Morningstar sees a bright second half for stock market

For those suffering from the darkness of doom predictions, Morningstar analysts had a bit of sunshine in their 2023 Stock Market Outlook.

Although the first half of the year will still be rough for stocks, the second half will be the start of an uptick in the economy and equities, the analysts said in a presentation on Tuesday.

Dave Sekera, Morningstar’s chief U.S. market strategist, said this year looks far different than the beginning of 2022, when Morningstar saw that company valuations were overvalued. Now companies are looking undervalued going into 2023.

“We actually see a lot of undervalued opportunities here today,” Sekera said. “As much as we do think the market is undervalued. I do suspect that we're going to be in somewhat of a volatile trading range for at least the next several months as those headwinds that we identified last year will continue to play out before they really fully abate and turn into tailwinds by the second half of this year.”

A contrasting perspective

This perspective contrasts with many other analysts who say that company valuations have not taken in the full scope of inflation’s impact. In Morgan Stanley’s stock outlook, for example, analysts said they expect equities to drop more than 20% this year. A key Morgan Stanley analyst, Michael Wilson, said that although many observers expect a dip mid-year, they are underestimating the depth of that drop because corporate profit estimates are still way too high.

The Morningstar analysts said they do believe there will be a dip in the first half, and maybe even a recession, but it will be a short one. Preston Caldwell, Morningstar head of U.S. economics, said people are asking the wrong question.

Caldwell expects GDP growth to be subdued this year, down to 0.8% in 2023, which he said translates to a 30% to 50% chance of a recession.

“The binary question of will there or won't there be a recession gets way too much attention,” Caldwell said, “because answering this question doesn't actually tell us that much.”

Instead, we need to focus on the question of what kind of a recession we are likely to have, he said. Rather than the prolonged recession following the 2008 crash, Caldwell and Sekera said they expect a bounce like the one after the rate-increase shock imposed by the Federal Reserve in the early ’80s, after which the decade boomed with growth.

Sharp rebound expected in 2024

“In 2024, we expect growth to rebound sharply and remain strong in the following years,” Caldwell said. “That rebound will be fueled by a Fed pivot to looser monetary policy, and ultimately enabled by supply side expansion, both in terms of labor supply and productivity on the inflation front.”

One of the other “will it or won’t it” questions is when the Fed will stop increasing its funds rate and even dial back down. Fed governors have indicated that they want to keep ratcheting up the rate and keep it there to dampen inflation long term. That might mean a couple of more increases to get the funds rate to about 5%, but they emphasized that they want to bring inflation down to 2%. Morgan Stanley, for example, said that drive could bring about a deep recession.

Caldwell disagreed that the recession will be deep and predicted that the Fed will see a 2% inflation rate far sooner than others have said.

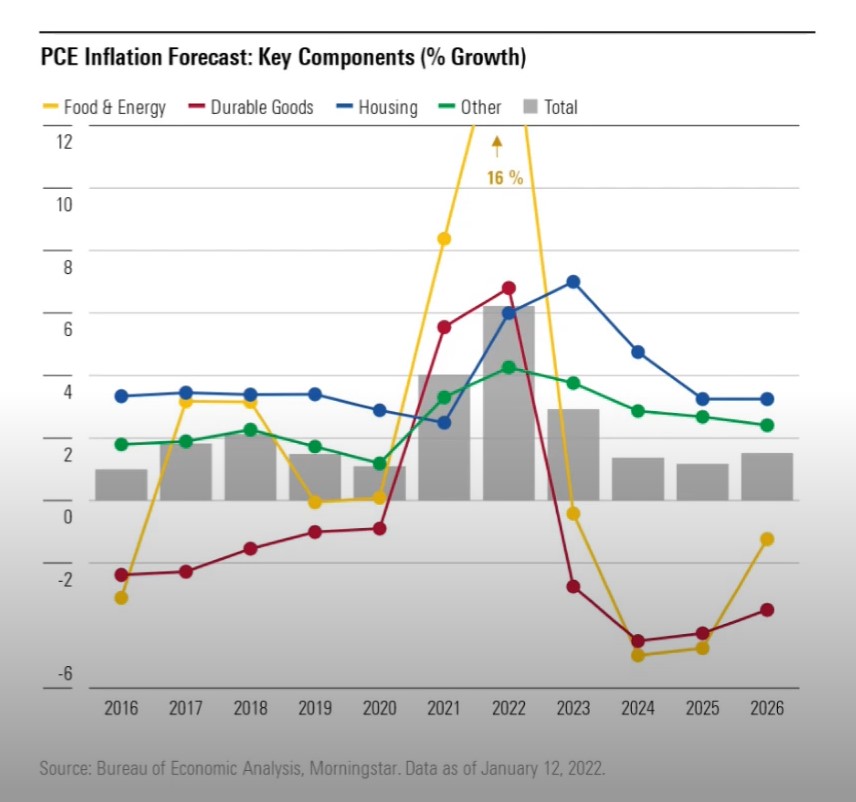

“We're expecting inflation to come down dramatically in the next couple of years, owing to a cooling off of the economy from Fed tightening as well as easing supply constraints,” Caldwell said. “We expect inflation to hit 2.9% for 2023, on average, even getting to 1.6%, below the Fed’s 2% target by 2024.”

A key reason for the optimism is that Caldwell expects that kinks will work out in the supply chain and the labor force will normalize. Although he recognized that this is contrary to the consensus, he attributed the sour outlook of other observers to an overreaction to productivity issues, which Caldwell said were due to temporary factors.

“The biggest difference is that we're more confident that the supply shocks, which have caused inflation in 2021 and 2022, will not only cease in impact, but actually unwind in impact, providing much deflationary pressure over the next several years,” Caldwell said.

Stocks undervalued

In focusing on companies, Sekera said that half of the stocks that Morningstar covers are trading at undervalued levels, with only 19% of the companies trading in overvalued territory, which he said was a sharp reversal from the end of 2021. Coming into 2022, only 24% of stocks were unvalued and 32% were overvalued.

Energy is currently the most overvalued sector, trading at 12% premium to Morningstar’s fair value, Sekera said, adding that he would caution investors in that sector. Other sectors in what he called the consumer defensive group were also close to being overvalued, principally healthcare and utilities.

“Now's the time that you should be moving more into some of those interest rate sensitive sectors and into the cyclical sectors,” Sekera said.

One of those more attractive sectors might be surprising, communications, which has been taking a beating recently. He included Alphabet and Meta in the group, which he considered undervalued. A key reason for the resurgence is the need to advertise as consumers spend the money they have been saving during the pandemic.

More cyclical sectors, such as technology, which was overvalued last year, are offering more opportunities, he said. An example of an industry that is on a long-term upward trajectory is electric vehicles. But he suggested a way of taking advantage that did not involve investing in auto manufacturers, instead focusing on the lithium market, which is integral to the production of electric vehicles.

Other sectors are benefitting from consumers shaking off the pandemic, such as travel. A company there would be Carnival, which has been undervalued as consumers avoided cruises. Park Hotels, an upscale chain, is seeing an uptick because of the return of business travelers. And, of course, Southwest Airlines has had a bit of a dip in price because of its recent debacle.

The shift in companies’ fortunes was evident in the megacap stocks, which are companies with more than $250 billion in market cap. Of its 2022 list of 15 megacap companies, nine underperformed and only two had positive returns. This year’s list only has 10 companies.

“The real takeaway on this list,” Sekera said, “is to see how much sometimes the market can act like a pendulum and swing from being overvalued to undervalued.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Nearly 16M Americans sign up for ACA plans so far

The impact of chronic disease and immunity on field underwriting

Advisor News

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

- How OBBBA is a once-in-a-career window

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

- How the life insurance industry can reach the social media generations

- Judge rules against loosening receivership over Greg Lindberg finances

- KBRA Assigns Rating to Soteria Reinsurance Ltd.

More Life Insurance News