Premium Financing: Helping Heirs With Estate Taxes

In today’s uncertain tax environment, many financial and estate planners are forced to make difficult choices. They must determine how much money to allocate toward life insurance premiums to provide estate liquidity and hedge against future estate taxes, and how much to dedicate to business interests and personal investments where yields are likely to be higher.

Life insurance premiums can appear daunting. As a result, many clients end up purchasing the amount of coverage they are comfortable paying for instead of buying the amount of coverage their plan requires. In certain situations, premium-financed life insurance can provide the opportunity to acquire the amount of coverage required, while adding flexibility and reducing the annual outlay required by paying premiums traditionally.

Mrs. Bryant

A widow for several years, Mrs. Bryant, 73, had a $30 million estate and was facing a projected estate tax liability of $8 million. A needs-based analysis concluded that a life insurance strategy to obtain $10 million in coverage could serve two purposes. First, it would provide an efficient way to offset Mrs. Bryant’s growing estate tax liability and ensure her legacy was maximized as it passed to the next generation. Second, life insurance proceeds would provide liquidity to pay the taxes due. This would save Mrs. Bryant’s daughters from being forced into selling assets or securities at unfavorable prices and possibly incurring additional taxes.

The Life Insurance Analysis

Mrs. Bryant faced a dilemma. If she were to purchase a traditional guaranteed life insurance policy with $10 million in coverage at her age and in her risk class, the lifetime premium would be approximately $320,000 a year. This is money Mrs. Bryant would not have available to spend on her daily living expenses or future care costs.

Even if there were additional liquidity to pay premiums, buying this policy would not be the best use of capital. By the time she reached her anticipated life expectancy at age 91, Mrs. Bryant would have paid $5.7 million in premium to provide her estate with $10 million in death benefit, a net insurance benefit of $4.3 million, or an internal rate of return of 5.55%.

Mrs. Bryant didn’t care for the premium amount, the lifetime duration of the premiums or the lack of value she perceived she was receiving.

At this stage, it still wasn’t known whether Mrs. Bryant was a candidate for premium loan financing. Done properly, a life insurance analysis evaluating the effectiveness of premium loan financing must include an assessment of:

» A policy design that integrates with the estate plan;

» Multiple lending options considering various collateral arrangements;

» The exit from the loan arrangement; and

» A full disclosure and acceptance of the risks involved.

The Policy Design

For Mrs. Bryant, an indexed universal life policy presented advantages over other cash policy types. An IUL policy permits a client to participate in the upside of market growth linked to selected indexes, while severely limiting exposure to market declines through guaranteed minimum interest rates and index floors, mitigating some of the risk in financing premiums for IUL.

The premium finance strategy provided Mrs. Bryant significant savings and limited the length of her contribution commitment. She would borrow $2.7 million annually for seven years and contribute $150,000 annually toward debt service for 10 years for a total cost of $1.5 million. At life expectancy, the finance design was projected to provide $13 million in death benefit, for a total net insurance benefit of $11.5 million, or an IRR of 16.6%.

Mrs. Bryant used her investment portfolio as collateral and used excess cash flow generated by her investments to service the annual commitment of $150,000.

The benefits of financing appear to be considerable. Mrs. Bryant was projected to exceed her death benefit goal while saving more than 50% annually and limiting her payment duration from lifetime to 10 years.

Premium financing in today’s market is most effective for clients ages 40-60 seeking at least $10 million of coverage. In building death benefit designs, the planner should target a death benefit amount that is slightly higher than the client needs. This is to maintain a net death benefit that targets the client’s goal throughout the lifetime of the transaction. If the client dies, the bank is repaid first, with the remaining proceeds passing to the client’s beneficiaries.

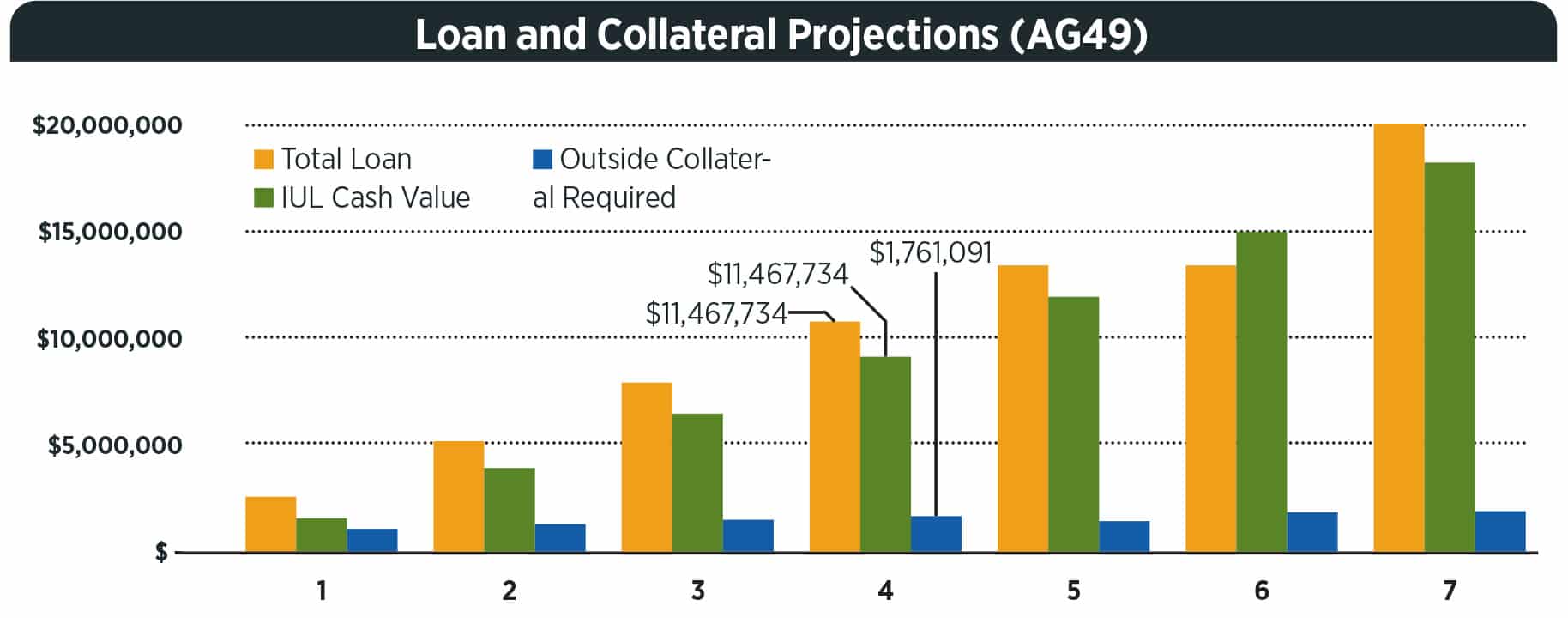

The Loan

At the time Mrs. Bryant applied for financing, she was able to secure a 3.40% first-year variable rate, highly competitive at the time. The cash value of the IUL policy served as the primary collateral, and the secondary collateral was secured through a portion of Mrs. Bryant’s outside assets.

Mrs. Bryant’s transaction required $1 million in outside collateral in the first year, projected to grow to a high point of $2 million for policy years six through eight. A series of stress tests, which took poor policy performance and a rising loan interest rate into consideration, showed the collateral could grow as high as $3 million and could possibly be required for 10 years.

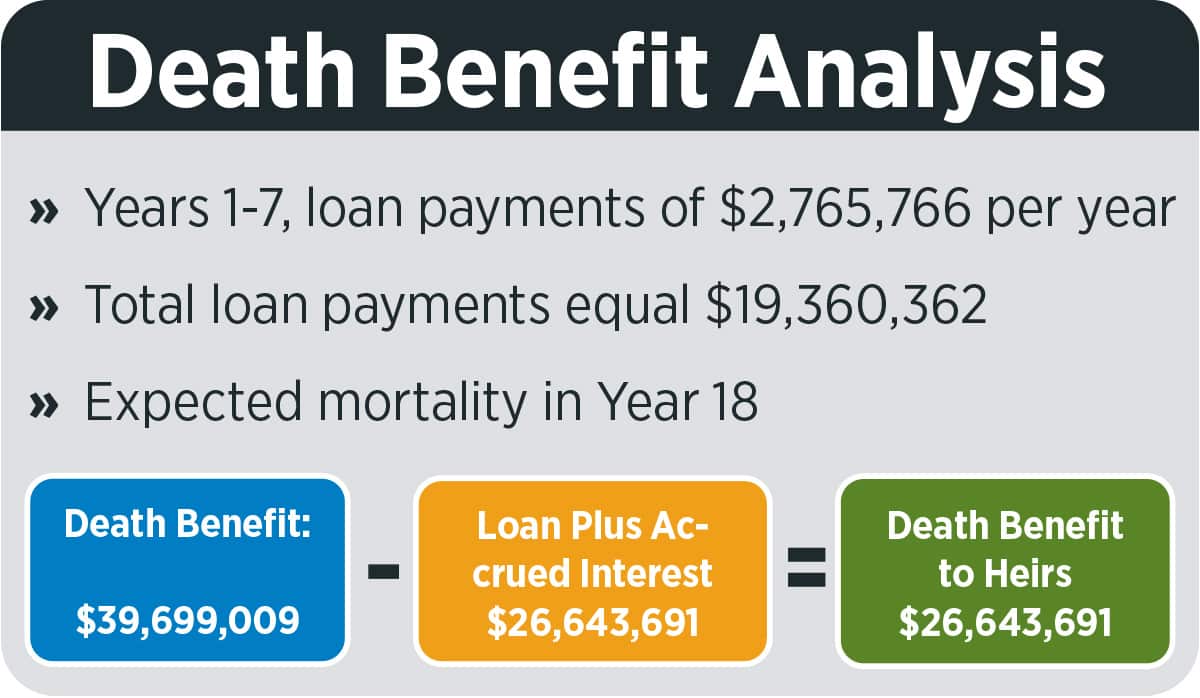

Projecting The Exit

When constructing a premium-financed death benefit design for a client over the age of 70, death is often the exit strategy when the lender will be repaid from the death benefit and the remainder will pass to the policy’s beneficiaries. It is critical for these designs to target the net death benefit to match the client’s goal of $10 million.

Consider The Risks

There are several risks to consider before moving forward with a premium-financing transaction. These risks generally fall into three categories:

1. Policy risks involve adjustments to the life insurance policy’s performance.

2. Personal risks are largely related to someone’s net worth, liquidity and posted collateral, which impact a client’s ability to qualify for a loan.

3. Lending risks are almost always associated with the interest rates for loans but may also come from changes to other terms.

The Outcome

Mrs. Bryant died unexpectedly in 2020, a few years after implementing her plan. This permitted a review of her premium loan financing strategy.

Projected vs. Actual Premium Finance Results at Mortality

Actual Total Death Benefit: $27,000,000 vs. Projected Death Benefit: $27,000,000

Actual Total Outstanding Loan: $11,297,186 vs. Projected Outstanding Loan: $11,735,256

Actual Net Death Benefit to Estate: $15,702,814 vs. Projected Net Death Benefit to Estate: $15,264,744

After Mrs. Bryant’s passing, her estate was valued at $35 million, and her children received the liquidity they needed to pay $7 million in estate taxes. As a result of her plan, $44 million passed to the next generation. This amount included higher-than-expected death benefit proceeds of more than $15 million.

Premium loan financing may be the solution to challenging estate planning scenarios involving individuals who cannot divert cash to pay for life insurance. Evaluating the suitability of premium financing involves much more than simply reviewing policy death benefit amounts and lending interest rates. All aspects of how premium loan financing impacts an estate must be considered.

Matthew Levesque is a principal of Vérité Group, a national life insurance planning firm based in Miami. He may be contacted at [email protected].

DOL Likely To Revisit A True Fiduciary Standard, Experts Say

Manhattan Project — With Barjes Angulo

Advisor News

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

More Life Insurance News