Regulators lukewarm on illustrations rewrite in 2024

Consumer advocates point to four barriers that prevent Americans from gaining the financial literacy needed to responsibly manage their retirement.

"Misleading and deceptive practices" is the one barrier regulators could do something about, they say. It starts with addressing misleading illustrations.

Birny Birnbaum and Brenda J. Cude urged regulators to tackle that barrier by updating the life insurance illustration regulation. Birnbaum and Cude are designated consumer representatives by the National Association of Insurance Commissioners. They addressed the Life Insurance and Annuities Committee at the NAIC fall meeting in December.

"Clearly there needs to be a reengineering of illustration regulations for a consistent approach for both index annuities and life insurance," said Birnbaum, executive director of the Center for Economic Justice. "We need to stop the incentives for illustration unrealistic accumulation competition, eliminate hypothetical historical results and projection of non-guaranteed outcomes."

Lack of financial education

Other barriers to financial literacy include a lack of relevant education and training, complexity of products, and cognitive biases, Birnbaum and Cude said. All of the barriers are intertwined, they added.

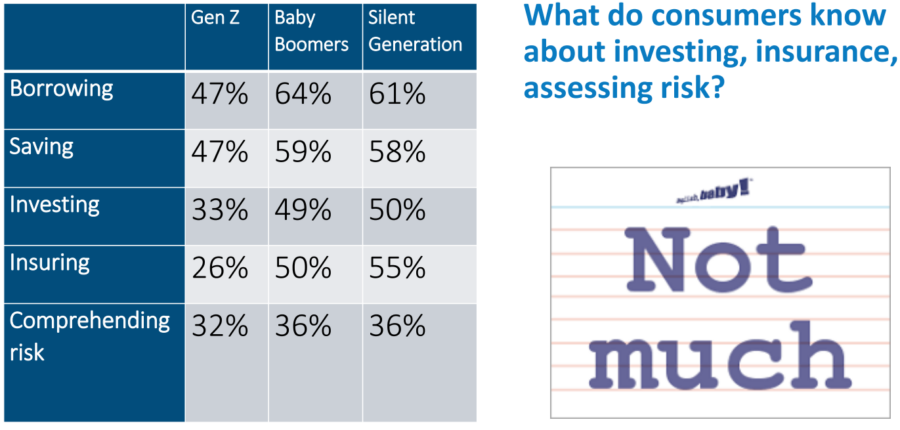

The duo shared data showing that barely half of Americans understand basic financial concepts. Just 36% of baby boomers understand risk principles, according to data from the 2023 TIAA Institute-GFLEC Personal Finance Index.

This test data is based on very simple concepts presented in a multiple choice or true-false format, explained Cude, professor emeritus in the Department of Financial Planning, Housing and Consumer Economics at the University of Georgia.

She showed regulators this sample question: It you had $100 in a savings account and the interest rate is 2% a year, after five years you would have: A) more than $102, B) Less than $102, C) Exactly $102.

"Seemingly very simple concepts," Cude said. "And yet, just more than half [of Americans] get these correct. Think about that for a moment. Just more than half understand inflation, compound interest [and] risk diversification."

Now consider illustrations that show often-inflated gains. In particular, the growth of proprietary indices is bothersome to many in the industry. At one time, the S&P 500 was used in almost all index products but came with limited ability to design product features. So, carriers created their own indexes and haven’t looked back.

Since then, more than 160 indexes have been created. Unlike the S&P 500, few of them have any solid history to draw from.

With no history to draw from to support illustrations, insurers created “backtested” hypothetical performance from proprietary index components. But critics say this results in misleading illustrations untethered from reality.

"Engineered indices are optimized to deliver not just lights-out illustrated performance for the most recent 10-year period, but also to maintain higher returns in the worst 10-year [period]," Birnbaum noted. "Carriers and agents play this up as a can't lose situation where the worst-case scenario is still double-digit returns. This is a fundamentally misleading characterization."

Birnbaum provided regulators one sample illustration of a product showing a 20% return as a "worst-case scenario."

"The question then arises, why are insurers selling insurance instead of simply making the investments they're illustrating?" he asked incredulously. "Why would shareholders put up with an insurer risking a measly 10% return on shareholder equity when an investment that produces a worst-case scenario of 20% average return for the next 50 years is available?"

Years-long process

NAIC regulators are candid about not wanting to reopen the overall illustrations model because it would likely be a years-long process. The current illustrations regulation was adopted in 1997 after a similar process. And that was before indexed universal life insurance even existed.

Instead of a full rework, regulators settled on Actuarial Guideline 49 in 2015 as the first check on IUL illustrations. Insurers quickly got around AG 49 by offering IUL products with multipliers and bonuses. That led to AG 49-A, adopted in late 2020, followed by AG 49-B in 2023.

The NAIC's Indexed Universal Life Illustration Subgroup hinted at a full illustrations rework late in 2022, opening a comment period that only asked for revision "concepts" for the model. That effort went nowhere and the subgroup's 2024 work charges revealed no plans for illustrations.

With the exception of Philip Barlow, associate commissioner for insurance with the District of Columbia Department of Insurance, Securities and Banking, none of the regulators sought further information from Birnbaum or Cude.

"Looking at some of those sample illustrations they seem to be things that are not plausible for somebody who has any level of financial literacy," Barlow said. "That they can be used with people seems to be a big problem."

Barlow asked what the NAIC could do to address illustrations but the question went unanswered.

'It's time'

The Indexed Universal Life Illustration Subgroup would be the place an illustrations rewrite would begin. But regulators there have not addressed the issue in months, approving a 2024 list of charges, or goals, in the fall.

It is long overdue to update the life illustrations model regulation, agreed Sheryl Moore, CEO of Wink, Inc. and Moore Market Intelligence.

"It is time to nip the illustration gamesmanship by the bud," she said. "Indexed life didn’t exist when the life insurance illustration model regulation was adopted by the states. It’s time to reopen the model reg, and ensure that all cash value life insurance products are being illustrated in a manner that is helpful in ensuring that the consumer understands how the product truly works."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

The question of self-insurance: Helping clients navigate the risks

NY Gov. Hochul vetoes ‘wrongful death’ legislation opposed by insurers

Advisor News

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

More Advisor NewsAnnuity News

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

- Trademark Application for “EMPOWER MY WEALTH” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Conning says insurers’ success in 2026 will depend on ‘strategic adaptation’

- The structural rise of structured products

More Annuity NewsHealth/Employee Benefits News

- 30 DAYS, $1.8 MILLION AND ZERO BILLS PASSED: KDP STATEMENT ON WASTEFUL GOP-LED GENERAL ASSEMBLY

- New Vaccines Findings from University of California Riverside Outlined (Emergency Department Survey of Vaccination Knowledge, Vaccination Coverage, and Willingness To Receive Vaccines In an Emergency Department Among Underserved Populations – …): Immunization – Vaccines

- Researchers at George Washington University School of Medicine and Health Sciences Target Artificial Intelligence (Health Insurance Portability and Accountability Act Liability in the Age of Generative Artificial Intelligence): Artificial Intelligence

- Nevada's health insurance marketplace sees growth since inception and new public plan

- Data from University of Indonesia Advance Knowledge in Diabetes Mellitus (The Impact of Performance-based Capitation On Diabetes Care: Evidence From Indonesia’s National Health Insurance Program): Nutritional and Metabolic Diseases and Conditions – Diabetes Mellitus

More Health/Employee Benefits NewsLife Insurance News