MetLife Considering Sale Of Variable Annuity Block, Reuters Reports

MetLife is mum this morning on reports that the carrier is looking to sell its variable annuity block, although the company’s stock was expected to pop on the news as it builds on its all-time highs.

MetLife is just starting to work with an investment bank on selling the VA business to focus on higher-growth segments, according to sources cited by Reuters in an article published on Friday. Private equity buyers have been snapping up legacy carriers’ annuity blocks, often for investment capital.

MetLife does not disclose the size of its variable annuity business, according to Reuters. The carrier’s variable and fixed annuity business totaled $58.23 billion in 2021, according to financial filings. MetLife is the largest life insurer in terms of life insurance "in-force" in North America.

"As a matter of policy, we do not comment on market rumors or speculation," a MetLife spokeswoman said this morning.

The company does not sell individual life and annuity products, instead focusing on group products. Sale of the VA block would release potentially billions of dollars for the company. MetLife spun off its retail business as Brighthouse in 2017.

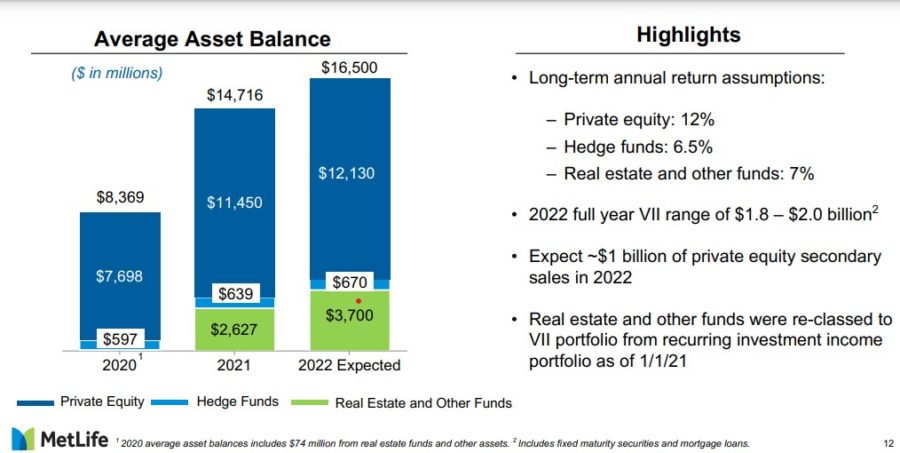

The company’s Retirement and Income Solutions, or RIS, adjusted earnings were up 18% year-over-year in 2021. The primary driver was higher variable investment income, according to MetLife’s year-end statement, largely due to strong private equity returns. RIS investment spreads were 202 basis points, driven by another strong quarter of variable investment income.

Morningstar Ratings said it made sense that the carrier would be looking for a deal but issued caution on the price.

“While we appreciate the logic of selling the variable annuity book, which will free up capital to pursue growth opportunities, we believe it is important that the growth opportunities come at a reasonable price,” the ratings agency said in reaction to the news. “We note that Prudential recently took a write-down on its acquisition of Assurance IQ. With no deal certainty and a deal likely to only be a fraction of the firm’s market capitalization, we are maintaining our no-moat rating and $52 fair value estimate for MetLife.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Ohio National Pays $1.5B In Dividends To Policyholders In 2021

Investment App Usage Bloomed As COVID-19 Spread, Survey Finds

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- How might carriers respond to drop in ACA enrollment?

- CalOptima reports steep membership drop as providers brace for surge in uninsured patients

- Why Hospitality Owners in South Carolina Need Specialized Group Health Insurance Guidance

- 'Insurance is not cheap': School board debates absorbing $1.3M premium hike

- Pennie cancellations mount as swelling costs drive enrollees away from health insurance

More Health/Employee Benefits NewsLife Insurance News