Prudential Shrugs Off Omicron Losses To Post Strong 4Q Earnings

Prudential Financial reported financial losses from the flare-up of the Omicron variant throughout the fall 2021.

The insurer's group insurance business reported a loss of $205 million in the fourth quarter, compared to an $87 million loss in the 2020 fourth quarter.

"We have a high concentration of large retail and healthcare employer accounts," explained Andy Sullivan, executive vice president and head of U.S. Businesses. "If you think about it, those are employers that have a high number of frontline workers that are out and about and exposed on a daily basis. Also, many of those workers are in low vaccination geographies."

The poor results continued a trend from the third quarter, when Prudential reported an adjusted operating loss of $135 million in the group life and disability segment.

Likewise, the fourth quarter saw some shift in COVID infection rates to older ages, but "we're still seeing significant increase in incidence rates in the under-55 population," Sullivan said. "And that population tends to have larger dollar amount policies."

On the whole, it was another successful quarter for Prudential. The insurer reported quarterly earnings of $3.18 per share, beating the Zacks Consensus Estimate of $2.39 per share. Prudential reported net income of $1.2 billion, compared to $819 million in the year-ago quarter.

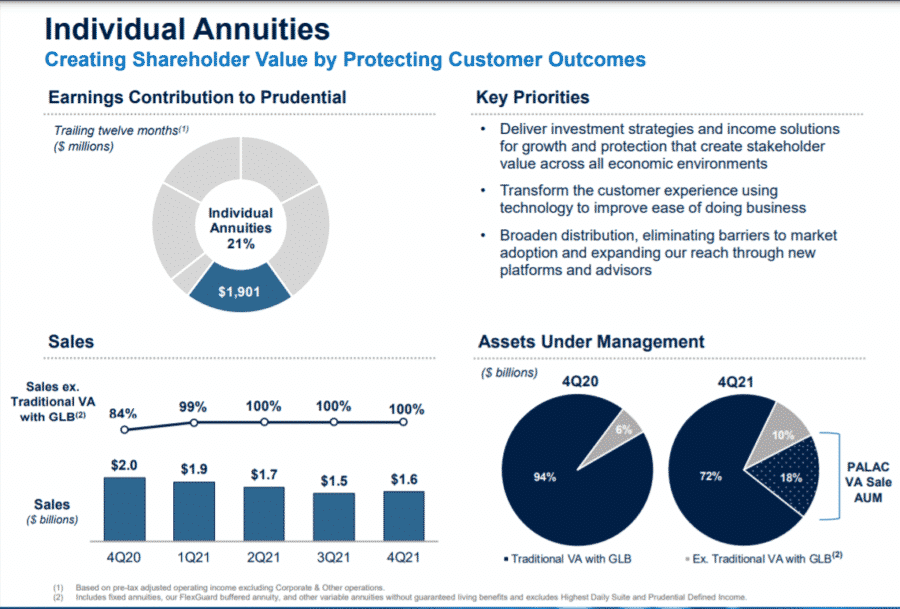

Annuity Sales

Prudential pivoted away from traditional variable annuities in recent quarters, while relying on robust sales of its FlexGuard line, an indexed-linked product introduced in 2020, to keep the segment healthy.

"Our product pivots have worked well, demonstrated by continued strong sales for our buffered annuities, which were nearly $6 billion dollars for the year, representing 87% of individual annuity sales," said Rob Falzon, vice chairman. "These sales reflect customer demand for investment solutions that offer the potential for appreciation from equity markets, combined with downside protection."

In the annuity segment, Prudential reported adjusted operating income of $486 million in the fourth quarter, compared to $440 million in the year-ago quarter. The increase "reflects higher fee income, net of distribution expenses and other associated costs, higher net investment spread results, including higher variable investment income, and lower expenses," the insurer said in its earnings release.

Account values of $182 billion were up 3% from the year-ago quarter, reflecting market appreciation, partially offset by net outflows. Gross sales of $1.6 billion in the fourth quarter reflect the continued success of FlexGuard, the release said.

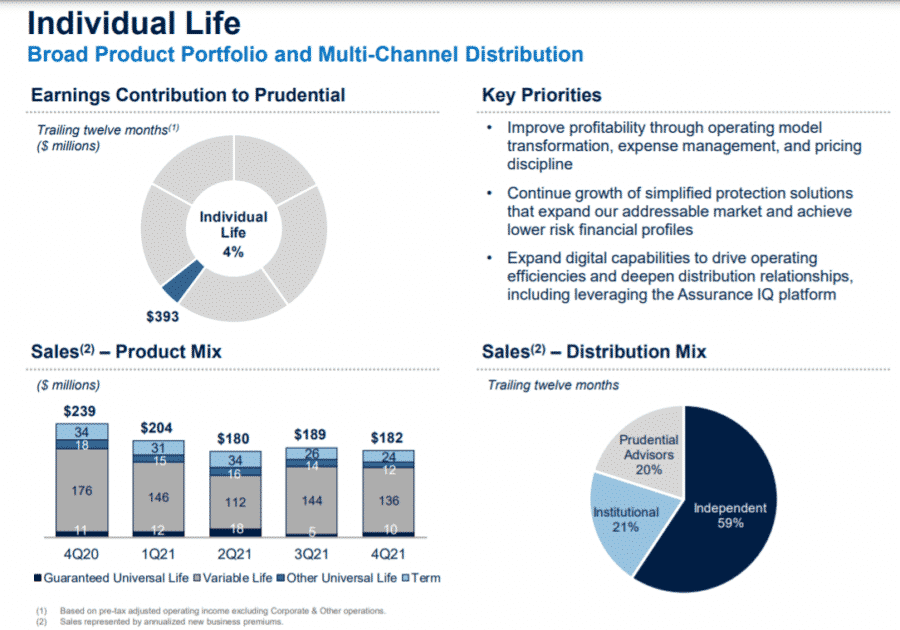

Individual Life Insurance

Prudential continues to push variable life sales, with success, said Charles Lowrey, president and CEO, and is seeing success incorporating artificial intelligence into its sales processes.

"We use AI to quickly and accurately assess risk in our life insurance businesses," Lowrey said, "and to expedite the application and underwriting process. The application of innovative technology generated significant efficiencies for our global businesses during 2021 while delivering a dramatically better experience for our customers."

In the life segment, Prudential reported adjusted operating income of $81 million in the fourth quarter, compared to a loss of $65 million in the year-ago quarter. This increase reflects "more favorable underwriting results and higher net investment spread results, including higher variable investment income, partially offset by higher expenses, driven by a legal reserve," the earnings release said.

Sales of $182 million in the current quarter decreased 24% from the year-ago quarter. The decrease was primarily driven by higher sales ahead of product repricing in the year-ago quarter.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Would You Buy Insurance From Amazon? 55% Said Yes

Put Your Best Pitch Forward: How To Become An Industry Speaker

Advisor News

- Ex-employees sue Verizon over pension transfer deal with Prudential, RGA

- Gary Brecka, Cardones file dueling lawsuits in battle of social media stars

- Confidence is key to cold calling success

- Overcoming the indecision of prospects

- What issues top consumers’ list of financial goals for 2025?

More Advisor NewsAnnuity News

- Sapiens wins XCelent award for Customer Base and Support for UnderwritingPro for Life & Annuities

- SB 263 expected to bring chaos to Calif. insurance, annuity sales come Jan. 1

- Lincoln Financial hires industry veteran Tom Morelli as Vice President, Investment Distribution

- Structured settlements protect young injury victims | H. Dennis Beaver

- MetLife Inc. (NYSE: MET) Highlighted for Surprising Price Action

More Annuity NewsHealth/Employee Benefits News

- Insurance assurance:

Health care proposal does little to address Hoosiers' full needs

- Studies from University of Michigan Have Provided New Information about Arthroplasty (Employer-sponsored Medicare Advantage Plans and the 2018 Therapy Cap Repeal

<i>

reduced Overall Spending Does Not Constrain Out

</i>-

<i>

of

</i>-<i>pocket …): Surgery – Arthroplasty

- City of Aurora to open new health clinic for its employees

- Mayo Clinic sues Sanford Health Plan over $700K in unpaid medical bills

- Mayo Clinic sues Sanford Health Plan over $700K in unpaid medical bills

More Health/Employee Benefits NewsLife Insurance News

- Registration Statement by Foreign Issuer (Form F-1)

- Confidence is key to cold calling success

- Exemption Application under Investment Company Act (Form 40-APP/A)

- AM Best Assigns Credit Ratings to Min Xin Insurance Company Limited

- Proxy Statement (Form DEF 14A)

More Life Insurance News