Panel: Is the American retirement system ‘broken’?

America’s 401(k) retirement savings plan is “not broken” but working well in tandem with Social Security, according to experts on an Employee Benefit Research Institute panel.

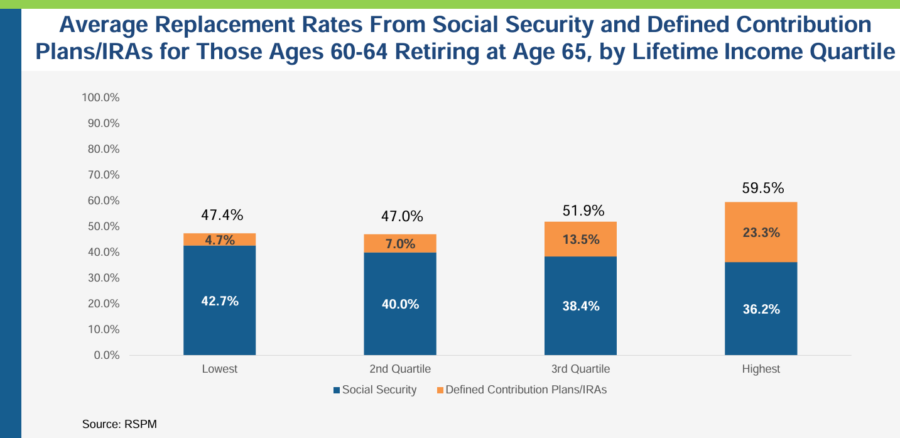

They suggested that Social Security provides the most benefit for lower-income earners, while middle- to high-income earners rely more on private retirement systems. But replacement rates are highest when they’re combined, they said.

“Some reports that have been coming out in recent years, unfortunately, are stating that the 401(k) system is broken; we have a ‘retirement crisis.’ Unfortunately, I think a lot of that research is based off of anecdotal information — off of survey information,” Will Hansen, chief government affairs officer, American Retirement Association, said.

He dismissed the validity of such surveys’ results.

“There are surveys out there asking Americans if there is a retirement crisis and, I don’t know, 50-60% of Americans say yes, there’s a retirement crisis. I think if you ask that same person if they’re having a midlife crisis, they probably would say yes as well,” Hansen said.

“I think we need to be focused on the data that shows the system is working… The 401(k) system is resilient and we need to continue to find ways to improve upon it,” Hansen emphasized.

Replacement rates on upward trend

Data from EBRI’s retirement security projection model indicate Americans benefit from the highest replacement rates if they start planning earlier and retire slightly later.

For Americans already nearing retirement, the lowest income earners achieve an average replacement rate of around 48% (43% from Social Security and 5% from DC plans). That rate increases with the middle- and high-income earners, with the highest income earners achieving just under 60% (36% from Social Security and 23% from DC plans).

Those rates could skyrocket to nearly 90% if contributions start between 25 to 39 years old and last for the rest of the individual’s career, according to EBRI. Similarly, if they retire at age 67 instead of age 65, rates can reach just under 80%.

Craig Copeland, director, Wealth Benefits Research, EBRI, also partially attributed these higher rates to the Secure 2.0 Act introduced under the Biden administration.

“We know, in most cases, those in the high incomes will be alright in retirement. It’s really those in middle-income quartiles where Social Security plus the DC system is going to make the difference for them to have a successful retirement financially,” he said.

On the other hand, EBRI’s research suggests that even a 25% reduction in Social Security could cause replacement rates to peak in the mid-60s for Americans in all income brackets — even if they retire at 67.

“I’m not advocating any Social Security reform proposal; I’m just saying what happens…and showing how that impact changes,” Copeland said.

Looking to future improvements

While panelists generally contended that the current American retirement system is working adequately, they also discussed how prospects could be improved even further with:

- Auto-enrollment in private plans

- Appropriately priced and structured retirement products

- Better access to advisors

- AI-assisted product personalization

- Further development of retirement systems

“Anything we can do to advance QDIAs in a more accelerated fashion. We are fully supportive of all the mandates that have already come out for auto-enrollment with all new plans being formed. We ought to take that up a notch,” Michael Doshier, senior retirement strategist, T. Rowe Price, said.

He added that more focus should be placed on product structure and appropriate pricing.

“We all need to do a better job of moving towards more appropriately structured and priced products to make the entire industry priced right, given the assets that are in it,” Doshier said.

At the same time, Peter Kapinos, head of workplace and investment marketing, Empower, said not enough Americans have access to financial advisors. He noted that many people believe they can’t afford an advisor and are more likely to go online — although research suggests people fare better financially when they work with an advisor.

“I think you will continue to see more ways for people to get access to advice… You’re going to continue to see a lot more tools, resources designed for [a mobile] screen, not a laptop screen, [and] a lot more personalization aided by AI so that you can get personalized recommendations,” Kapinos said.

Meanwhile, Hansen said service providers should continue to innovate to make retirement prospects stronger with “Secure 3.0 down the road.”

“There are now provisions out there where we’re trying to solve for other crises. So, for example, there is an education crisis in this country. There is a student loan crisis in this country. Where did they turn to help people pay off their student loan debt? They turned to the 401(k) system, which just goes to show that this is a strong system,” he said.

EBRI is a non-profit organization founded in 1978 and based in Washington, DC. It conducts research and provides education on employee benefits. ARA is a non-profit organization founded in 1966 and based in Washington, DC. It provides education and advocates for policy and legislation to improve retirement for Americans.

T. Rowe Price is a publicly owned investment management firm founded in 1937 and based in Baltimore, Maryland. Empower is a financial services firm founded in 1891 and based in Greenwood Village, Colorado.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Rayne Morgan is a journalist, copywriter, and editor with over 10 years' combined experience in digital content and print media. You can reach her at [email protected].

State regulators want to put the kibosh on the Federal Insurance Office

Bull or bear? What are financial advisors’ market expectations for 2025?

Advisor News

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- New Generation MyCare Program – What is it?

- Local lawmakers, advocates talk about BadgerCare expansion

- Wellmark still worries over lowered projections of Iowa tax hike

- Families defend disability services amid health cuts

- RANDALL LEADS 43 DEMOCRATS IN DEMANDING ANSWERS FROM OPM OVER DECISION TO ELIMINATE COVERAGE FOR MEDICALLY NECESSARY TRANS HEALTH CARE

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News