Principal Financial Takes Slight Hit From COVID-19

Principal Financial Group’s overall income dropped year-over-year with the COVID-19 crisis depressing some sectors and lifting others, particularly a spike in term life sales, according to the company’s first-quarter report and earnings call.

Like other diversified life and annuity companies, Principal went into the year with stronger performance in variable annuity assets and other business associated with the surging equities market, and struggling on the fixed annuity side because of historically low interest rates. Although fixed annuities ticked up for the industry as a whole in March, it was not enough to offset the drop in the quarter’s overall revenue.

Despite entering the pandemic from "one of the strongest financial positions" in company history, as stated by Deanna Strable, Principal’s chief financial officer, some first-quarter numbers were down.

Principal reported $285 million in net income on $4.6 billion in revenue -- compared with $452 million in net income on $3.7 billion in revenue for the first quarter of 2019.

Annuity highlights:

Principal's retirement and income solutions sector reported $205 million in pretax operating profits on $2.6 billion in revenue. That compares with $241 million in pretax operating profits on $1.7 billion in revenue in the year-ago quarter.

- Pre-tax operating earnings increased due to favorable experience gains and higher variable investment income, partially offset by the net impact of lower annuity sales in the quarter.

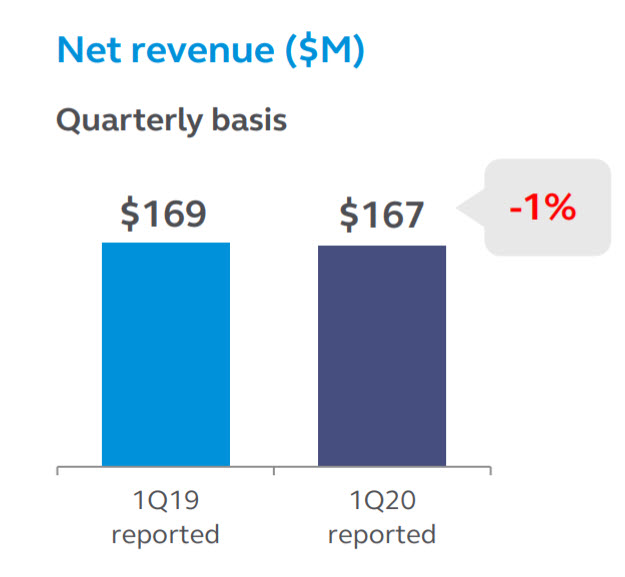

- Quarterly net revenue decreased slightly due to lower fixed annuity sales in the current quarter.

- Quarterly sales of $2.3B, including a record $1.5B of pension risk transfer sales.

- Sales pipeline slowing with COVID-19 crisis and rate environment; Bank generating increased sales in deposit sweep products.

Life highlights:

Principal's individual life sector reported $41 million in pretax operating earnings on $484 million in revenue. That fell short of the $51 million in pretax operating earnings on $466 million in revenue for the first quarter 2019.

- Pre-tax operating earnings decreased due to higher claims partially offset by growth in the business.

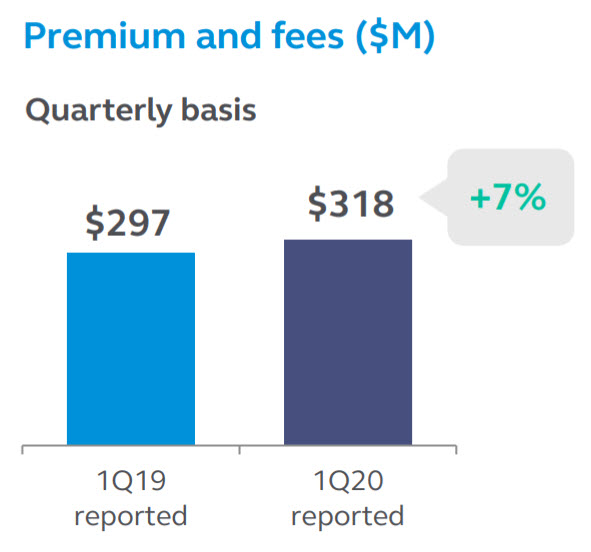

- Premium and fees increased 7% over the year ago quarter.

- COVID-19 pandemic highlighting the importance of life insurance; seeing increased interest for term life.

Strable acknowledged that widespread unemployment "is starting to have an impact" on Principal’s retirement plans' business. So far, just "a small percentage of plan sponsors" have made changes, she added, and participant withdrawals are only "slightly elevated." Principal added more than 450 plans and 75,000 participants to its legacy defined contribution business during the quarter, Strable said.

“We expect COVID will continue to present challenges to people and businesses all over the world," she said. "Starting from one of the strongest financial positions in our company’s history, Principal will continue to navigate this crisis through its strategic plans and will make purposeful decisions."

One of the first insurers to report first-quarter earnings, Principal recorded quarterly net income of $288.9 million. On a per-share basis, the Des Moines, Iowa-based company said it had profit of $1.04. Earnings, adjusted for investment costs, came to $1.15 per share, just missing analysts' expectations of $1.19 per share.

Principal is paying a $0.56/share quarterly dividend, 1.8% increase from the prior dividend of $0.55. The company paused its stock repurchasing in early March.

CEO Dan Houston said the company adjusted quickly to the pandemic, and 95% of Principal's 18,000 global employees are working remotely. Otherwise, executives cited PFG's broad portfolio as positioning it well to withstand the steep economic downturn.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Workers More Concerned About Their Finances Than Their Health

COVID-19 Brings Uncertainty To Insurance, Retirement Plans

Advisor News

- Economy showing momentum despite uncertainty

- 7 ways financial advisors can benefit by giving back to nonprofits

- Emergency Preparedness: How advisors can prepare clients for hurricanes

- Federal employees: An emerging market for advisors

- The financial advisor’s guide to creating an effective value proposition

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Guest opinion: The high costs of single-payer health care

- Medicaid overhaul proves to be politically perilous proposition

- Worries persist about CVS Health

- Cigna commercial health plans may go out-of-network at large local hospital group

- The Medicaid Asset Protection Trust (MAPT)

More Health/Employee Benefits NewsLife Insurance News

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

- Securian Financial Enhances Its Flagship Indexed Universal Life Insurance Product

- AM Best Affirms Credit Ratings of The Dai-ichi Life Insurance Company, Limited

More Life Insurance News