SEC Claims Texas Advisor Used Life Insurance To Fuel $58M Scam

The Securities and Exchange Commission charged a San Antonio-based advisor with scamming nearly 300 investors out of $58 million over six years.

According to court documents, Robert J. Mueller, allegedly pitched a scam that unfolded like this: investors were persuaded to cash out annuities or individual retirement accounts to invest in funds Mueller controlled.

Mueller was an advisor for two pooled investment funds that he created, the SEC claimed, while his company, deeproot Funds, also served as an advisor.

Mueller and deeproot "told investors the funds would invest in life insurance policies and deeproot-related businesses to provide relatively safe returns to investors," court documents say.

Mueller and deeproot told investors that his funds would invest the majority of fund assets in life insurance policies, court documents say. Instead, he invested less than $10 million in life insurance, the SEC said.

"Notably, Defendants purchased no new insurance policies for the Funds after September 2017, despite raising approximately $43 million for the Funds after that time," court documents say.

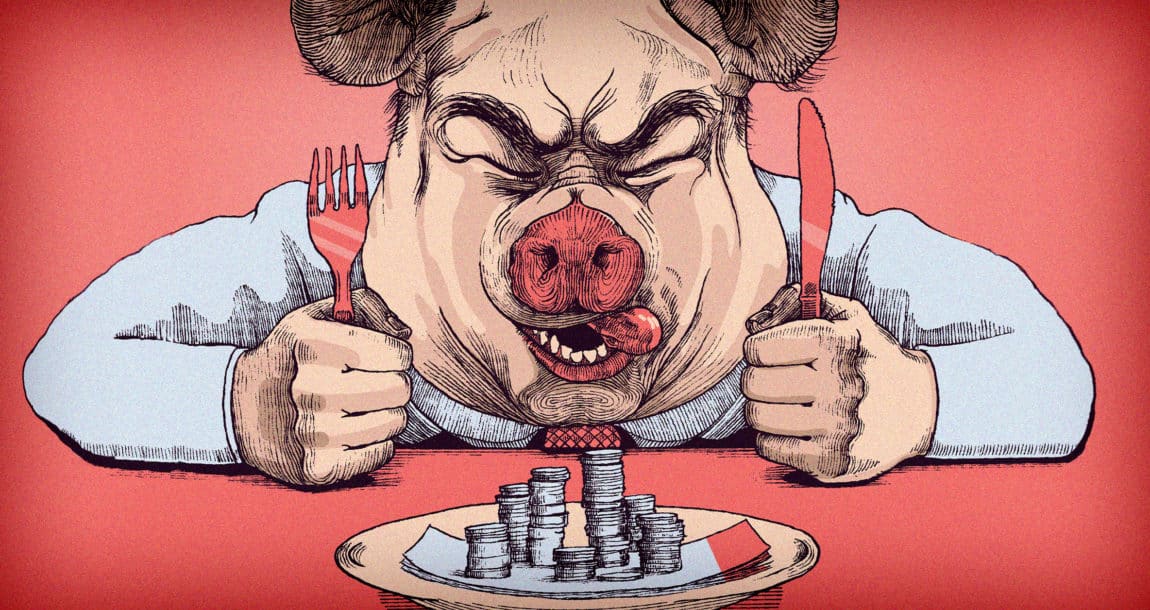

Instead, Mueller used "the vast majority" of client funds "like a piggy bank to fund Mueller’s

deeproot-affiliated businesses, the Relief Defendants," court documents explain.

Mueller funneled more than $30 million of the funds’ assets to the Relief Defendants in non-arms-length transactions "whenever he determined the Relief Defendant businesses had expenses that needed to be paid," court documents say, "and he did so without any analysis as to whether such transfers constituted suitable investments for his client funds."

Mueller made these transfers to Relief Defendants without obtaining anything of substance in return for the funds and without memorializing the transactions in any way, the SEC said.

Since he started working with these investors in 2015, neither the life insurance investments or any other investments have returned any "significant revenue or cash flow for the defendants," court documents say.

As the scheme began to unravel, Mueller and Policy Services defaulted on the purchase of one $10 million face value life insurance policy, losing nearly $3.5 million of the funds’ money in the process, the SEC said.

Mueller and deeproot made more than $820,000 of "Ponzi-like payments" to earlier investors in the funds using money raised from new investors, and made at least $177,000 in payments from money borrowed on a short-term basis using the life insurance policies as collateral, court documents say.

Mueller used more than $1.5 million of the funds’ assets to pay hundreds of personal expenses, including, court documents say, "his daughter’s private school tuition, vacations with his family, his second wedding, his second divorce, his third wedding, jewelry for both his second and third wives (including engagement rings and wedding bands for both wives), other lifestyle spending for and by his family, and to buy a condominium in Kauai, Hawaii."

When asked by SEC counsel during investigative testimony about his use of the Funds’ assets to pay for these personal and family expenses, Mueller asserted his Fifth Amendment right against self-incrimination.

Filed in federal court in San Antonio, the SEC complaint named several of Mueller’s affiliated businesses and a Mueller family trust as relief defendants in the suit. The SEC seeks disgorgement and civil penalties, as well as permanent injunctions for Mueller and the businesses.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Empathy Partners With New York Life On Mobile App For Those Dealing With Loss

Life Settlement Broker Vs. Provider: What’s The Difference?

Advisor News

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News