Medigap rules vary to the ‘extreme’ from state to state, advocates say

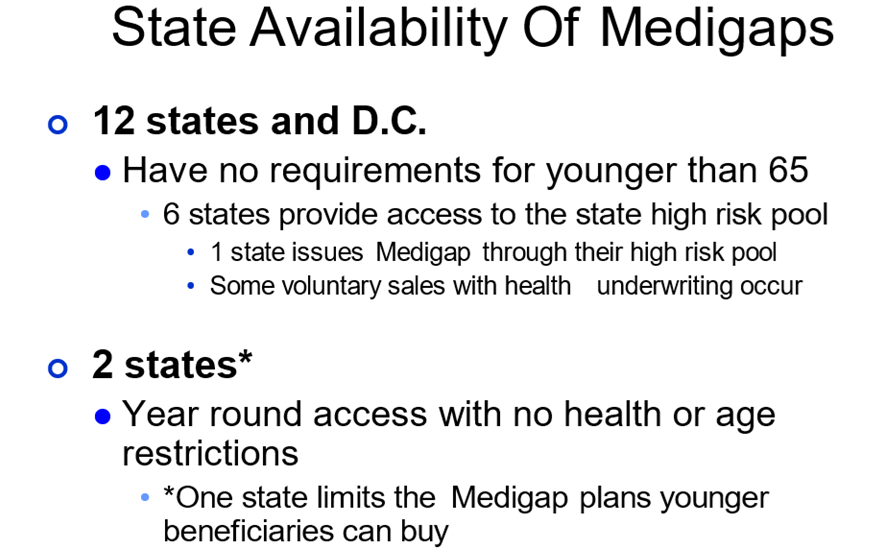

Access to an often much-needed Medigap policy varies greatly by state for those under age 65. That is policy that some health care advocates are eager to see change.

"There's a large number of states where there's no access at all to someone under the age of 65," said Bonnie Burns, training and policy specialist with California Health Advocates. "And nationally, only 2% of younger beneficiaries have a Medigap."

Burns joined colleagues in presenting on the Medigap topic Thursday before the Senior Issues Task Force, which reports to the National Association of Insurance Commissioners.

Also known as Medicare Supplement, or MedSup, Medigap policies are a crucial form of health insurance for many older Americans. Sold by private insurers, Medigap policies cover the out-of-pocket costs associated with Medicare.

Regular Medicare normally requires beneficiaries to pay 20 percent of their medical bills after their deductibles are met.

All Medigap policies are standardized, meaning they offer the same basic benefits no matter where you live or which insurance company you buy the policy from. There are 10 different types of Medigap plans offered in most states, which are named by letters: A-D, F, G, and K-N. Price is the only difference between plans with the same letter that are sold by different insurers.

Those under age 65 face a different set of issues with Medicare supplemental coverage, said Kara Nett Hinkley, vice president of state policy at The ALS Association. In 2023, 30.8 million Medicare beneficiaries were enrolled in a Medicare Advantage plans, she noted.

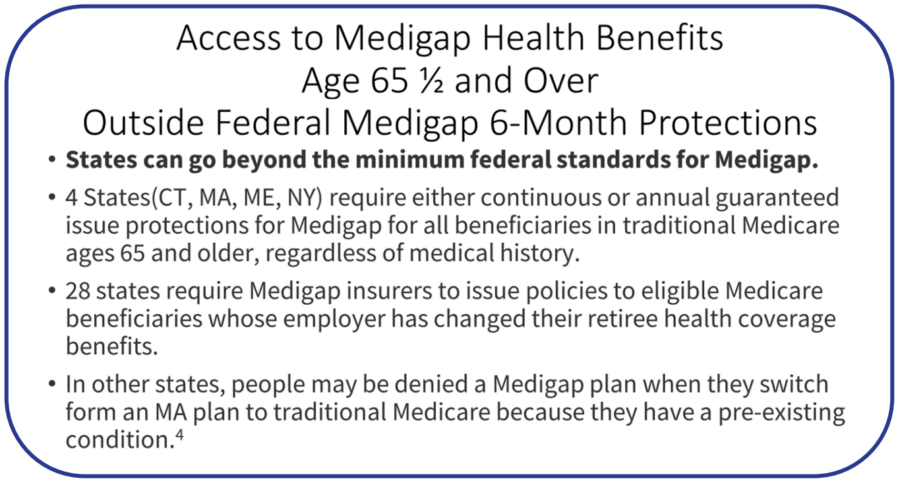

"And now many have become stuck in a plan that changed benefits providers or networks and they no longer are meeting the needs of patients," Hinkley explained. "So while Medicare Advantage members can return to original Medicare during the annual enrollment period, they have little or no access to Medigap in most of the states."

Why just 3 states?

Burns has over thirty years of experience in Medicare, Medicare supplemental insurance, and long-term care insurance. To compile her data on availability of Medigap policies, she visited each state's website.

"There are more than 30 states now that have attempted in some way or another to offer access to a Medigap to someone under the age of 65," she reported. "But the variations are extreme from one state to another."

Just three states offer the ideal scenario, Burns said: full Medigap access to all Medicare beneficiaries with no health or age pricing factors.

"Why can in three states all the risks be accepted, regardless of age?" Burns asked. "What is it that happens in those states and doesn't happen in other states? And what can states learn from those three states? The NAIC could collect data to help inform states and policymakers to help understand how to make more insurance available to people under the age of 65."

Medicare Advantage often a trap

As the Kaiser Family Foundation reported recently, Medicare Advantage business is booming. More than half of the 60 million Americans with Medicare are now enrolled in the private plans rather than the traditional government-run program.

However, once you’re in a Medicare Advantage plan, you may not be able to get out, said Deborah Darcy, director of government relations for the American Kidney Fund.

"One of the reasons is traditional Medicare fee-for-service, Medicare Part B covers 80% and the coinsurance is 20%," Darcy explained. "So if you don't have a secondary insurance, it's basically unaffordable, and you have to stay in that Medicare Advantage plan."

On top of that, various medical groups and hospital systems from San Diego to Georgia are now refusing to accept some Medicare Advantage plans, she added. That development "left those particular subscribers in those particular Medicare Advantage plans struggling to find care."

Since the 90s, we're now seeing similar challenges for those over As more Americans opt for Medicare Advantage plans, there will be more people who want to opt-out, Darcy said. As one example, a person in kidney failure who only has a traditional Medicare plan without a secondary plan, such as a retirement or Medigap plan, will not be considered fully insured and will not be placed on the transplant waiting list, she noted.he age of 65 and 2023 38 million Medicare beneficiaries were enrolled in a Medicare Advantage plans.

States can do more

Federal law gives Americans six months after signing up for Medicare to enroll in a Medigap plan. After that, state laws take over and vary greatly, speakers noted.

Fifty percent of Medicare Advantage enrollees leave their plan within five years, Darcy said. Those people need better options and better protections, she added.

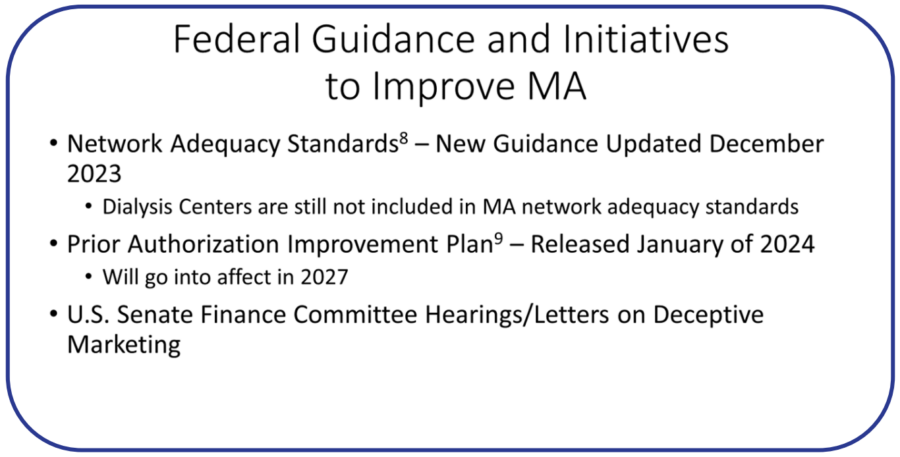

Over 2 million prior authorization requests were fully or partially denied by the Medicare Advantage insurers and 11% of those prior authorization denials were appealed, Darcy said. Eighty-two percent of those appealed denials were later approved.

There are some federal regulatory initiatives in the works, speakers pointed out.

To date, the NAIC is mainly tackling deceptive Medicare Advantage ads. The Improper Marketing of Health Insurance Working Group is considering amendments to the Unfair Trade Practices Act and will meet again later this month at the NAIC spring meeting.

"I think it will come as no surprise that this continues to be a point of focus for the NAIC," said Scott Kipper, Nevada insurance commissioner and char of the task force. "In our recent commissioners' conference, we had extensive discussion about Medicare Advantage and the marketing of these plans and what can be done."

Correction: This story has been updated to reflect inaccurate information presented during the session.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

IncomePath: Helping clients reimagine retirement spending

#FinanceTok: Leveraging social media challenges for financial education

Advisor News

- The financial advisor’s guide to creating an effective value proposition

- Thrivent survey finds gap between financial fear and action

- 1 in 3 say it doesn’t make financial sense to retire in their location

- Help your clients navigate tax regulations

- CFP Board announces CEO leadership transition

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Findings from Texas Technical University Yields New Findings on Managed Care (National and Geographic Trends In Medicare Reimbursement for Pain Management 2014-2023): Managed Care

- New Findings in Health Education Described from University of Utah (Development of a Navigator-delivered Health Insurance Education Program for Hispanic and Latine Communities): Education – Health Education

- The feds promised Colorado $339 million for health insurance. The money hasn't arrived yet.

- Studies from University of Colorado Yield New Data on Managed Care (Navigating the Orthopaedic Maze As a New Patient: a National Mystery Caller Study On Medicaid Coverage and Access To Specialized Surgeons): Managed Care

- Seek savings from insurers, not medical research

More Health/Employee Benefits NewsLife Insurance News

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

- Securian Financial Enhances Its Flagship Indexed Universal Life Insurance Product

- AM Best Affirms Credit Ratings of The Dai-ichi Life Insurance Company, Limited

- Annual Report for Fiscal Year Ending December 31, 2024 (Form 40-F)

- NC yanks incentives for Charlotte-area firms that had pledged $200M investment, 900 jobs

More Life Insurance News