Overcoming the all-or-nothing mindset

It is clear that there is a life insurance need gap — the difference between those who say they need life insurance and those who actually own it — and therefore a large opportunity for more individuals to obtain coverage. However, booming sales have not materialized. According to LIMRA, total U.S. retail life insurance new annualized premium fell 7% in the first quarter of 2023 to $3.7 billion. How do we grow this market?

One area to consider is helping consumers overcome the all-or-nothing mindset. This mindset refers to a thought process where individuals perceive things in extremes, considering situations or outcomes as either completely successful or completely unsuccessful. This mindset can make it challenging to find balance and to create realistic expectations. In many cases, individuals will just procrastinate and be inert.

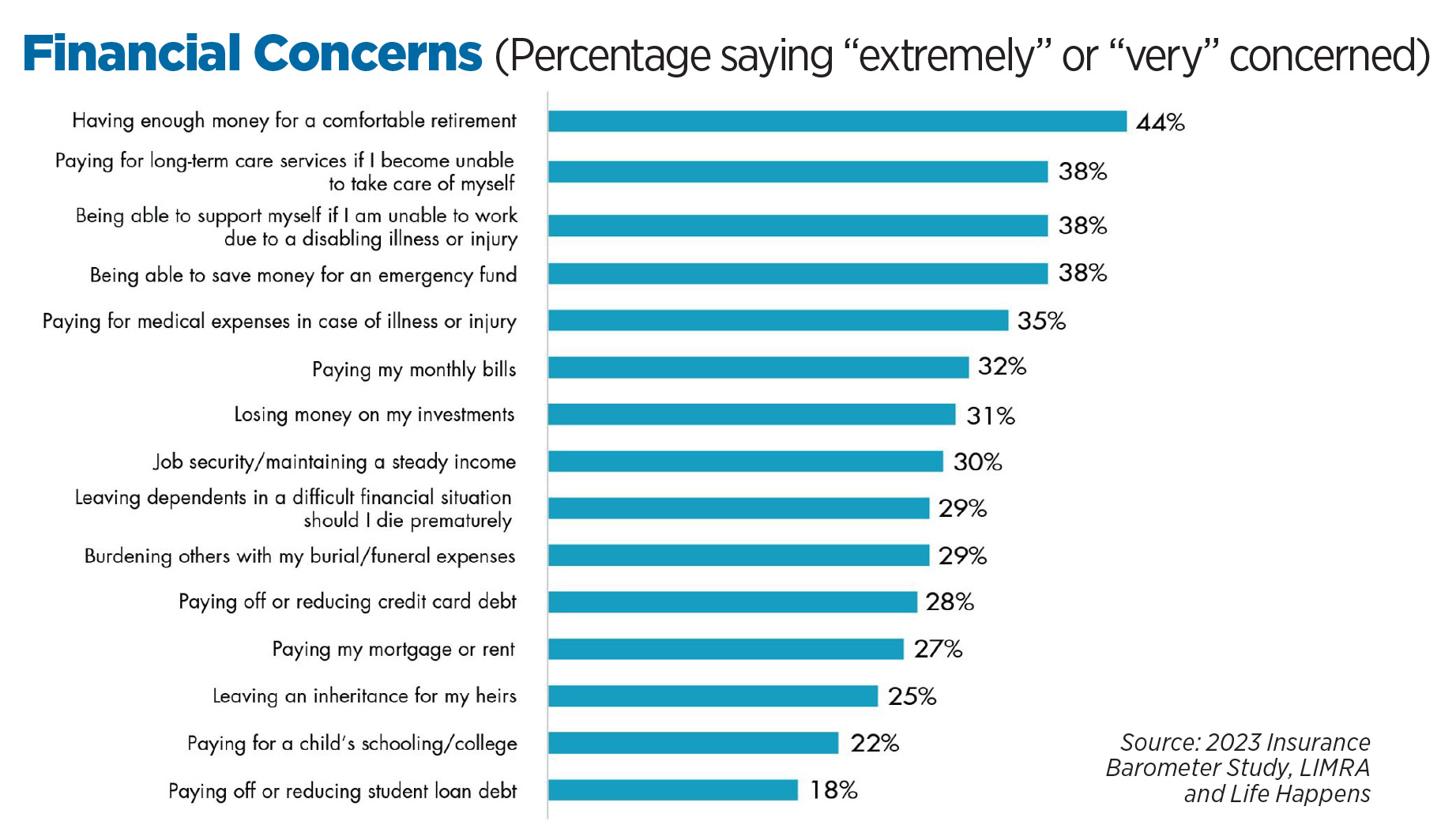

According to the 2023 Insurance Barometer Study, conducted by LIMRA and Life Happens, today’s consumers are trying to manage a multitude of financial concerns. Things such as saving money, paying monthly bills and paying down debt, or burdening others with their expenses are top of mind. These financial concerns could lead to consumer paralysis or result in consumers coming up with excuses. Two key reasons for not purchasing life insurance are “having other financial priorities” and “haven’t gotten around to it.”

Here are three things agents/advisors could do to help close the need gap.

1. Help individuals focus on small goals. Let them achieve and make progress. It doesn’t have to be all doom and gloom. Let them build momentum and see results.

In some cases, full-blown financial planning can be overwhelming and lead to customer concerns. According to a survey by Schroders, 76% of Americans say they feel overwhelmed by the thought of creating a financial plan and 56% say life is too uncertain for a plan to have any value.

2. Illustrate the impact of a dollar. Consumers can more easily visualize small dollar amounts through mental accounting. How much insurance could you buy instead of buying a latte? A relatively small change can amplify positive outcomes at relatively minimal cost.

There is also the potential to use subscription-based terminology and marketing to align with the growth of plans such as Netflix or Amazon Prime. According to eLabs, 64% of respondents say that they feel which connected to companies with which they have a direct subscription experience versus companies whose products they simply purchase as one-off transactions. In addition, 78% of adults globally have a subscription service.

3. Embrace digital in order to be relevant for younger consumers. For the first time, consumers are more likely to say they would prefer buying life insurance online than by any other method.

This is especially true for young adults. They expect a seamless experience and streamlined process that enables them to purchase coverage quickly and easily.

Younger customers also appreciate flexibility and personalized options. As you build trust over time, having the ability to offer your customers customized coverage based on their specific needs and budget will be crucial. You could start with simple and easy product options like term life insurance and increase coverage with other products as their circumstances change.

The financial services industry has always been based on relationships. That hasn’t changed. But to be effective, approaching these relationships must evolve to include a better understanding of clients’ needs, trying new sales tactics and embracing technology.

This will increase sales of life insurance across different and new demographics and help more Americans get the coverage they need to protect their loved ones.

Keith Golembiewski is senior director of LIMRA’s strategic research program. He may be contacted at [email protected].

Charting the course of life insurance

Annuities can help manage income risks in retirement

Advisor News

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- University of Houston Researchers Detail New Studies and Findings in the Area of Nursing (A Comprehensive Evaluation of Feasibility and Acceptability of a Nurse-Managed Health Clinic for Homeless and Working Poor Populations: A 3-Year Study): Health and Medicine – Nursing

- Study Results from University of Colorado Anschutz School of Medicine Broaden Understanding of Managed Care (Impact of Medicaid, Medicare, and Private Insurance on Access to Orthopaedic Surgeons of the Spine: A National Mystery Caller Study): Managed Care

- Caucasus University Researcher Reports Recent Findings in Health Management (An Analysis of Claims Adjustment Processes in Georgia’s Health Insurance Sector: Qualitative Study): Health and Medicine – Health Management

- New Managed Care Findings from Brigham and Women’s Hospital and Harvard Medical School Described (Z-Drug Use in the First Trimester of Pregnancy and Risk of Congenital Malformations): Managed Care

- AMO CALLS OUT REPUBLICANS' HEALTH CARE COST CRISIS

More Health/Employee Benefits NewsLife Insurance News

- One Bellevue Place changes hands for $90.3M

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

More Life Insurance News