Prudential Continues Product Shifts, Posts Strong 3Q Earnings

By Doug Bailey

Prudential Financial efforts to “reposition” its business strategy are on track or ahead of schedule, executives said, and the results are reflected in strong third quarter results that significantly beat Wall Street estimates.

Chairman and CEO Charles Lowrey said a previously announced plan to achieve cost savings of $750 million by 2023 already achieved $590 million in reductions by the end of the quarter (it had earmarked $500 million).

Combined with the sales of its full-service recordkeeping business and agreements to sell a portion of its traditional variable annuities lines, the insurance giant reported net income of $1.53 billion, or $3.90 per share, compared to $1.48 billion, or $3.70 per share, in the third quarter 2020.

The results outpaced an analyst consensus per share estimate by $1.17, something the company has a track record of accomplishing about 90 percent of the time over the last two years.

'Significant Progress'

“We made significant progress executing against our transformation strategy to become a higher growth, less market sensitive, and more nimble company,” Lowrey said in a conference call following this morning.

The results were helped by strong investment performance across all its lines of business as well as increased fees and a high demand for its products worldwide, Lowery said.

The pandemic, however, took a toll on its group life and disability insurance results, which reported an adjusted operating loss of $135 million compared to net income of $22 million for the year-ago quarter.

The weakening was almost wholly attributed to underwriting losses from COVID-19. The Delta variant, in particular, was more deadly than expected, with more than three times the estimated fatalities in the 35-to-54-year-old category, according to Andy Sullivan, executive vice president and head of U.S. Businesses.

“Fifty percent of the impact came from claims in the southern part of the U.S.,” he said.

Nevertheless, the company said its individual life sales continued to be strong with higher variable life sales compared to the year-ago quarter, offset by lower sales of other policies, in particular universal life sales, consistent with its product pivot strategy.

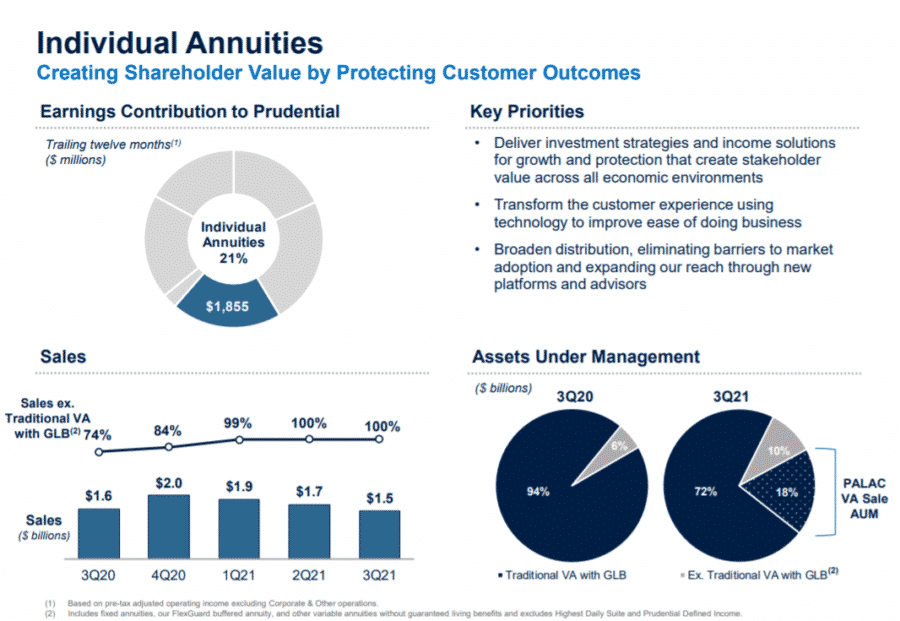

The company noted the continued success of its FlexGuard product line, introduced last year. FlexGuard is a registered index-linked annuity, designed to provide customers with downside protection and the opportunity to grow and accelerate the performance of their retirement assets into the future. More important for Prudential and it is in keeping with its transformation strategy of less interest-rate sensitive instruments.

“Our product pivots have worked well,” said Robert Michael Falzon, vice chairman. FlexGuard sales, “were $1.3 billion in the third quarter, representing 88% of total individual annuity sales.”

Since the launch of FlexGuard in 2020, sales have exceeded $6 billion.

Phasing Out VAs

Executives said the company is committed to significantly reducing the earnings contribution from traditional variable annuities with guaranteed living benefits, an industry-wide trend.

Looking ahead, company executives said they expected the company’s growth outlook was strong, but it would likely come “organically,” as opposed to through mergers and acquisitions as some of its industry peers seem to be doing.

Asked to elaborate, however, Ken Tanji, Prudential’s executive vice president and chief financial officer, said the company wants to be “in the know and in the flow” with respect to potential M&A opportunities, but with $6 billion in capital set aside to fuel growth, there’s no overarching need to expand through buying other companies.

“Only if they make sense for our shareholders and constituents,” Lowrey said.

The company presented a baseline EPS estimate for the fourth quarter of $2.27 per share that included items specific to the quarter that would reduce results by $0.78 per share.

LTCi Industry Makes Push After Sales Decline In 2020

Lincoln Financial Reports Strong Sales, Declining Income In 3Q

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Recent Research from Medical College of Wisconsin Highlight Findings in Managed Care and Specialty Pharmacy (Differences In Glp-1 Ra Medication Adherence Across Place-based Variables In Patients With Diabetes Living In Wisconsin): Drugs and Therapies – Managed Care and Specialty Pharmacy

- Trademark Application for “NAYYA” Filed by Nayya Health, Inc.: Nayya Health Inc.

- Researchers at Augusta University Target Managed Care (The importance and challenge of comparing stroke care, utilization and outcomes in Medicare Advantage and Fee-for-Service Medicare: a narrative review and vision for the future): Managed Care

- Researchers’ Work from Oregon Health & Science University (OHSU) Focuses on Managed Care (Evaluating variation between states in algorithms used for identifying abortions in Medicaid claims data): Managed Care

- Proposed Medicaid cut could end meal deliveries for thousands of Idaho seniors

More Health/Employee Benefits NewsLife Insurance News