Most Consumers Baffled By Annuities, Study Finds

Courtesy of LIMRA

According to a recent Secure Retirement Institute study, only 1 in 4 consumers can correctly answer at least 7 out of 10 annuity-related questions. In addition, more than 40% answered “not sure” to each of the 10 questions.

“Our study revealed annuity owners go to the head of the class when it comes to understanding how annuities work,” said Matt Drinkwater, corporate vice president at SRI. “Almost 6 in 10 annuity owners achieved a high score on the annuity quiz, compared with just 21% of those who don’t own an annuity. We believe that knowledge likely contributes to annuity owners’ positive views of annuities. Twice as many annuity owners view the products positively, compared to non-owners (83% to 41%).”

The research also showed that Americans are confused about how to turn workplace savings into lifetime guaranteed income. Based on the quiz, only 1 in 4 consumers understood that annuities could be purchased with money saved in workplace retirement plans, such as 401(k) and 403(b) plans.

In general, the SRI study found consumers who reported having greater financial knowledge in general scored higher on the annuities quiz. Almost half of consumers (49%) claiming to be very knowledgeable about financial products or investments had a high annuity knowledge score, compared with 35% of those who professed to be somewhat knowledgeable.

Just 17% of consumers who said they were not very knowledgeable achieved a high annuity knowledge score.

To put this into perspective, fewer than 1 in 10 Americans consider themselves very knowledgeable about financial products and investments, according to a 2019 SRI study.

Annuity Knowledge Key

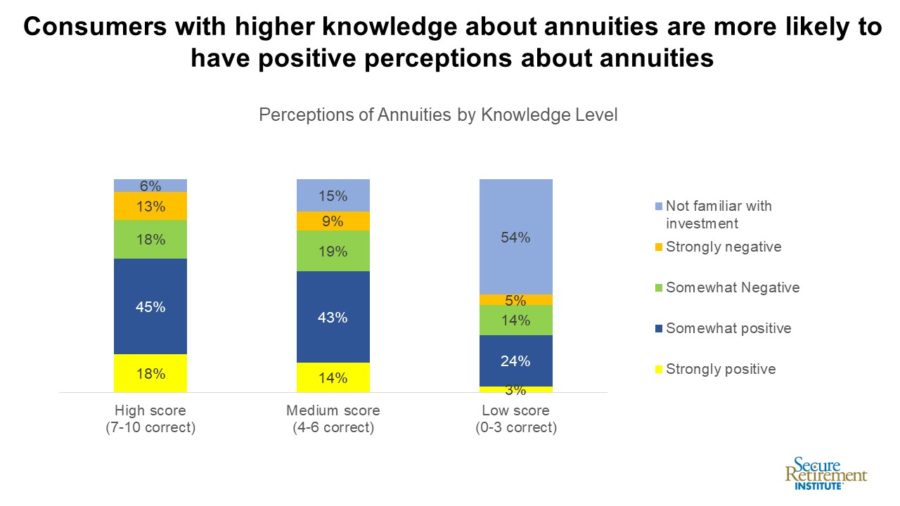

The study finds consumers who have a high level of annuity knowledge are more likely to have positive views about annuities, compared with those who scored poorly. Sixty-three percent of consumers who answered at least 7 of the 10 questions correctly had a positive view of annuities, compared with just 27% of those who answered 3 or fewer questions correctly (see chart).

“Greater annuity knowledge also translated into higher interest in converting assets into guaranteed lifetime annuities,” noted Drinkwater. “Nearly 4 in 10 consumers (37%) with high annuity knowledge expressed interest in annuitizing a portion of their retirement assets, compared with only 15% of those with low knowledge levels.”

SRI researchers suggest consumers who have less knowledge about annuities may be more susceptible to negative press coverage of annuities, which could impact their views. To combat misinformation, financial advisors and annuity manufacturers should find creative and engaging ways to teach potential clients about the key features and benefits of annuities.

Non-traditional forms of learning, such as online games and tools, can increase awareness and improve knowledge about annuities.

Americans Nervous About Looming Recession: MDRT Survey

Five Steps To Navigate Working From Home

Advisor News

- Empower CEO: stock market volatility ‘here to stay for a bit’

- Raven MacFarlane-Bradbrook: We need Medicaid more than billionaires need tax cuts

- Could in-plan annuities head up a new asset class?

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Anwar would bar AI from making health care decisions

- Anwar would bar AI from making health care decisions

- Interim Report Q3 2024/2025 Report

- Findings from School of Humanities and Social Sciences Broaden Understanding of Mental Health Diseases and Conditions (Migration and Depression Among Chinese Grandparents: Moderated Mediation Model of Social Support and Social Health Insurance): Mental Health Diseases and Conditions

- AM Best Affirms Credit Ratings of UnitedHealth Group Incorporated and Its Subsidiaries

More Health/Employee Benefits NewsLife Insurance News