Pandemic investors still have the fever

Although it’s been a couple of crazy years in the markets, most investors in a group that started in the pandemic’s early days in 2020 are still in the game, according to a follow-up study.

The FINRA Investor Education Foundation and NORC at the University of Chicago conducted the first study in 2020 to understand investors who opened their first taxable investment accounts and compare them to experienced investors who opened additional accounts at the same time.

When the researchers returned to the participants, they found that most of both groups (78.9%) were still investing, although it was a larger majority of the experienced investors (88.6%) than the new ones (75.2%).

Not only did they still have active accounts, the investors were active in their accounts.

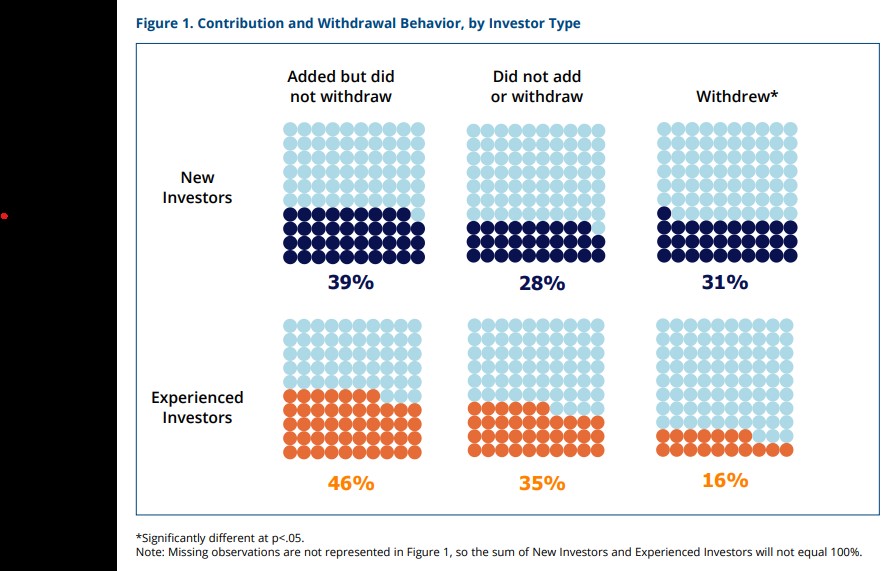

“In addition to remaining in the market, we see evidence of investors leaning in to investing by adding funds to their accounts,” according to the report. “When asked about account activity, almost half of Experienced Investors (46.1 percent) added funds to their accounts without withdrawing funds at any time during the period under consideration.”

New investors were more likely to withdraw money from the accounts, with nearly a third (31%) doing so compared to 16.3% of experienced investors pulling money out.

Although it’s been a volatile ride for markets over the past three years, the study’s investors seemed to remain steady on their risk tolerance, which was low to begin with. Just 5.1% traded on margin and 11.6% traded options. Their knowledge also did not change much, with just a 6.3% improvement in an investing quiz. New investors improved the most, by 9%, while the experienced ones increased 3%. The differences did not vary significantly along demographic lines.

The difference appeared in their intentions. Those who opened an account to learn about investing tended to increase their investing knowledge significantly, by 21.5% on average.

Looking to advisors

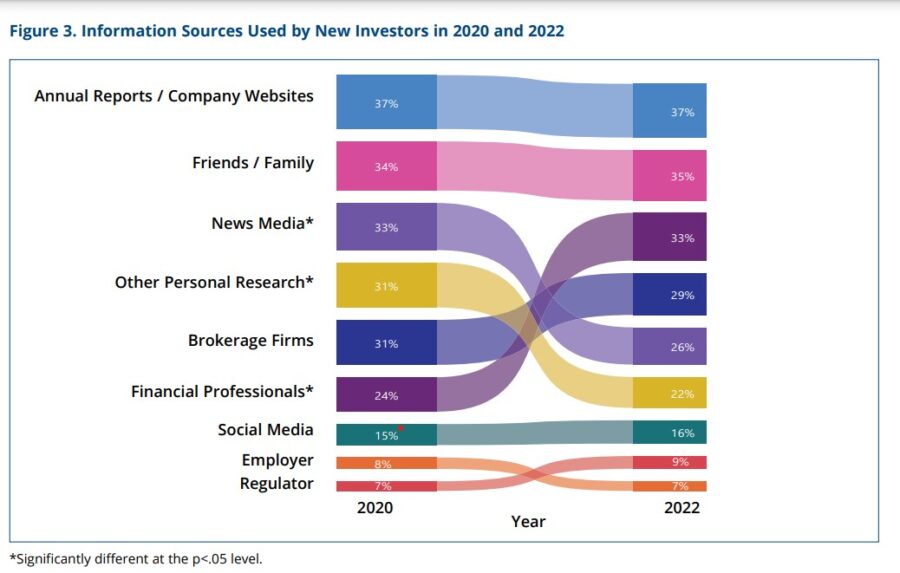

Although many started on their venture to learn more about investing, more of the new investors turned to financial advisors and away from their own research.

“This shift in the use of financial professionals is substantial: In 2020, information from financial professionals was the sixth most frequently cited source, while in 2022 it was the third most frequently cited information source,” according to the report.

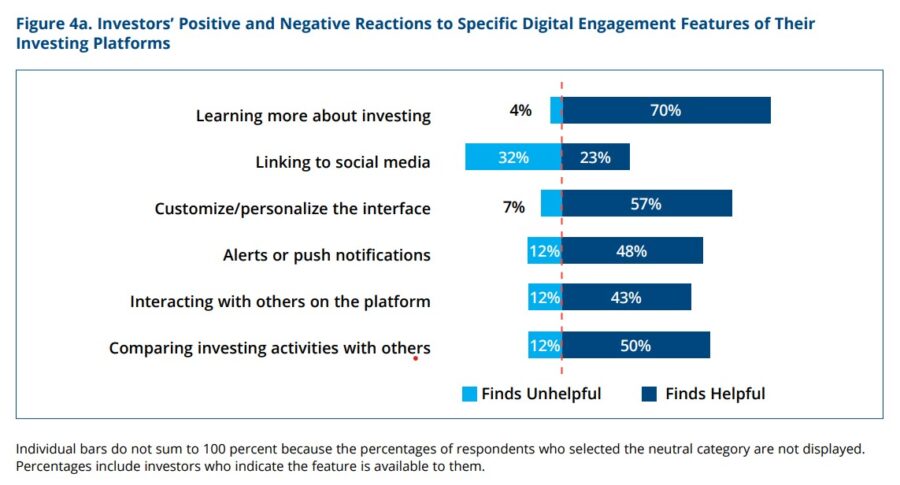

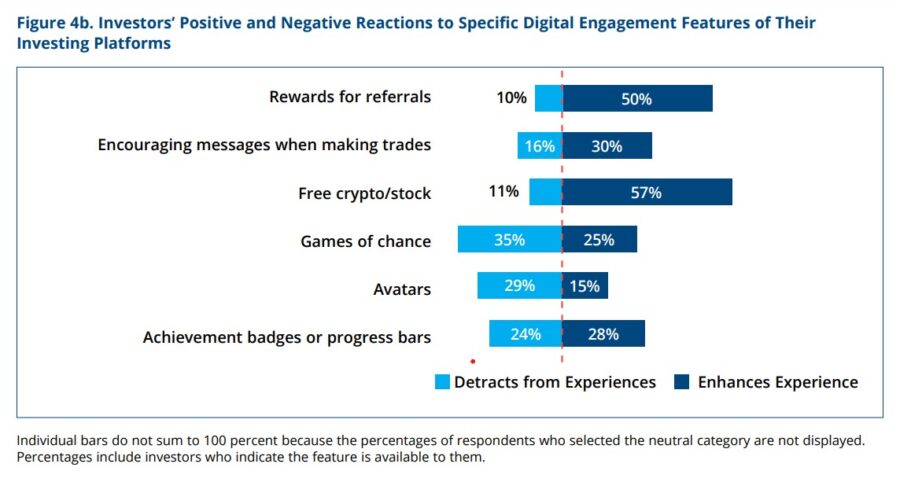

They are also serious about their investing. In a new series of questions, the researchers asked about digital platforms. They wanted the features that allowed them to learn with 70% finding that helpful. A smaller majority (57%) also liked being able to customize and personalize the user interface. The same percentage also liked getting free stock or cryptocurrency upon opening an account.

They were not totally enthused about games of chance when using an account, with 35% saying it detracted from the experience. Also, being able to select an avatar was detracting for 29%. A third (32%) found it unhelpful to be able to link the user interface with social media.

Getting into cryptocurrency

Although their risk tolerance did not seem to change much, new and experienced investors did a deeper dive into cryptocurrency.

In 2020, 14.1% of new investors and 19.1% of experienced Investors held alternative investments, which included crypto, gold or hedge funds. In 2022, the researchers asked about crypto specifically and found 28.1% of new investors and 22% of the experienced investors held digital currency.

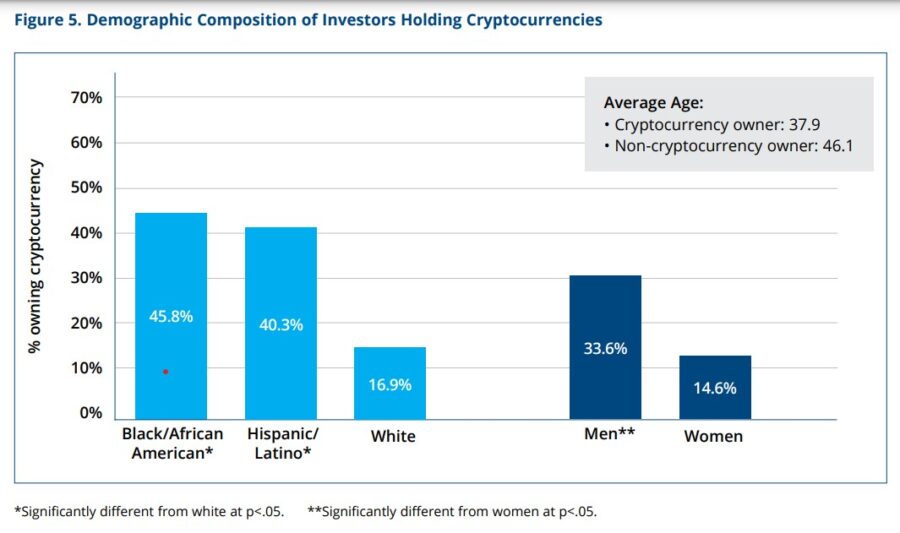

This was an area that did differ along demographics. They tended to be younger, Black, Hispanic and male by a large margin, and more risk tolerant.

Crypto holders also tended to have a lower balance in their account overall, with 59.6% having investment balances below $2,000, while only 27.3 percent of investors who do not own cryptocurrency held less than $2,000 in their accounts.

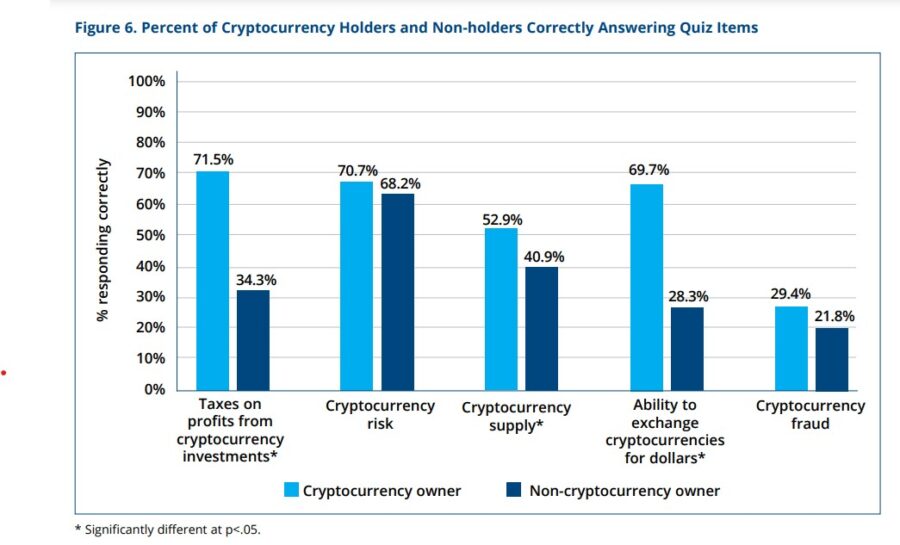

Whether they were in the crypto game or not, the investors knew more about digital currency than they did about investing in general, according to the report. Those who were into crypto did seem to know their stuff on digital currency, though.

Even though the investors knew less about investing, they thought they knew more.

“Although investors may objectively know more about cryptocurrency than investing in general (as measured by our quizzes), they subjectively believe they know more about general investing,” according to the report. “Only 10.1 percent of study participants indicated they have high or very high knowledge of cryptocurrency, while 19.7 percent indicated they have high or very high knowledge of investing in general.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Regulators taking remedial actions in attempt to contain jittery markets

As continuous enrollment provision ends, states begin Medicaid ‘unwinding’

Advisor News

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Findings on Managed Care Reported by Investigators at University of Pennsylvania (Awaiting Insurance Coverage: Medicaid Enrollment and Post-acute Care Use After Traumatic Injury): Managed Care

- New Findings on CDC and FDA from Department of Emergency Medicine Summarized (The Long-term Trend of the Affordable Care Act On Health Insurance Marketplace Enrollment): CDC and FDA

- Proxy Statement (Form DEF 14A)

- More than 5M could lose Medicaid coverage if feds impose work requirements

- States try to rein in health insurers’ claim denials, with mixed results

More Health/Employee Benefits NewsLife Insurance News

- SC regulators ‘reviewing’ rehab strategy for Atlantic Coast

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- 2025 Proxy Statement

- New York Life Appoints Christopher D. Kastner to Board of Directors

More Life Insurance News