Regulators taking remedial actions in attempt to contain jittery markets

The operating environment for U.S. banks has clearly deteriorated in March, but it is DBRS Morningstar's view that the two significant bank failures to date, Silicon Valley Bank (SVB) and Signature Bank (both unrated by DBRS Morningstar), remain idiosyncratic and not representative of the overall U.S. banking sector.

Moreover, in Morningstar's view, regulators are taking appropriate remedial actions in an attempt to help calm clearly jittery markets. With respect to our rated U.S. bank universe, thus far we have seen limited deposit outflows which underpins our current rating outlooks.

Traits causing pressure

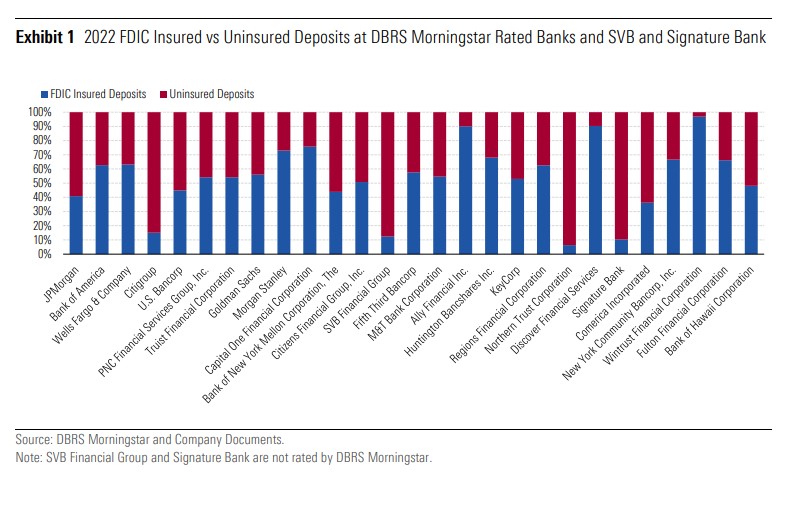

The markets have targeted banks whose deposits are mostly comprised of uninsured deposits (see Exhibit 1). These banks typically also have large securities portfolios that are negatively valued as a result of the Federal Reserve’s recent rapid interest rate tightening. Many banks have made mistakes in their asset and liability management (ALM) framework, funding longer dated fixed rate assets with shorter term funding which has become much more expensive with higher interest rates. At the same time the securities portfolios have been losing value.

We expect this dynamic will continue to pressure bank net interest margins and overall profitability, but should remain manageable for most banks. We also expect some banks to take charges, sizeable at times, to reposition their securities portfolios.

Outliers in terms of profitability will see ratings pressure, but we do not expect the ALM issues to result in failed banks in our rated universe.

SVB Bank and Signature Bank: Idiosyncratic or systemic risk?

In our view, the failures of SVB and Signature Bank are largely idiosyncratic rather than systemic. While all banks have securities portfolios in loss positions, we believe there were many bank-specific issues that led to each bank’s respective failure.

In the case of SVB, the deposit and customer base was concentrated in technology and life science firms, as well as the venture capital (VC) and private equity firms who funded them. Higher interest rates hurt valuations and VC firms pulled back on funding. Portfolio companies (these companies typically rely on the next funding round to stay afloat as they are not cash flow positive) started burning through their cash balances to run their businesses, which caused deposits to decline.

To meet the withdrawals, SVB sold securities at a loss prior to attempting to raise capital, and the large loss alarmed investors as well as depositors who quickly pulled a large amount of funds from the bank forcing its closure. Prior to this, SVB had experienced incredible growth during the recent technology boom and found itself awash in deposits which were then deployed into high quality, but longer dated, fixed rate assets.

For Signature Bank, they too had a sizeable portfolio of uninsured deposits, a concentrated client base, large unrealized securities losses, as well as exposure to the crypto sector. The bank was also facing a criminal probe, contributing to a loss in confidence and its subsequent collapse.

Regulators taking remedial steps to stem contagion

The situation remains very fluid, but regulators, both in the U.S. and abroad, are taking remedial steps tosupport and stabilize the financial system.

Following the SVB and Signature Bank defaults, regulators announced that all uninsured depositors would be made whole at both banks. Subsequently, U.S. Treasury Secretary Yellen noted that only banks that pose a systemic risk will have their uninsured deposits protected, not every bank. In addition, the Federal Reserve created the Bank Term Funding Program (BTFP), which allows banks to pledge high-quality securities at par and receive loans of up to one year.

This should help prevent banks from being forced to realize losses if other funding evaporates. There may be some stigma associated with using the Program, but participants won’t be disclosed until the end of the Program giving banks time to figure out a more permanent funding solution.

Most recently, the U.S. regulators brought eleven large banks together to deposit a total of $30 billion into First Republic Bank (unrated by DBRS Morningstar), another bank that has seen a lot of pressure given its high composition of uninsured deposits and large securities losses, despite having a clean loan book. In our view, this is another important step in support of the financial system.

Unintended consequences of regulatory actions

U.S. regulators are helping stabilize the system, but the existing regulatory framework and new level of support are also having unintended consequences. Indeed, Dodd-Frank was intended to layer on extra supervision of the large banks through extra capital buffers, and more expensive liquidity requirements in order to slow the growth of too-big-to-fail banks. At the smaller banks, which were viewed as important competitors and key to a healthier financial system, regulation was not as onerous. This has caused depositors to move funds from smaller players to the larger, safer players.

With Treasury Secretary Yellen’s comments on Thursday that only systemically important bank deposits will be insured, not smaller banks, this will only speed up the move of deposits away from smaller banks to larger banks in our opinion. After all, why keep your deposits and relationship at a small regional bank, when you can get your deposits fully guaranteed at a bank that has a regulatory requirement to meet more robust capital and liquidity requirements? That being said, we do expect that regulatory requirements will be ratcheted up for banks below the $250 billion in assets threshold with bills already introduced to lower the threshold back to $50 billion. As such, we expect some banks to merge in an effort to become systemically important.

B/Ds must respond to shifting advisor preferences

Pandemic investors still have the fever

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Product understanding will drive the future of insurance

- Nearly Half of Americans More Stressed Heading into 2026, Allianz Life Study Finds

- New York Life Investments Expands Active ETF Lineup With Launch of NYLI MacKay Muni Allocation ETF (MMMA)

- LTC riders: More education is needed, NAIFA president says

- Best’s Market Segment Report: AM Best Maintains Stable Outlook on Malaysia’s Non-Life Insurance Segment

More Life Insurance News