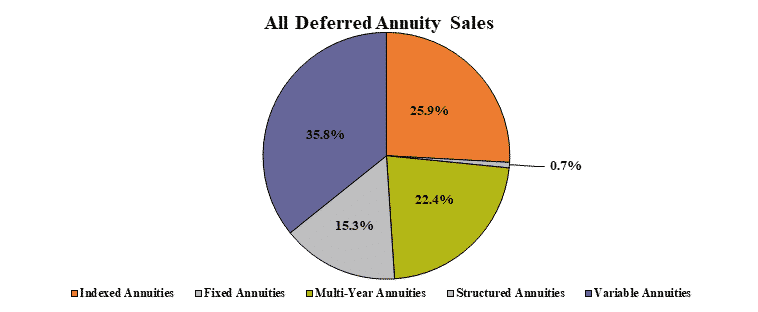

Total second-quarter sales for all deferred annuities were $64.4 billion, an increase of more than 10% when compared to the previous quarter, according to Wink’s Sales & Market Report.

Sales represent an increase of 40.4% when compared to the same period last year, Wink reported.

Total deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for all deferred annuity sales in the second quarter include Jackson National Life ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 7.5%. AIG moved into second place, while Equitable Financial, Allianz Life, and New York Life rounded out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling deferred annuity, for all channels combined in overall sales for the tenth consecutive quarter.

Total second quarter non-variable deferred annuity sales were $31.5 billion, up 11.1% when compared to the previous quarter and up 22% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the second quarter include AIG ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 8.1%. Global Atlantic Financial Group moved into second place, while Massachusetts Mutual Life Companies, New York Life, and Allianz Life completed the top five carriers in the market, respectively.

Allianz Life’s Allianz Benefit Control Annuity, an indexed annuity, was the No. 1 selling non-variable deferred annuity, for all channels combined in overall sales for the second consecutive quarter.

Total second quarter variable deferred annuity sales were $32.9 billion, an increase of 9.4% when compared to the previous quarter and an increase of 63.5% when compared to the same period last year. Variable deferred annuities include the structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the second quarter include Jackson National Life ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 14.6%. Equitable Financial held onto the second-place position, as Lincoln National Life, Nationwide, and Brighthouse Financial concluded the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined in overall sales for the tenth consecutive quarter.

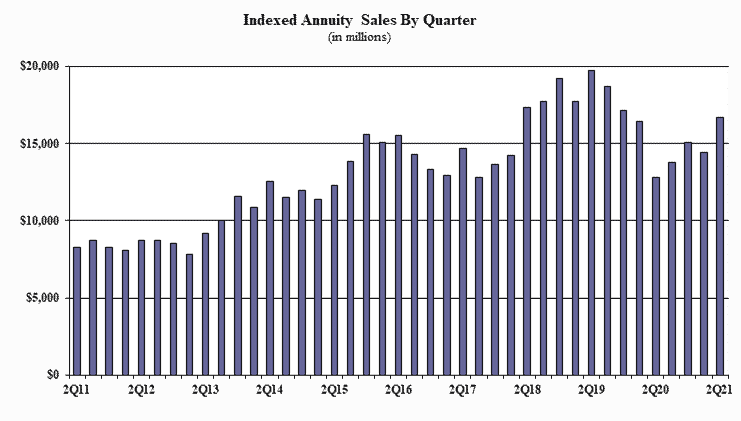

Indexed annuity sales for the second quarter were $16.6 billion, up 14.5% when compared to the previous quarter, and up 29.9% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Noteworthy highlights for indexed annuities in the second quarter include Allianz Life ranking as the No. 1 seller of indexed annuities, with a market share of 10.7%. Athene USA moved into the second-ranked position while AIG, Fidelity & Guaranty Life and Sammons Financial Companies rounded out the top five carriers in the market, respectively.

Allianz Life’s Allianz Benefit Control Annuity was the No. 1 selling indexed annuity, for all channels combined for the third consecutive quarter.

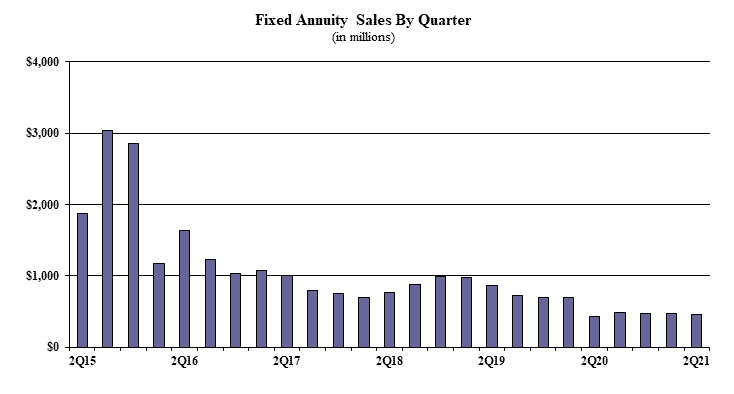

Traditional fixed annuity sales in the second quarter were $462 million. Sales were down 3.1% when compared to the previous quarter, and up 8.5% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the second quarter include Modern Woodmen of America ranking as the No. 1 carrier in fixed annuities, with a market share of 18.4%. Global Atlantic Financial Group ranked second, while Jackson National Life, American National, and EquiTrust rounded out the top five carriers in the market, respectively.

Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined for the fourth consecutive quarter.

Sheryl Moore, CEO of both Wink, Inc. and Moore Market Intelligence: “unfortunately, fixed annuities with a one-year guaranteed rate have been a casualty of the low interest rate environment. That aside, we are on track for 2021 to be the best year for overall annuity sales ever.”

Multi-year guaranteed annuity (MYGA) sales in the second quarter were $14.4 billion, up 8.6% when compared to the previous quarter, and up 15.2% when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the second quarter include New York Life ranking as the No. 1 carrier, with a market share of 13%. Massachusetts Mutual Life Companies took the second-ranked position, as Global Atlantic Financial Group, AIG, and Western-Southern Life Assurance Company rounded-out the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year was the No. 1 selling multi-year guaranteed annuity for all channels combined.

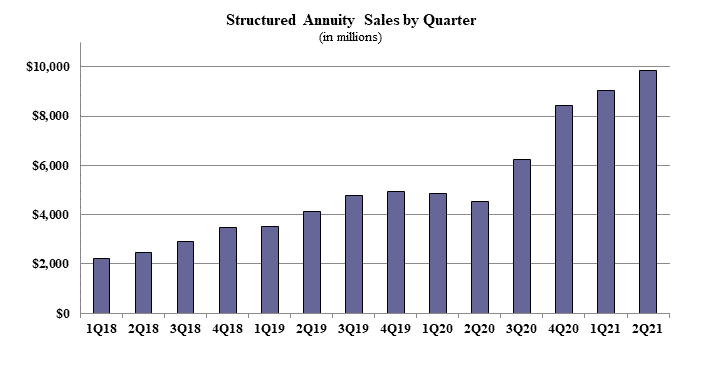

Structured annuity sales in the second quarter were $9.8 billion, up 8.9% as compared to the previous quarter, and up 117.9% as compared to the previous year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the second quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 19.3%. Allianz Life ranked second, while Lincoln National Life, Brighthouse Financial, and Prudential completed the top five carriers in the market, respectively.

Equitable Financial’s Structured Capital Strategies Plus was the No. 1 selling structured annuity for all channels combined, for the second consecutive quarter.

“Structured annuities are definitely the darling of the deferred annuity market” Moore said. “Everybody’s doing it. If a company isn’t selling it today, they’re doing R&D on it. Structured annuities are here to stay.”

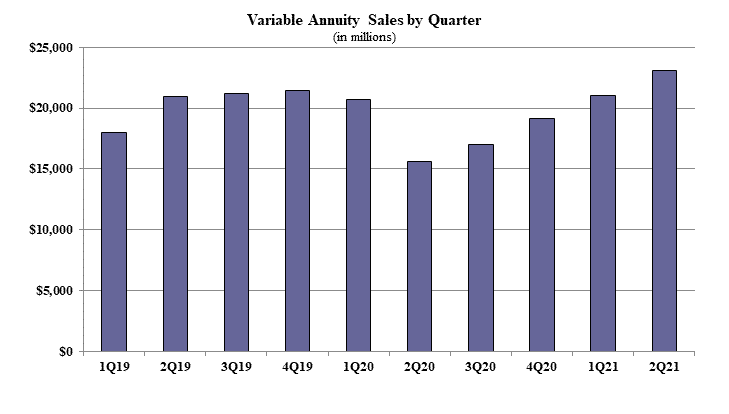

Variable annuity sales in the second quarter were $23 billion, an increase of 9.6% as compared to the previous quarter and an increase of 47.8% as compared to the same period last year. Variable annuities have no floor, and potential for gains/losses that are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the second quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 20.9%. Nationwide ranked second, while Equitable Financial, Pacific Life Companies, and AIG finished out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the ninth consecutive quarter, for all channels combined.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

Sixty-six indexed annuity providers, 46 fixed annuity providers, 70 multi-year guaranteed annuity (MYGA) providers, 14 structured annuity providers, and 43 variable annuity providers participated in the 96th edition of Wink’s Sales & Market Report for 2nd Quarter, 2021.

The Medicare Maze

Congress Trying To Make Retirement Saving Easier, IRI Members Told

Advisor News

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

More Advisor NewsHealth/Employee Benefits News

- Rising health costs could mean a shift in making premium payments

- SENSITIVITY OF THE DISTRIBUTION OF HOUSEHOLD INCOME TO THE TREATMENT OF HEALTH INSURANCE FROM 1979 TO 2021

- Thousands in state face higher health insurance costs

- Thousands facing higher health insurance costs

- Trump wants GOP to 'own' health care issue but show 'flexibility' on abortion coverage restrictions

More Health/Employee Benefits NewsLife Insurance News

Property and Casualty News

- Insurance Premium Pressure: 57% Have Made Financial Sacrifices to Afford Home Insurance | Insurify

- Best’s Special Report: Lower U.S. Property/Casualty Insurer Expenses Boost Segment’s Underwriting Results

- AIG CEO Peter Zaffino to step aside by mid-2026; succession plan revealed

- Alinsco Insurance Completes Zero-Downtime VMware Exit with VergeOS

- The Hartford Expands Technology Team With New Office In Columbus, Ohio

More Property and Casualty News