Need for financial advice drives more secondary accounts to wealth management firms

In their search for financial advice, more Americans are shifting secondary account deposits from traditional banks to financial firms such as wealth management and online financial services, new research by data analytics company J.D. Power suggests.

J.D. Power recently found that more clients of traditional banks have opened a secondary account at an investment/wealth management or internet-only financial company and received advice from that secondary provider over the last year.

"This deposit account movement is driven by national bank customers who feel financially healthy and/or have deposit balances greater than $10,000," Paul McAdam, J.D. Power senior director of banking and payments intelligence, told InsuranceNewsNet. "These are the customers most likely to move deposit accounts and balances."

Opportunity for financial firms

While clients seeking advice from wealth management firms and online services is a potential "danger facing the National Banks," said McAdam, it's simultaneously an area financial services firms can take advantage of.

J.D. Power's study suggests that many "competitive" providers may already be doing so.

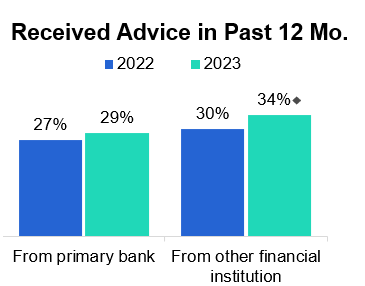

"The increase [from 29%] to 34% receiving advice from the secondary deposit provider points to increased risk of primary providers losing future wallet share," he said.

"Financial services professionals who work for investment/brokerage, bank, insurance and other types of providers that accept deposit relationships should embrace the fact that a good number of these new deposit customers are looking for advice," McAdam said.

He noted that the industry has historically viewed secondary deposit customers as transactional customers who are only looking for a good deal, such as higher deposit interest rates. With the study suggesting they are increasingly seeking advice from those secondary providers, however, that outlook could pivot.

"The national banks are not meeting the demand for advice that is expressed by these attractive, high-potential customers," McAdam said. "The study tells us that competitive financial services providers are taking advantage of this."

Financial advice a satisfaction driver

McAdam noted that quality financial advice is increasingly becoming a major satisfaction driver that influences a client's preference for which financial services provider to choose.

"Customers who receive advice from any type of financial service provider [are] more likely to open new accounts with that provider and reuse the provider the next time they need a financial product," he said.

This is a critical factor that could have played a role in the shift from banks to wealth management and online services for secondary accounts, as J.D. Power found an increasing proportion in the number of Americans looking to their secondary service provider for advice over the last two years.

Among customers of the nine U.S. national banks who have a secondary deposit account relationship with a different provider, 34% received advice from the secondary deposit provider in the past 12 months. In comparison, just 29% received advice from their primary bank.

Further, McAdam noted the 4% difference observed this year was slightly wider than the 30% vs. 27% advice differential in 2022, suggesting it could be increasing each year.

Secondary accounts at banks declining

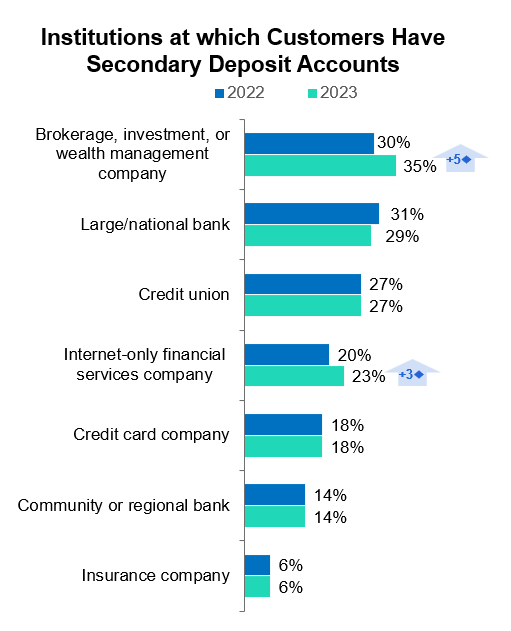

While large or national banks had the highest share of secondary deposit accounts in 2022, at 31%, this percentage dropped to 29% in 2023.

At the same time, the percentage of secondary deposit accounts opened with brokerage, investment or wealth management companies increased from 30% in 2022 to 35% in 2023. This category now accounts for the highest share of secondary deposit accounts among customers of traditional banks.

Additionally, the percentage of secondary deposit accounts opened with an internet-only financial services company increased from 20% in 2022 to 23% in 2023.

The data conveys that, collectively, more than 50% of Americans use a major bank for their primary deposit account but either a wealth management firm or online financial service for secondary deposit accounts.

7 satisfaction metrics identified

In its recently released U.S. National Banking Satisfaction Study, J.D. Power examined client satisfaction with their banking experience based on seven key metrics:

- Trust

- People

- Account offerings

- Allowing customers to bank how and when they want

- Saving time and money

- Digital channels

- Resolving problems or complaints

The study evaluated and ranked scores across the nine major U.S. banks and found overall satisfaction with the banking experience has increased slightly year-over-year. On a 1,000-point scale, the average ranking has jumped from 648 in 2022 to 653 in 2023.

The J.D. Power National Banking Satisfaction Study, now in its seventh year, was based on a survey of just under 13,000 retail banking customers. The nine major banks included in the study were Capital One, Chase, TD Bank, U.S. Bank, PNC, Citi Bank, Bank of America, Wells Fargo and Truist.

In the 2023 edition of the survey, Capital One ranked the highest for overall satisfaction for the fourth consecutive year, with a score of 706 on a 1,000-point scale.

This survey is the latest in a series of studies conducted by J.D. Power to assess client and advisor satisfaction with financial tools such as websites and apps, as well as with overall experience.

Rayne Morgan is a Content Marketing Manager with PolicyAdvisor.com and a freelance journalist and copywriter.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Rayne Morgan is a journalist, copywriter, and editor with over 10 years' combined experience in digital content and print media. You can reach her at [email protected].

Supplemental spousal liability coverage: A choice for New Yorkers to make

Committee lists policy priorities as ERISA marks 50 years

Advisor News

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

More Advisor NewsAnnuity News

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Judge tosses Penn Mutual whole life lawsuit; plaintiffs to refile

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

More Life Insurance News