Prudential Scores Winning 2Q With FlexGuard

Prudential had another blazing quarter largely due to booming sales in its registered index-linked annuity along with equity markets and inflows boosting account values, which offset a dip in its investment business.

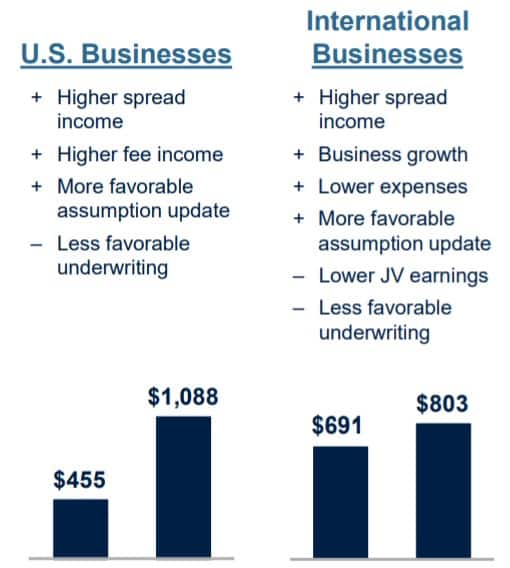

Prudential’s U.S. businesses reported adjusted operating income more than doubled to $1.09 billion for the second quarter over the $455 million in the year-ago quarter, which suffered the effects of the COVID-19 lockdown. Its annuity segment jumped nearly 90% to $472 million over the $249 million in the second quarter of last year.

The company attributed the gains to “higher net investment spread results, driven by higher variable investment income, and higher net fee income, driven primarily by equity market appreciation, partially offset by less favorable underwriting results.”

Prudential has been on a long-term pivot away from traditional variable annuities, selling blocks of VAs off its books and reducing sales to zero in the second quarter. The company has been dialing up sales in its registered index-linked annuity, FlexGuard, said Andy Sullivan, head of U.S. businesses, during an earnings call with analysts on Wednesday.

“We are committed to significantly reducing the earnings contribution from traditional variable annuities with guaranteed living benefits,” Sullivan said, adding that it is a two-step process starting with selling blocks of business. “We experienced $3.8 billion in runoff in those products in the quarter. We've pivoted to products that are much better balanced -- consumer value with shareholder value -- obviously FlexgGuard being the chassis product there. We saw a 17% market share in the first quarter, and we were the No.2 provider of indexed variable annuities.”

Although the company had a strong showing in its retirement segment, the company is selling its full-service retirement business to Empower in a $3.5 billion deal expected to close in the first quarter of next year.

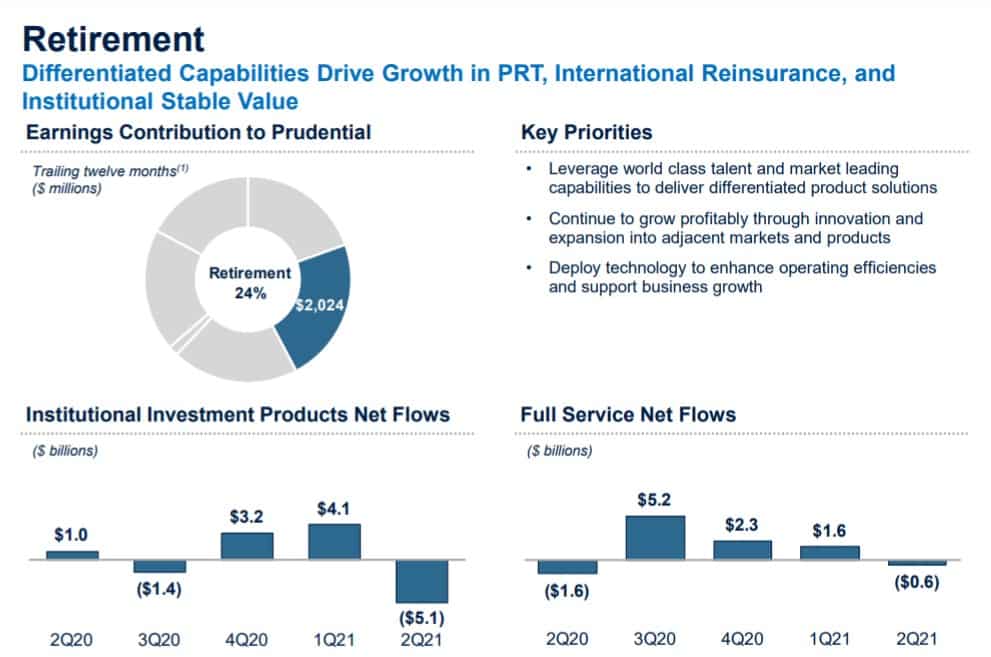

Retirement:

- Operating income of $491 million in the current quarter, compared to $281 million in the year-ago quarter. Results primarily reflect higher net investment spread results, driven by higher variable investment income, and higher fee income, partially offset by lower reserve gains, driven by a decline in COVID-19 mortality.

- Account values of $586 billion, a record high, were up 18% from the year-ago quarter, driven by market appreciation and business growth. Net outflows in the current quarter totaled $5.7 billion with $5.1 billion from Institutional Investment Products and $0.6 billion from Full Service.

Individual annuities:

- Operating income of $472 million in the second quarter, compared to $249 million in the year-ago quarter.

- Account values of $182 billion, a record high, were up 15% from the year-ago quarter, reflecting market appreciation, partially offset by net outflows. Gross sales of $1.7 billion in the current quarter reflect the continuing success of the company’s FlexGuard Indexed Variable Annuity.

Individual Life:

- Operating income of $146 million in the current quarter, compared to a loss of $64 million in the year-ago quarter. Results primarily reflect higher net investment spread results, driven by higher variable investment income.

- Sales of $180 million in the current quarter were down 2% from the year-ago quarter, as lower universal life and term sales were mostly offset by higher variable life sales, reflecting the company’s product repricing and pivot strategy.

Group Insurance:

- Operating income of $17 million in the quarter, compared to adjusted operating income of $5 million in the year-ago quarter. Results primarily reflect higher net investment spread results, driven by higher variable investment income, and favorable group life underwriting results due to lower COVID-19 claims, partially offset by less favorable group disability underwriting results and higher expenses.

- Reported earned premiums, policy charges, and fees of $1.4 billion were up 2% from the year-ago quarter.

Prudential Global Investment Management:

- Operating income of $315 million for the second quarter, compared to $324 million in the year-ago quarter. This reflects higher asset management fees, driven by an increase in average account values, that were more than offset by a decrease in seed and co-investment income, and higher expenses.

- PGIM assets under management of $1.511 trillion, a record high, were up 8% from the year-ago quarter, primarily reflecting market appreciation, positive third-party net flows, and strong investment performance. Third-party net inflows of $5.3 billion in the current quarter reflect institutional inflows of $5.6 billion, partially offset by $0.3 billion of retail outflows.

The company is still getting its footing with Assurance IQ, a direct-to-consumer business using data science and machine learning to speed up the application process and purchasing of health, life, medigap, home and auto policies from more than 20 providers. Although the company was reportedly profitable when Prudential bought it for $2.3 billion in 2019, Assurance IQ reported a loss, on an adjusted operating income basis, of $38 million in the second quarter, compared to a loss of $16 million in the year-ago quarter. This reflects a 92% increase in revenues that were more than offset by increased expenses to support business growth

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

DI Bill Passes In New York State

Can COVID-19 Long-Haulers Get Life Insurance?

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

More Annuity NewsHealth/Employee Benefits News

- Researchers from Boston University Report Findings in Managed Care (Unexplained Pauses In Centers for Disease Control and Prevention Surveillance: Erosion of the Public Evidence Base for Health Policy): Managed Care

- New Managed Care Study Results Reported from University of Houston (Impact of Adjuvant GLP-1RA Treatment on the Adherence of Second-Generation Antipsychotics in Nondiabetic Adults): Managed Care

- New Findings on Managed Care Reported by Lane Moore et al (State Disparities in Medicaid Versus Medicare Reimbursement for Hand Surgery): Managed Care

- New Kentucky House GOP budget fixes insurance issue, ups education spending

- Missouri and Kansas families pay nearly 10% of their income on employer-provided health insurance

More Health/Employee Benefits NewsLife Insurance News