Minnesota studies a Medicare companion product for LTC coverage

A consultant working with Minnesota officials says a Medicare companion product might be a better answer than taxing residents to underwrite a public long-term care benefit.

The state is studying a public-private partnership plan to create more options for residents to get LTC coverage. One significant idea is to add home care benefits to a Medicare Supplemental (Medigap) insurance or Medicare Advantage plan.

"Essentially you hybridize a Medicare Advantage product, or a Medicare Supplement product with a long-term care insurance, or a short-term care insurance, or something meaningful to allow these families and their loved ones to actually have coordinated care," explained Steve Schoonveld, managing director of Global Insurance Services at FTI Consulting.

FTI is working with Minnesota officials on its Own Your Future long-term care educational campaign. Schoonveld presented some initial findings Saturday at the Long-Term Care Actuarial Working Group meeting. The working group met at the National Association of Insurance Commissioner's Summer Meeting in Seattle.

While the ideas Schoonveld presented have been kicked around for a few years, the Minnesota group is nearing the end of its work. One additional advantage of building an LTC component off of Medicare is it can be done fast, Schoonveld said.

"I could file this product right now in all of your states for the most part," he told regulators. "With the loose tie to the Medicare Advantage or the Medicare Supplement plan a person has no regulatory changes whatsoever."

It opens the door to other LTC insurance solutions as well, Schoonveld added.

"The private industry can also offer extended coverage on top of that, or they could assume the risk in collaboration with a Medicare Advantage product or a Medicare Supplement carrier," Schoonveld said.

Early intervention

A focus of efforts in Minnesota is on early intervention, or being able to offer residents assistance when they are beginning to experience decline rather than waiting until their needs reach the serious, and more costly, stage.

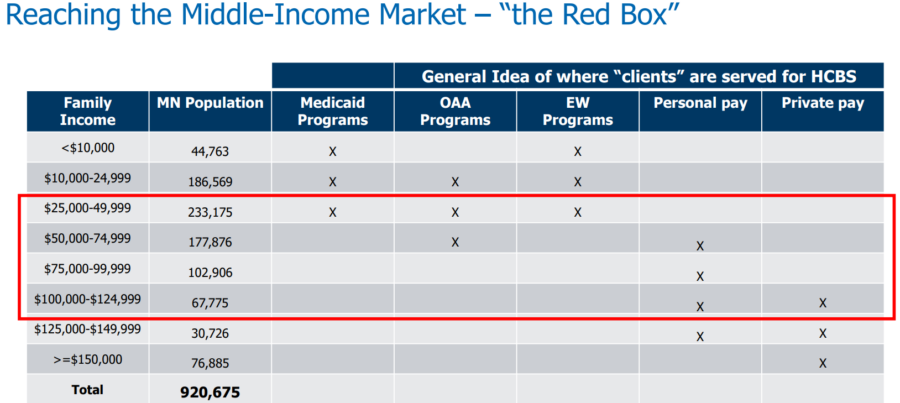

Specifically, it is the middle market Minnesotians most likely to need help and not be able to find it, Schoonveld explained. The study group identified the "Red Box" group of most vulnerable residents as those with incomes between $25,000 and $125,000.

Minnesota stakeholders are considering a "no wrong door" approach and tapping all available revenue streams to meet the needs of residents, Schoonveld said. But it is not considering a tax, he added.

"This is about building on what's really working today in Minnesota," he said. "Right now, in Washington state, they are taxing people 58 basis points even if you are Medicaid eligible right now. That's not something that is equitable in my mind. We're not talking about that in Minnesota.

"We're talking about helping people in the Red Box. Funding is secondary."

WA Cares up and running

Washington state residents began paying taxes on July 1 as the state’s WA Cares Act – a bill aimed at helping residents pay for long-term care – took effect. It is the first-of-its-kind public LTC benefit and continues to draw plenty of criticism.

WA Cares requires employers to withhold a 0.58% premium tax on employee wages to pay into the state-mandated trust called the WA Cares Fund. The fund is designed to provide Washington residents up to $36,500 adjusted for inflation per lifetime to pay for long-term care, beginning in July 2026. Residents must pay into the fund for at least 10 years to be eligible for the benefit.

The increasing cost of Medicaid to pay for long-term care was cited as the main reason behind implementing WA Cares. In Washington state, Medicaid expenditures related to long-term care costs are $2.1 billion annually.

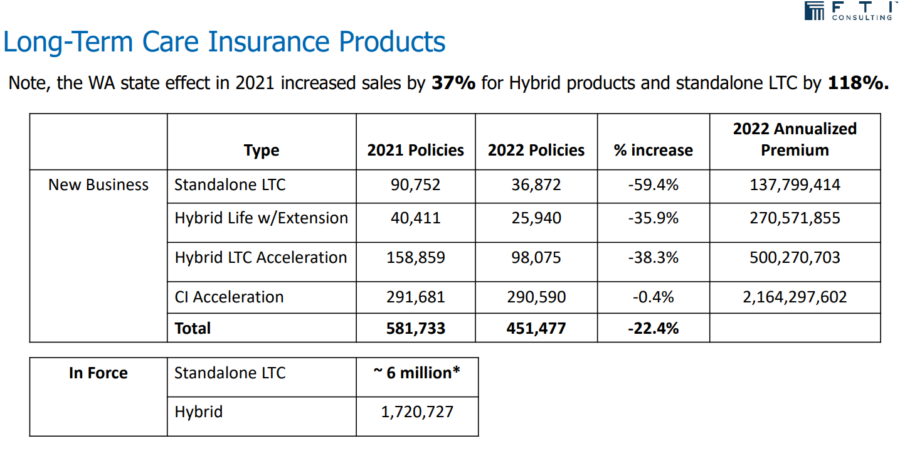

Carroll Golden, director of NAIFA’s Limited and Extended Care Planning Center, has said that 50% of agents surveyed in Washington said they believe the WA Cares program prompted positive conversations about long-term care. About 500,000 Washington residents were able to opt out of the WA Cares program by purchasing their own long-term care coverage.

The spike in sales created the false impression that LTC insurance products are in decline, Schoonveld said.

"That's the one thing to take away from this, that there are multiple ways that people are looking to fund their long-term care needs," Schoonveld said.

Correction: A previous version of this article incorrectly cited "Minnesota officials" in connection with the presentation. No Minnesota officials participated in the meeting

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

401(k) plan is becoming non-negotiable for job seekers, study finds

Annuities: Maximizing retirement income in 2023 and beyond

Advisor News

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

More Advisor NewsAnnuity News

- Trademark Application for “EMPOWER MY WEALTH” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Conning says insurers’ success in 2026 will depend on ‘strategic adaptation’

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

More Annuity NewsHealth/Employee Benefits News

- New Managed Care Study Findings Have Been Reported by G. Martin Reinhart and Co-Researchers (Psychiatric Medication Prescribing by Nurse Practitioners and Physician Associates for Medicare Beneficiaries): Managed Care

- Data on Managed Care Reported by Researchers at American Dental Association (Early association of expanded Medicare dental benefits to dentist billing in Medicare): Managed Care

- Researchers to study universal health care, as Coloradans face $1 billion in medical debt

- Veteran speaks out on veterans mail-order drug bill

- National Life Group Selects FINEOS AdminSuite to Transform Living Benefit and Life Insurance Claims Operations

More Health/Employee Benefits NewsLife Insurance News