Morningstar raises ‘safe’ withdrawal rate recommendation

Morningstar has raised its recommended retirement withdrawal rate closer to the 4% rule of thumb in an era of low equity valuations and higher bond yields.

In its research, The State of Retirement Income 2022, Morningstar raised its recommended safe withdrawal rate to 3.8%, with annual inflation adjustments, up from 3.3% last year, even in an equity bear market.

The study authors acknowledged that new retirees are facing a sequence risk because they are entering their drawdown years just as equity and bond prices decline. The bad market conditions early in retirement drag on wealth and returns for the rest of the drawdown period of 30+ years. But that isn’t all.

“Exacerbating sequence risk this time around is the fact that inflation has risen, potentially forcing retirees to take higher withdrawals from their reduced portfolios,” according to an article on the report by Christine Benz, Morningstar personal finance director, and John Rekenthaler, Morningstar vice president of research.

Despite those headwinds, cash and bond yields have increased enough to give portfolios a “nice lift,” although it’s not a set-it-and-forget-it proposition.

“Retirees who are willing to employ more-flexible strategies or make other modifications to a fixed real withdrawal system can enjoy even higher starting withdrawals, assuming they’re willing to accept other trade-offs, such as fluctuating year-to-year real cash flows and the possibility of fewer leftover assets at the end of a 30-year period,” according to the article.

The modeling assumes a 50/50 stock/bond allocation and a 30-year horizon for a 90% probability of not outliving the money, as long as the retiree adjusts for inflation.

Although it’s been a tough year for stocks, researchers increased their long-term equity outlook, pegging the 30-year average returns at 9%-12%, up from 6%-11%. Expected bond returns were also raised to 5%, up from 3%, reflecting higher yields. The expected inflation rate was also increased to 2.8% annually, up from 2.2%.

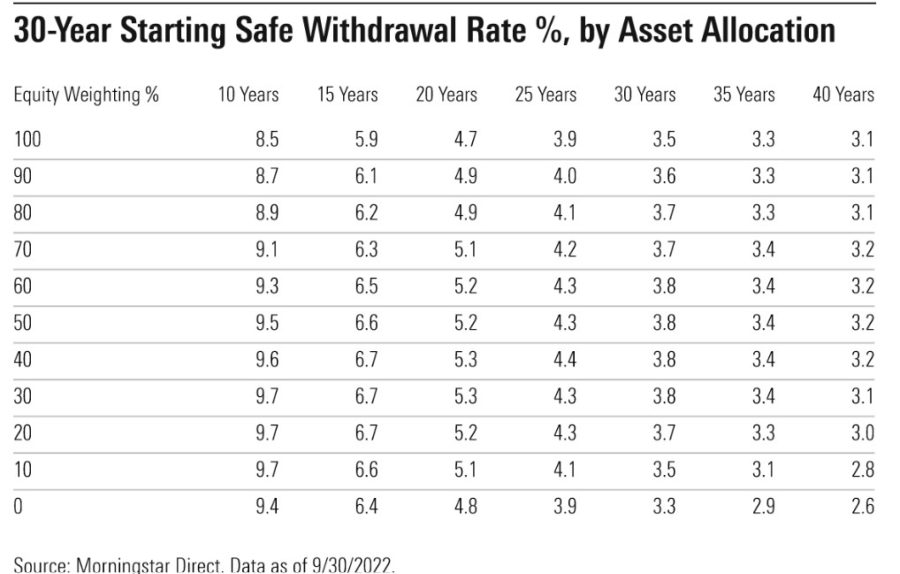

“Even factoring in those higher inflation adjustments, however, our research suggests that retirees embarking on retirement today can reasonably use a higher starting withdrawal rate than indicated last year,” the article stated. “Moreover, our research suggests that new retirees don’t need to stick their necks out with higher equity weightings in order to obtain higher starting paydays.”

The withdrawal rate would sustain even if the retiree decreased the equity ratio down to 30%, the authors wrote. People with a shorter horizon of 10-15 years could withdraw more aggressively if they lowered equities to less than 40% because of the decrease in volatility.

The study showed the equity return for 30-year periods between 1927 and 1992 ranged from 3.3% for the worst case, up to 5.9% for the best. But some periods were particularly treacherous, such as from the 1960s to the early 1970s, when a 4% starting withdrawal was dangerous.

“The results make clear that one period’s results cannot be used to predict those of the next period,” according to the article. “Bond yields change, stock valuations shift, and inflation rates rise and fall. Each has a strong effect on both portfolio performance and safe withdrawal amounts.”

Alternative withdrawal systems

The article pointed out that Morningstar’s model might not account for how people spend in retirement, which tends to be higher in the beginning, then tapering off until medical expenses increase toward the end. Even with inflation, retirees tend to spend about a percentage point below the inflation rate.

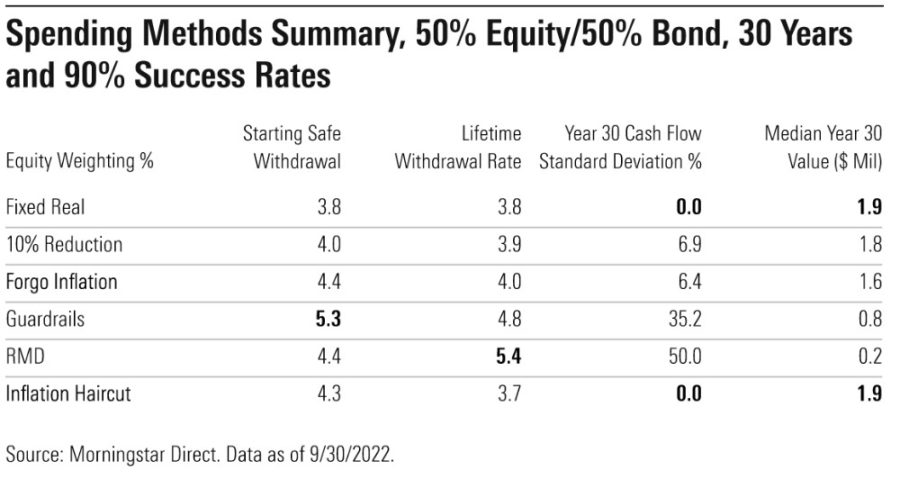

The withdrawal rate method offers paycheck-like regularity, but flexible, dynamic systems can offer higher average withdrawal rates, according to the study. The systems ranged from simple tweaks, such as forgoing inflation adjustments after the portfolio lost value the preceding year, to dynamic systems such as “guardrails,” which allows variability based on market performance but sets an upper boundary on how much comes out in good markets and a lower boundary around withdrawals in down markets.

“Our research found that all of these systems elevated starting and lifetime withdrawal rates (the average portfolio withdrawal rate over a 30-year time horizon) relative to the fixed real spending system we used as our base case,” according to the article.

The research report pointed out that a main trade-off is volatility in retirees’ cash flow.

“While most variable withdrawal strategies do help enlarge retirees’ lifetime payouts, they may also subject retirees to swings in their standards of living,” according to the report. “Consequently, retirees may find flexible schemes unacceptable.”

In a separate article, Benz said the steady withdrawal rate can work but be aware of current market impact on the long-term. Basically, flexibility is a good thing. Take out less in down markets such as this year’s. That way, retirees can take out more in good times.

“In environments like 2019 through 2021, for example, retirees who saw nice gains in their equity portfolios could potentially take more during those years,” Benz wrote. “Even if you're using something like the 4% guideline, planning to make those periodic course corrections is really valuable.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Want more loyal customers? Focus on these 4 differentiators

4 reasons to take on an industry leadership role

Advisor News

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Idaho is among the most expensive states to give birth in. Here are the rankings

- Some farmers take hard hit on health insurance costs

Farmers now owe a lot more for health insurance (copy)

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance News