LIMRA: Fraud Is On The Rise In Financial Services

A recent LIMRA survey of financial services companies identified increased fraudulent activity, as well as efforts to combat it through education and other preventive measures.

Fraud attacks are on the rise; within the last 60 days, 42% of responding companies have experienced an increase in overall fraudulent activity. In addition, 47% have seen an increase in account takeover (ATO) attacks.

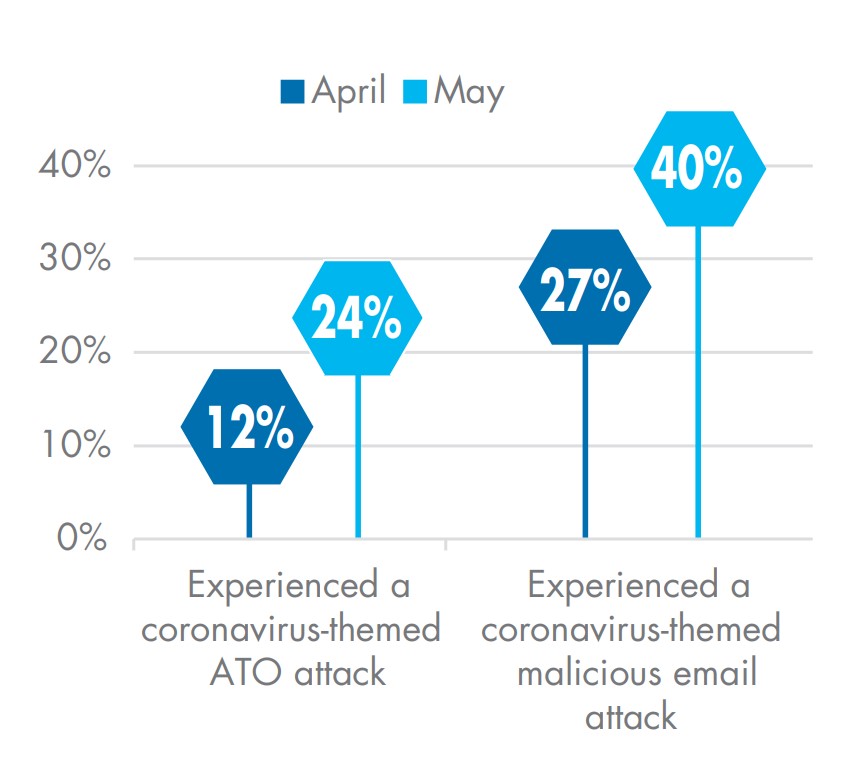

More than ever, criminals are taking advantage of pandemic-driven vulnerability.

“Examples might include fraudulent emails with claims of a vaccine or an offer to provide personal protection equipment,” said Russ Anderson, fraud program and technology manager, LL Global. “The goal of these emails is to get access to customers’ personal financial information.”

Companies are adjusting to new operating procedures and effectively managing fraud risk in the new work-from-home business environment. Initially, 66% of companies expected the shift to remote work to increase their fraud exposure. After adjusting to their new operating models, only 39% of companies believe the shift to remote work has increased their fraud exposure.

Training Is Key

Almost all respondents have stepped up fraud awareness training for the home offi¬ce and field agents.

• 97% have provided additional fraud education to call center and back-offi¬ce employees.

• 63% have taken additional measures to educate advisors and fi¬eld staff.

The heightened fraud risk represents a way for companies to protect customers and add value. In the last 60 days, 4 in 10 companies have provided or made available fraud prevention educational materials to customers.

“Since most account compromises begin with the customer’s personal computer, email or other accounts, having fraud-aware customers can be the best protection,” Anderson said. “Providing regular fraud awareness training and education to advisors and fi¬eld staff can go a long way towards protecting client data and accounts.”

Life Insurers Falling Short With Digital Offerings: J.D. Power Analyst

Trust In Insurance Agents At 12-Year High

Advisor News

- Goldman Sachs, others weigh in on what’s ahead for the market in 2025

- How is consumers’ investing confidence impacting the need for advisors?

- Can a balance of withdrawals and annuities outshine the 4% rule?

- Economy ‘in a sweet spot’ but some concerns ahead

- Trump, Capitol allies likely looking at quick cryptocurrency legislation

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Studies from University of Wisconsin Describe New Findings in Insurance (Care Transition Management and Patient Outcomes In Hospitalized Medicare Beneficiaries): Insurance

- Shock poll: 41 percent of young voters find killing of UnitedHealthcare CEO acceptable

- Former Bright Health, once a Minnesota IPO darling, goes private in $1.3B deal

- Ask the Medicare Specialist

- Murphy, safely re-elected, attacks medical insures

More Health/Employee Benefits NewsLife Insurance News