Researchers draw link between financial discipline and getting a good night’s sleep

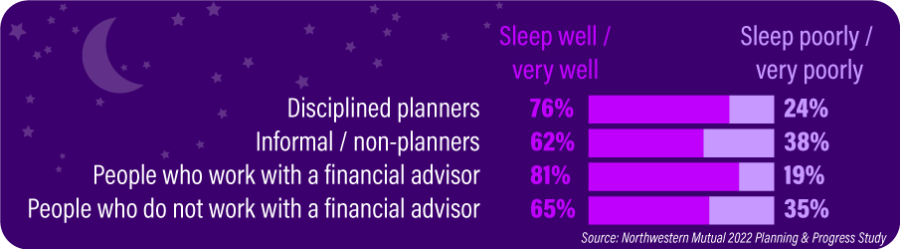

Although it may not be a scientifically supportable conclusion, the researchers behind a study of adults who work with a financial advisor believe they may have uncovered an interesting link: those who work with an advisor and who identify themselves as disciplined financial planners not only report lower levels of financial anxiety – but they may also sleep better at night.

In addition, they may experience higher levels of happiness.

“It’s important to understand that we didn’t ask specifically about how working with an advisor impacts things like sleep and happiness,” said Aaron Bell, in explaining the link between working with an advisor and better sleep that came out of the latest set of findings from the Northwestern Mutual 2022 Planning & Progress Study.

“We just saw a link: people with advisors say they sleep better and are happier. So any explanation behind it is speculative.” Bell is partner and wealth management advisor with Cannataro Family Capital Partners, which is part of Northwestern Mutual’s Private Client Group.

“That said, we have a few ideas,” Bell added. “When people have greater clarity and discipline around their finances, it can help alleviate anxiety and uncertainty. From there, it’s not much of a leap to think that could help with sleep and happiness.”

Financial advisors can play an important role in gaining that clarity and discipline, he added. They specialize in helping people to develop a plan, stay on track, and avoid guesswork when it comes to their financial futures. For many, that can help them gain peace of mind.

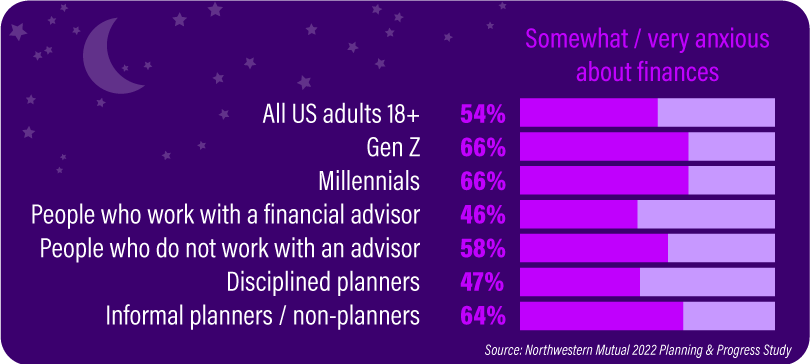

Most are anxious about finances

Although consumers who work with advisors may be sleeping better, the same cannot be said for the majority of the consumers who took part in the survey. The researchers reported that 54% of adults 18 years and older reported that they are somewhat/very anxious about their finances.

There is no single reason for this anxiety, since everyone has their own individual circumstances, explained Bell. But, he pointed out, there are a number of broad factors that are contributing to people’s uncertainty.

Concern over inflation is widespread, and understandably so, he said. Inflation is back and interest rates are the been since the 2008 global financial crisis, he said. Boomers are the only generation with experience in managing their finances in this kind of high-inflationary environment.

“These economic conditions are affecting everything from the macro to the micro: gas prices, rent, market swings,” he added. “When we asked what people think are the greatest obstacles to achieving financial security in retirement, the No. 1 answer was inflation and No. 2 was the economy. The current inflationary environment, coupled with uncertainty around the economy and recent market volatility is driving a lot of anxiety.”

On top of that, he said, “it’s worth noting that we’re still contending with a global pandemic and all the uncertainty that has created in our lives (and economy) over the last several years. That’s still top-of-mind for many people.”

Younger Folks Are Even More Anxious

The level of anxiety increases even more for younger adults, with two-thirds (66%) of both millennials and Gen Z saying they feel somewhat or very anxious about their finances. And a generational breakdown across wellness categories reveals that Gen X are the worst sleepers, and millennials and Gen Z are tied for the most anxious.

It is not terribly surprising that younger generations are more anxious about their finances than older generations, said Bell. “Younger people have a longer time horizon and less certainty about their careers, future economic cycles and what could be around the bend. They’re living with a higher degree of uncertainty, which often correlates with higher anxiety,” he said.

On top of that, he added, millennials and Gen Z entered adulthood during challenging economic times. Millennials in particular have already seen two once-in-a-generation events: the 2008 global financial crisis and the COVID-19 pandemic. These experiences amount to financial trauma and that can impact behavior, risk tolerance and decision-making going forward. “It’s something we’re watching very closely, “he said.

The 2022 Planning & Progress Study was conducted by The Harris Poll on behalf of Northwestern Mutual. It included 2,381 American adults aged 18 or older who participated in an online survey between February 8 and February 17, 2022.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at amseka@INNfeedback.com.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

FPA to pursue legal recognition of the term ‘financial planner’

No one ‘listens’ themselves out of an annuity sale

Advisor News

- Beyond Finance: How an inclusive approach builds client trust

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- Texas House panel escalates inquiry into Medicaid insurer that investigated lawmakers

- Minnesota Couple Indicted in $15 Million Medical Billing Fraud Scheme

- Stalled talks put Blue Cross Blue Shield of TX patients through ‘absolute hell’

- More cancer coverage for firefighters clears hurdle

- AG files suit against Syracuse claiming misappropriated funds

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News