Pandemic Dims Retirement Hopes For Blacks, Hispanics, EBRI Finds

The pandemic set Black and Hispanic Americans further back in their income potential and retirement prospects, further exacerbating an existing retirement disadvantage.

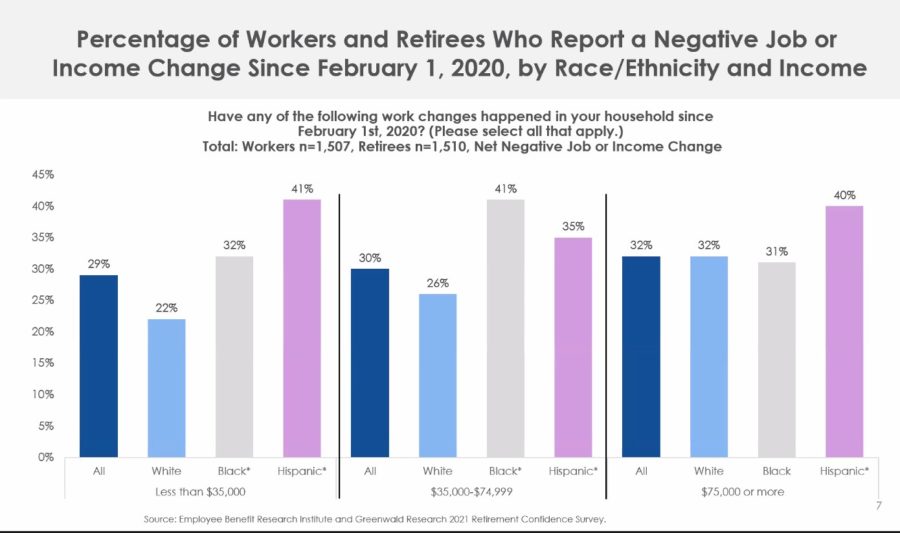

Blacks and Hispanics were more likely than whites to experience disruption in employment, according to findings from the 2021 Retirement Confidence Survey, conducted by the Employee Benefit Research Institute and the Greenwald Research. The most recent survey added a focus on racial and ethnic differences.

At least 35% of Hispanics across income groups had a negative job or income change since February 2020. Even in the highest income group, 40% of Hispanics reported a negative effect. At least 31% of all Blacks experienced a negative effect, with the most pronounced in the middle income group.

“So, they're already starting at a lower income, and they're more likely to have a negative impact,” said Craig Copeland, a senior research associate with EBRI.

The wealth gap between whites and Blacks or Hispanics remains throughout the income groups. Lower- and middle-income Black Americans were more likely to report savings of less than $1,000 compared with whites. Also, the share with the highest amount of assets ($250,000 or more) was much higher for whites than for Blacks or Hispanics for middle and upper incomes.

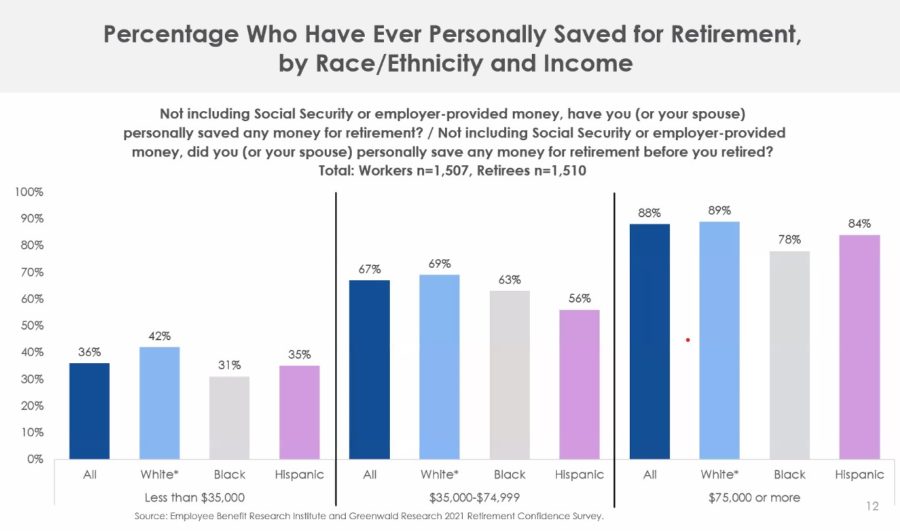

Blacks and Hispanics across the income groups were less likely than whites to have saved for retirement.

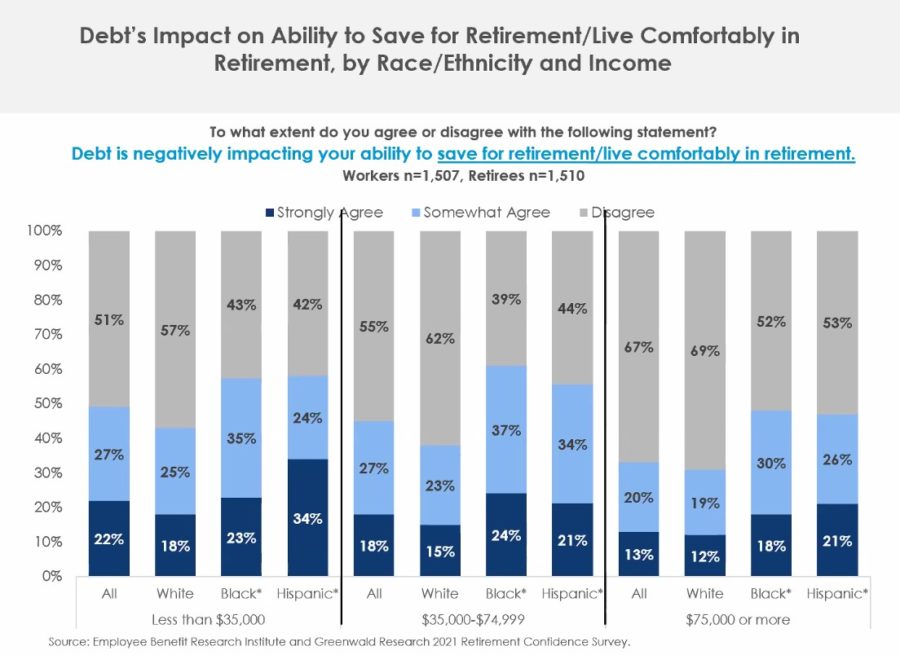

Blacks and Hispanics were also more troubled by debt, setting them further back. Even in the highest income group, nearly half of Blacks and Hispanics said their debt burden restricts their ability to save for retirement.

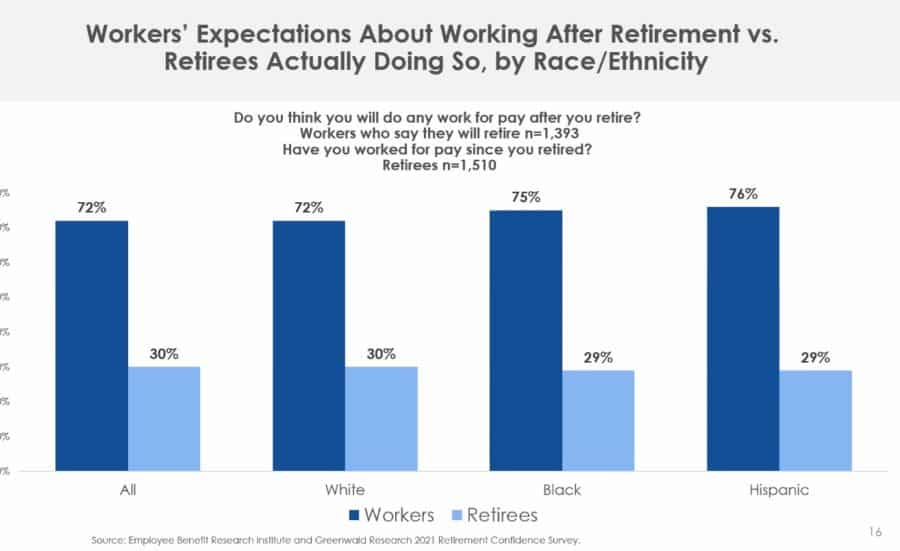

That is a particular problem because people retire sooner than they expect. Even though a majority of Americans believe they will be working into their retirement years, circumstance say otherwise.

Blacks and Hispanics who do work in retirement do so because they have to, rather than for fulfillment.

“White Americans say that they can afford to retire. That's their No.1 reason for why they retired,” Copeland said. “But when you look at it for the black retirees and Hispanic retirees, the No.1 reason was that they retired earlier because of their health or they had a disability.”

Copeland attributed the difference to a likely lack of health insurance along with less income and fewer assets.

Advisors And Attitudes

About a third of all respondents said they did not know where to go to find an advisor. And although less than half of the respondents in almost all groups worked with an advisor, the group who was most likely to have an advisor was high-income Hispanics.

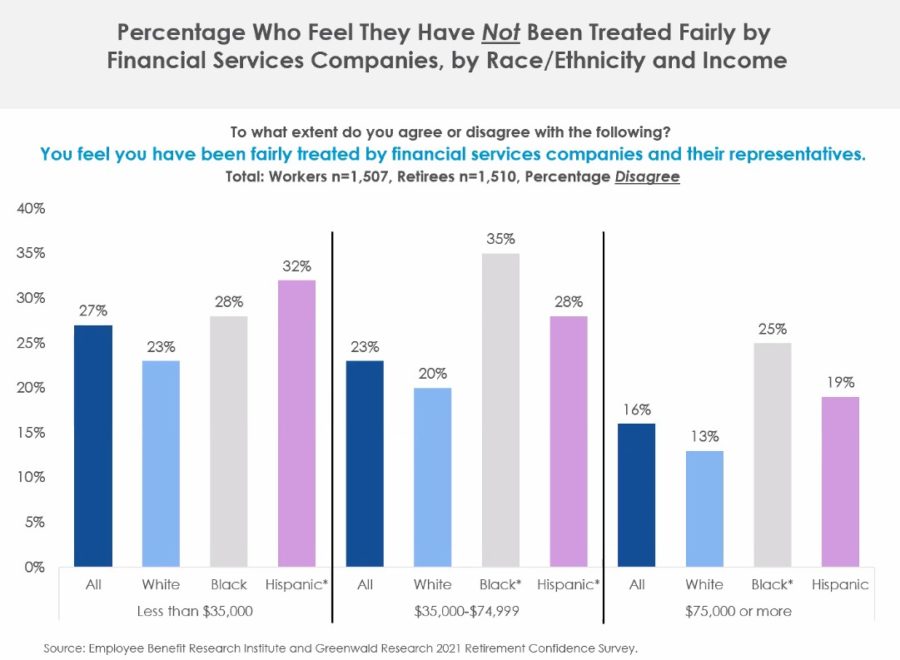

But that does not mean they enjoyed the experience. In all the income groups, Blacks and Hispanics were less likely than whites to say they had not been treated fairly by financial services companies.

Even in the top income group, 25% of Blacks said they were not treated fairly.

That might account for why Blacks and Hispanics were more likely to prefer working with advisors of the same background, race, ethnicity and even gender. About half of Blacks and Hispanics also preferred working with advisors who are affiliated with their employer.

One consistency across the groups is most people are stressed about planning for retirement. More than half of each group said they were stressed, said Lisa Greenwald, CEO of Greenwald Research.

“Regardless of some of the differences we've pointed out, a lot of Americans say preparing for retirement stresses them out. Although it’s certainly worth pointing out that in that lower income group and in the higher income group, Hispanic respondents were especially likely to agree,” Greenwald said. “So, the parting word is stress is universal.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Roadblocks And Motivators To Men’s Health

Alliance For Lifetime Income: Annuities Add Fuel To Bucket Lists

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

More Annuity NewsHealth/Employee Benefits News

- UnitedHealth Group shares fall nearly 20% as company forecasts lower sales this year

- Progress on nurses' strike as Mt. Sinai, NYP agree to keep health plans

- Nevada health insurance marketplace enrollment dips nearly 6% but 'remained fairly steady'

- AM Best Assigns Credit Ratings to CareSource Reinsurance LLC

- IOWA REPUBLICANS GET WHAT THEY VOTED FOR: HIGHER HEALTH INSURANCE PRICES, FEWER PEOPLE INSURED

More Health/Employee Benefits NewsLife Insurance News