Prudential falls short of earnings forecasts, execs stress long-term focus

Prudential Financial continues to make moves to shake off the earnings malaise and reverse a stock decline. As in recent quarters, the first-quarter results are mixed at best.

Led by Chairman and CEO Charlie Lowrey, company executives met with stock analysts Wednesday and touted some significant moves Prudential closed in recent months, including:

1. Acquiring a majority stake in Deerpath Capital Management. It was announced Tuesday that PGIM, Prudential's $1.2 trillion global investment management business, signed a deal to acquire Deerpath Capital Management and its associated affiliates. Deerpath Capital is a private credit and direct lending manager focused primarily on financing private equity sponsor-backed companies in the lower middle market and has more than $5 billion in assets under management.

2. A new indexed variable universal life product known as FlexGuard Life. Introduced in the fourth quarter, FlexGuard Life offers buffered index strategies with potential for cash value accumulation. The new product is "ramping up nicely," said Caroline Feeney, executive vice president and head of Prudential's U.S. Businesses.

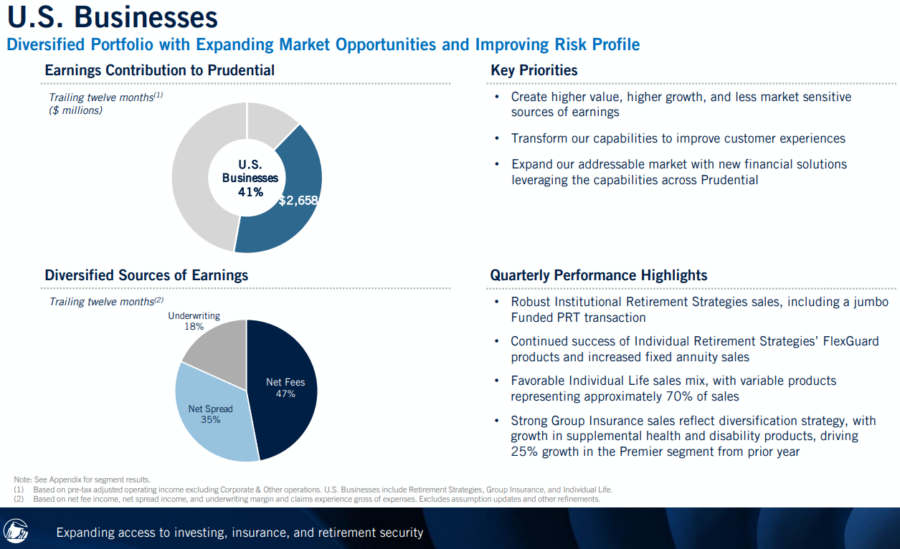

3. Pension Risk Transfer success. Prudential's Institutional Retirement Strategies division reported account values of $253 billion, a record high, increased 6% from the year-ago quarter. The insurer's PRT business had its best first quarter in the history of the company, Lowrey said.

Prudential posted revenues of $15.1 billion for the quarter ended March 31, compared to year-ago revenues of $13.30 billion. The insurer pointed to higher premiums, asset management fees, commissions and other income and net investment income for the revenue bump.

However, it translated to adjusted operating income of $2.66 per share, which fell well short of analysts' expectations. Prudential was plagued by declining operating income year over year for all of its segments and rising expenses. The company stock price is down nearly 24% year over year.

Lowrey maintained focus on the long term: "We're investing in long-term sustainable growth by expanding access to our products and services in markets around the world, including through programmatic M&A, and organic growth opportunities, creating the next generation of financial solutions and delivering industry leading customer experience."

Life insurance segment

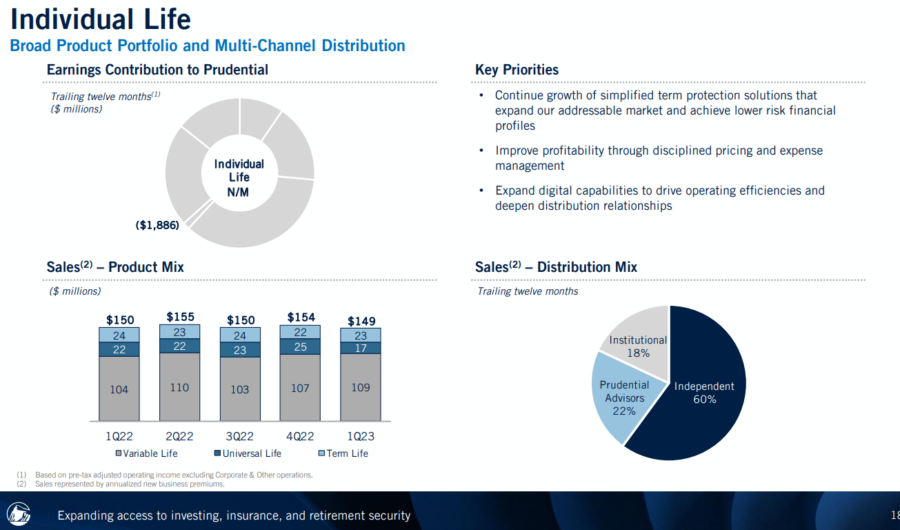

Prudential delivered stagnant results in its life insurance segment, reporting a loss, on an adjusted operating income basis, of $102 million, compared to a loss of $18 million in the year-ago quarter. The higher loss primarily reflects lower net investment spread results, driven by lower variable investment income, and less favorable underwriting results, Prudential reported.

Sales of $149 million were consistent with the year-ago quarter and "reflect our pivot to less market sensitive products," Prudential said in a news release.

"Our individual life sales reflect our earlier product pivot strategy with variable life products representing about 70% of sales for the quarter," said Rob Falzon, vice chairman.

Prudential includes annuity sales under its Individual Retirement Strategies segment, which reported adjusted operating income of $441 million in the quarter, compared to $431 million in the year-ago quarter. The increase reflects higher net investment spread results, partially offset by lower fee income, net of distribution expenses and other associated costs, driven by a reduction in account values, Prudential reported.

Account values of $124 billion were down 27% from the year-ago quarter, reflecting the sale of a block of legacy variable annuities, market depreciation, and net outflows, the insurer stated. Gross sales of $1.7 billion in the quarter "reflect the continued momentum from our FlexGuard products and increased sales of fixed annuity products," the release said.

"Sales of fixed annuities represented one-third of total individual annuity sales in the first quarter, a significant increase from the year-ago quarter," Lowrey said. "We continue to enhance the ways in which customers engage with our products and solutions to drive more digital experiences and better customer outcomes."

For example, a majority of annuities applications are now submitted with E-signature, Lowrey added, "which has reduced processing time by several days and improved our environmental impact."

Prudential executives all focused on the future, repeating the mantra of long-term stability. Assurance IQ, an insurance-distribution platform Prudential acquired in a $2.35 billion deal in 2019, was not mentioned in either the news release or the call with analysts. Prudential has struggled to make Assurance IQ a profitable venture.

While Assurance IQ finally turned a profit in the fourth quarter, it was negated by a $713 million "impairment charge" related to the fair value of business.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Progressive bolsters reserves, raising rates, will cut advertising

The Fed raises rates again, continues tug-of-war with inflation

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

More Annuity NewsHealth/Employee Benefits News

- MISSISSIPPI SENATE PASSES "JILL'S LAW," SENDING BIOMARKER TESTING COVERAGE BILL TO GOVERNOR'S DESK

- MEDICAID FINANCING: THE BASICS

- MORRISON JOINS COLLEAGUES, ADVOCATES TO HIGHLIGHT MEASURE PROVIDING COVERAGE FOR SEIZURE DETECTION DEVICES

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- Iowa insurance firms warn bill would make health costs rise

More Health/Employee Benefits NewsLife Insurance News

- Busch, Pacific Life settle dispute over $8.5M investmentFormer NASCAR champion Kyle Busch settles $8.5M lawsuit against life insurance companyTwo-time NASCAR champion Kyle Busch and a life insurance company have settled an $8.5 million lawsuit in which the driver said he was misled into purchasing policies marketed as safe retirement plans

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- U-Haul Holding Company Announces Quarterly Cash Dividend

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

More Life Insurance News