Prudential posts strong Q2 results off investment gains, FlexGuard sales

Like many insurers, Prudential Financial enjoyed a healthy second quarter thanks to stronger investment income and much stronger product sales.

For Prudential, it added up to a 21.5% rise in second-quarter adjusted profit. The Newark, N.J.-based insurer reported net income attributable of $511 million, compared to a net loss of $1.010 billion for the second quarter 2022. It represents a turnaround of sorts from the first quarter, when Prudential fell short of forecasts.

"Our second-quarter results reflect continued momentum across our businesses, including the fourth consecutive quarter of underlying earnings growth and record operating earnings for group insurance," Charles Lowrey, chairman and CEO, told analysts today.

"We continue to execute on our strategy by reducing market sensitivity and increasing our capital flexibility, enhancing our capabilities and optimizing operating efficiency to support long term growth."

Prudential moved away from variable products in recent years in a pivot to less market sensitive and higher growth products. That effort continued last week when Prudential struck a deal for Somerset Re to reinsure about $12.5 billion of reserves backing its guaranteed universal life policies.

"We expect to receive approximately $450 million of proceeds when the transaction closes, which is expected to be in the fourth quarter of this year," Lowrey said.

Rising interest rates is helping many insurers better manage their investment portfolios. PGIM, Prudential’s global investment management business, reported assets under management of $1.266 trillion, up 1% from the year-ago quarter.

FlexGuard sales strong

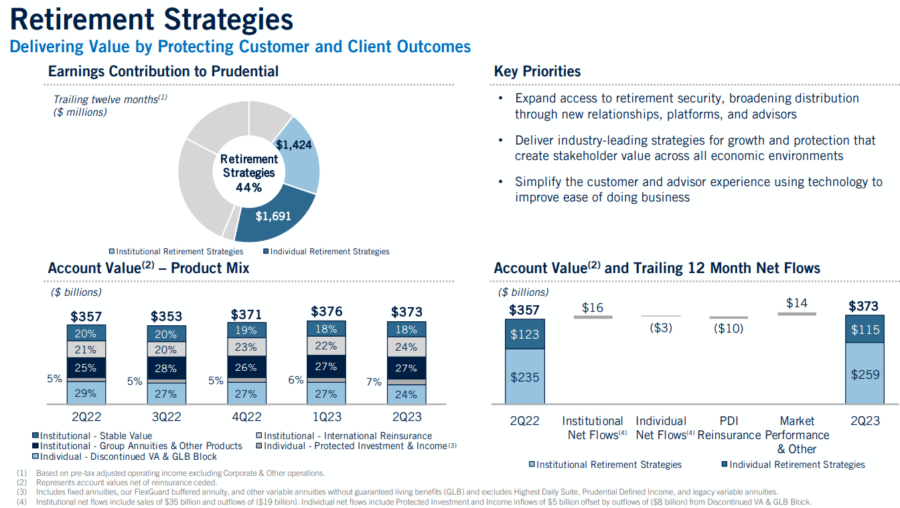

In its Individual Retirement Strategies segment, Prudential reported sales of $1.9 billion, up 19% from the year-ago quarter. The strong sales reflected "continued momentum from our FlexGuard products and increased sales of fixed annuity products," the insurer said.

"Our FlexGuard suite has reached $15 billion of sales over the past three years," Lowrey said. "And our fixed annuity sales in the quarter represented over one-third of new business as we innovate our portfolio of annuity solutions to meet customer needs. As we look ahead, we are well positioned as a global leader at the intersection of asset management and insurance."

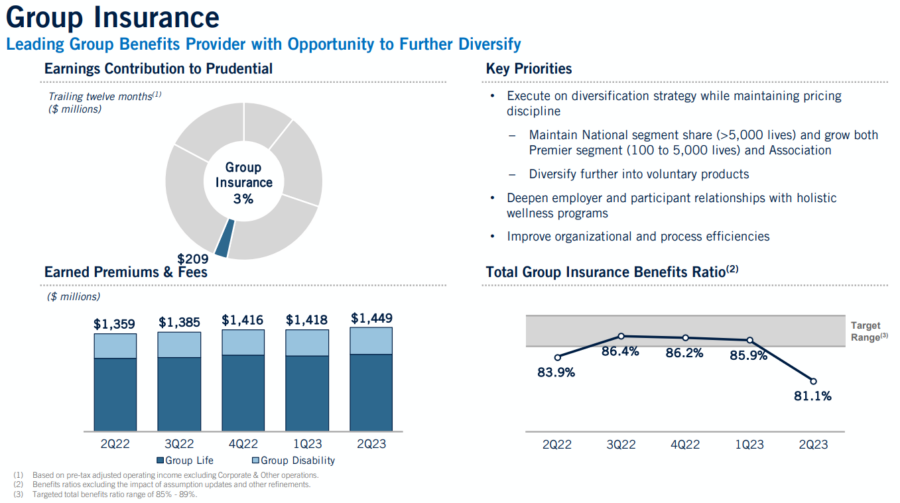

The insurer's Group Insurance segment posted record adjusted operating income of $139 million, compared to $54 million in the year-ago quarter. This increase includes a "favorable comparative impact from our annual assumption update and other refinements of $39 million," Prudential said in a news release.

Otherwise, current quarter results "primarily reflect more favorable underwriting results in both group life and disability, partially offset by higher expenses driven by business growth," the release said. Reported earned premiums, policy charges, and fees of $1.4 billion increased 7% from the year-ago quarter, reflecting growth in disability.

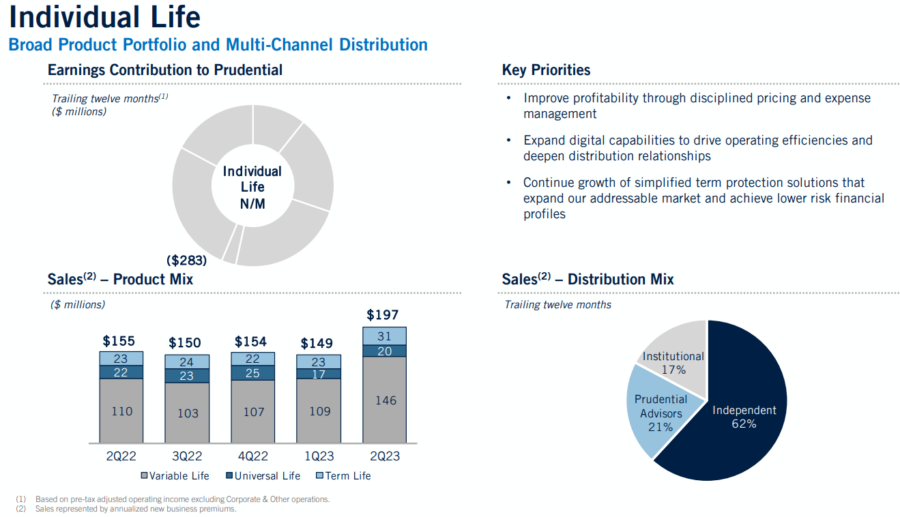

In its Individual Life segment, Prudential reported a loss, on an adjusted operating income basis, of $59 million, compared to a loss of $1.66 billion in the year-ago quarter. The reduced loss includes a favorable comparative impact from our annual assumption update and other refinements of $1.58 billion. Otherwise, current quarter results primarily reflect higher net investment spread results, the release said.

Sales of $197 million in the current quarter increased 27% from the year-ago quarter, driven by variable life sales, the insurer said.

Technology growth

Lowrey stressed the technology adoption at Prudential, which is helping the company in all aspects of the business.

"We continue to enhance the ways we leverage technology to improve customer experiences and optimize operating efficiency," he said.

He cited Prudential's new retirement modeller, a new digital tool designed to help institutional pension customers better understand of their retirement benefits and adjust their financial planning.

Likewise, Prudential recently formed a strategic partnership with Nayya, a leading benefits experience platform, to harness artificial intelligence and data science that empowers employees to make informed workplace benefits decisions.

Announced in July, the new partnership will allow Prudential Group Insurance clients to take advantage of Nayya’s benefits decision support tool during open enrollment.

"We're also using chatbot technology and robotic process automation to reduce transaction processing time across our U.S. businesses," Lowrey said. "As part of our continuous improvement framework, we are focusing on creating a leaner, faster and more agile company so that we can better meet the needs of our customers while driving growth and efficiency."

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Climate catastrophes take toll on Allstate Q2 earnings

Lincoln Financial execs reassure analysts on delayed Fortitude Re deal

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

More Life Insurance News