Maryland Couple Used Life Insurance To Fuel $20M Fraud, Feds Say

A Maryland couple allegedly concealed an elaborate fraud scheme over 25 years to reap more than $20 million in life insurance benefits on behalf of applicants.

A federal grand jury has returned an indictment charging James William Wilson, Jr., 74, and Maureen Ann Wilson, 73, of Owings Mills, Md., with federal charges of conspiracy, mail fraud, wire fraud, money laundering, and filing a false tax return. James Wilson has also been charged with aggravated identity theft.

According to the 21-count indictment, from at least 1996 until the present, the Wilsons conspired to fraudulently obtain more than 30 life insurance policies, worth more than $20 million in life insurance benefits, on behalf of applicants.

Specifically, the indictment alleges that the life insurance applications contained material misrepresentations about the applicant, including the amount of the applicant’s existing life insurance coverage, the applicant’s health, and the applicant’s income.

The indictment further alleges that the Wilsons fraudulently obtained money from victim investors to pay the premiums on life insurance policies. Allegedly, the Wilsons obtained these funds by misleading victim investors to believe their money was being used as either a loan or an investment that would be repaid with interest, when, in fact, the money was being used to pay premiums on fraudulently-obtained life insurance policies.

The indictment further alleges that the Wilsons forged signatures to make themselves and other nominees they controlled the owners and the beneficiaries of the life insurance policies. The Indictment alleges that when certain insureds died, the Wilsons received more than $8 million in life insurance proceeds.

Further, the indictment alleges the Wilsons attempted to launder and conceal the fraudulently-obtained funds by controlling multiple bank accounts, opening bank accounts with nominee owners, and causing fraud proceeds to move through bank accounts owned by others.

The indictment further alleges that Wilsons filed false tax returns in 2018 and 2019 when they failed to report millions of dollars of fraudulently-obtained life insurance proceeds.

If convicted, James and Maureen Wilson face a maximum sentence of 20 years in federal prison for each count of conspiracy, wire fraud, mail fraud, and money laundering with intent to conceal; and three years in federal prison for each count of filing a false tax return.

James Wilson faces a mandatory sentence of two years, consecutive to any other sentence imposed, for each of two counts of aggravated identity theft. Maureen Wilson faces 10 years in federal prison for transactional money laundering. Actual sentences for federal crimes are typically less than the maximum penalties.

Acting United States Attorney Jonathan F. Lenzner commended the IRS-Criminal Investigation, the Maryland Insurance Administration, and the Maryland Office of the Attorney General for their work in the investigation. Mr. Lenzner thanked Assistant U.S. Attorneys Matthew Phelps and Stephanie Williamson, and Trial Attorney Shawn Noud of the Justice Department’s Tax Division, who are prosecuting the federal case.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Americans Back On The Roads And Auto Insurers See Higher Costs

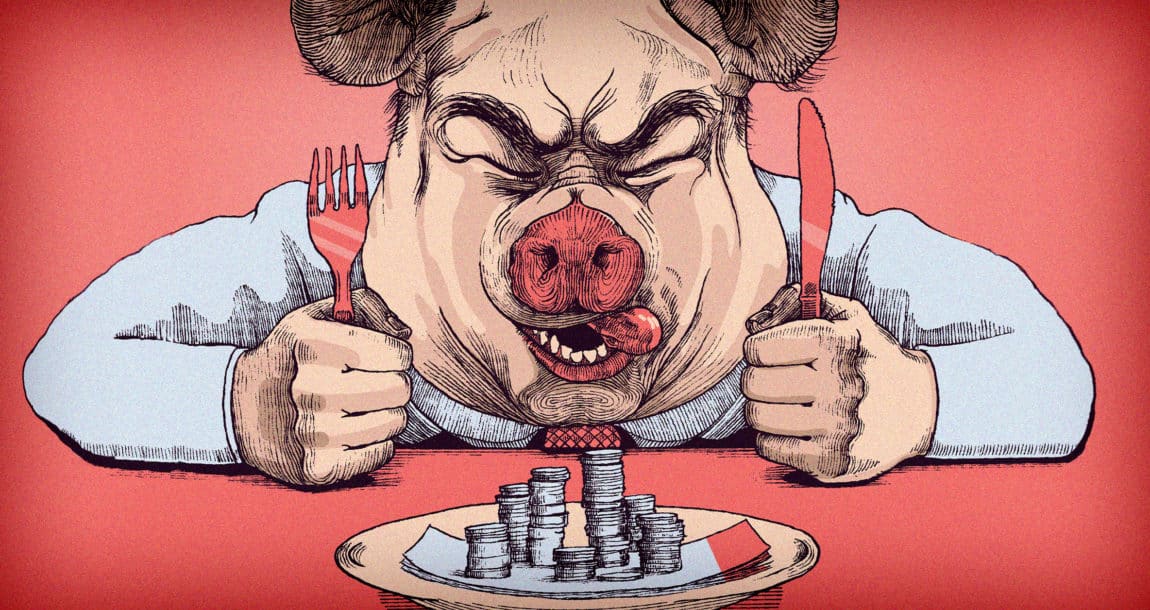

Democrats Hope Soaking The Rich Will Sell Biden’s Spending Plans

Advisor News

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

More Life Insurance News