‘Scary’ study: young people don’t consider insurance fraud a crime

More than a quarter of Americans under age 35 say they would be "envious" and "motivated" by someone they know committing insurance fraud.

The finding came from a new study by Verisk and the Coalition Against Insurance Fraud. Likewise, 23% say they would submit a false claim to their vehicle insurer for previous damage after an accident.

"This is scary," said Matthew J. Smith, executive director of the coalition. "This isn't, 'I might. I'd consider it.' This is, 'I would definitely do that crime.'"

Smith presented the findings Monday morning at the National Association of Insurance Commissioner's summer meeting of its Antifraud Task Force. Founded in 1993, the coalition produces periodic studies on the state of insurance fraud.

Insurance fraud costs the U.S. economy a record $308.6 billion annually, the coalition found in a 2022 study.

Americans divided on insurance fraud

The study analyzes how American consumers view insurance fraud and insurance crime. It delves into the psychology of insurance fraud to understand the motivations and justification for the crime with information derived from in-depth interviews with those convicted of insurance fraud.

Twenty-nine questions were asked to 1,500 respondents across various demographics. The results were double-tested to ensure accuracy, Smith said.

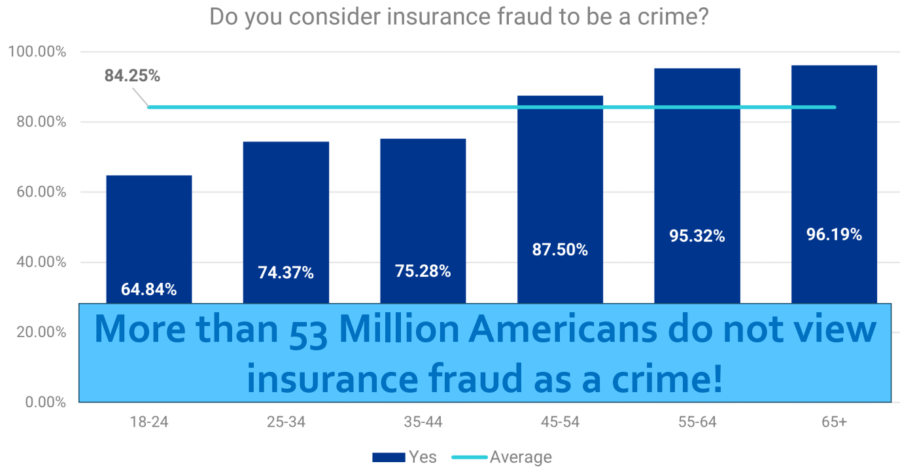

There is a clear dividing line between younger and older Americans on the seriousness of insurance fraud, Smith noted.

When compared to other crimes such as tax fraud or stealing, answers from the 18-24 age group stood out, Smith said.

"Almost 20% of them say it's a business practice," he said. "Almost 40% say there should be less punishment for it. They just don't see it as being wrong."

Other findings include:

- More than 36% of all Americans believe it’s acceptable to submit an inflated auto damage claim.

- More than 30% of 25- to 34-year-olds “definitely would” submit a fraudulent property damage claim.

- 27% of those 18-24 would commit workers’ compensation fraud, compared to less than 10% of those 45 and older.

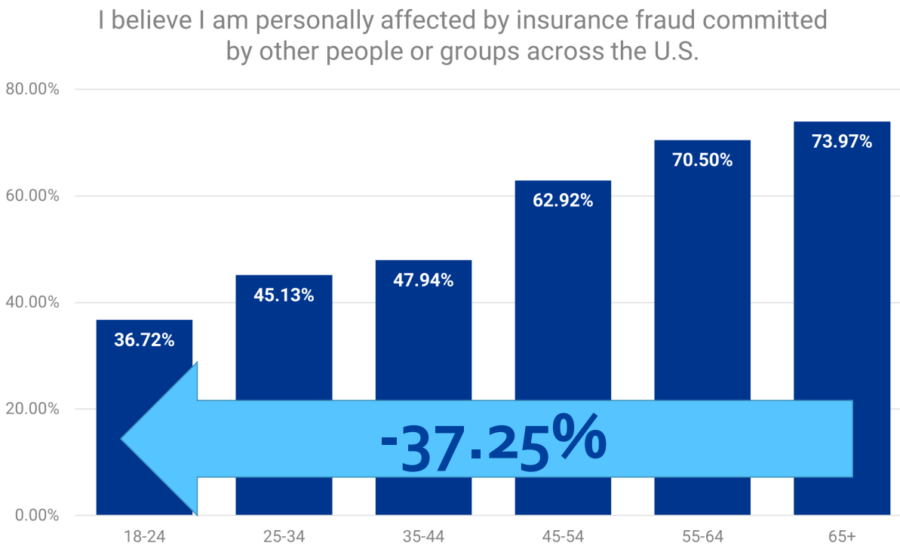

- More than a quarter of those 18-34 are “motivated” to commit insurance fraud, compared to less than 7% of those over 45.

One big issue is that younger people do not feel fiscally connected to insurance fraud. The 2022 coalition study, which examined all types of insurance products, found that the rising price of fraud penalizes every living American an equivalent of $932.63 a year, or $3,750.52 for the average U.S. family.

The next studies will look at the societal attitudes toward insurance by the younger demographics, Smith promised, in order to better determine where the casual response to insurance fraud originates.

Workers' comp fraud

In a separate presentation, Matthew F. Capece of the United Brotherhood of Carpenters and Joiners of America presented statistics on the impact of workers' compensation fraud to the task force.

There is growing problem of construction employers failing to pay wages, state and federal employment taxes, unemployment insurance and workers' compensation premiums, Capece said.

A national study of fraud released in 2020 found that 1.3 million to 2.2 million construction workers were paid off the books or mischaracterized as independent contractors in 2017. That equals 12.4% to 20.5% of the construction workforce. Workers' compensation carriers lost $2 billion.

Updated data based off 2021 data pegs the loss at $5 billion, Capece noted.

"When these contractors who are breaking the law do this, it isn't just workers' compensation premiums that are being stolen," he told task force members. "They're also doing things like cheating on their state and federal taxes, and the bill there is adding up to $8.4 billion a year."

Capece called on insurers to do a better job of tracking certificates of insurance and taking other steps to track and eliminate fraud.

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Wisconsin examines short-term health plans

Guardian Life exits Massachusetts’ small-plan dental market after referendum

Advisor News

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Thousands in state face higher health insurance costs

- Thousands facing higher health insurance costs

- Trump wants GOP to 'own' health care issue but show 'flexibility' on abortion coverage restrictions

- Ascension to stay in-network with BCBS

- New Mexico's insurance exchange sees record enrollment ahead of Jan. 15 deadline

More Health/Employee Benefits NewsLife Insurance News