Trust In Insurance Agents At 12-Year High

Despite the unsettled economy over the past half year, public confidence in insurance agents is at an all-time high, up dramatically from a low recorded in the wake of the 2008 crash, according to LIMRA data.

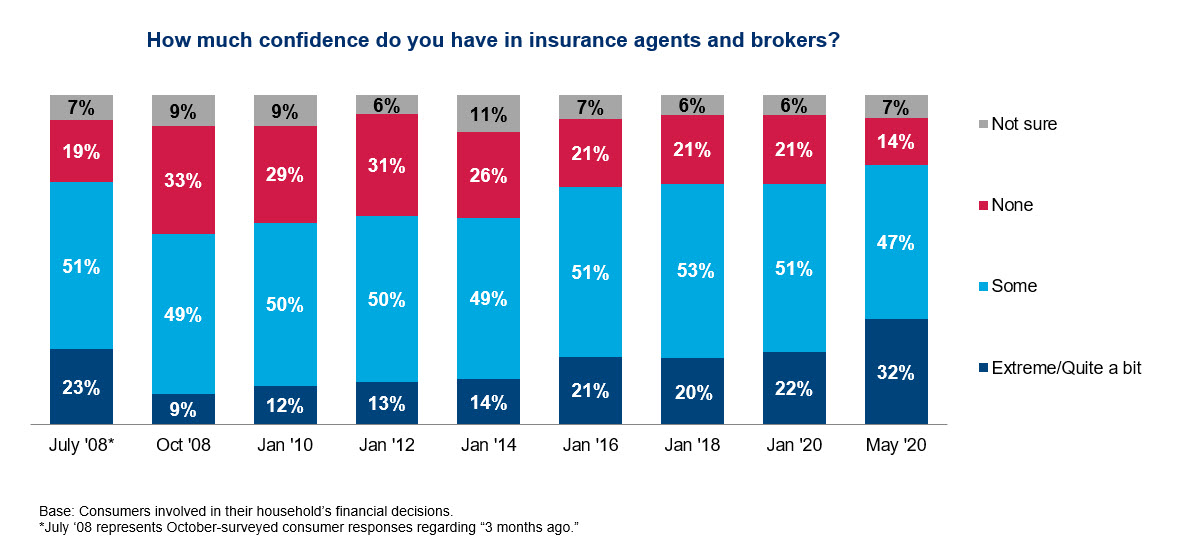

In October 2008, only 9% of consumers had “extreme/quite a bit” of confidence in insurance agents and brokers in LIMRA’s Consumer Sentiment Survey conducted.

In May of this year, that percent had risen to 32%, a 255% increase.

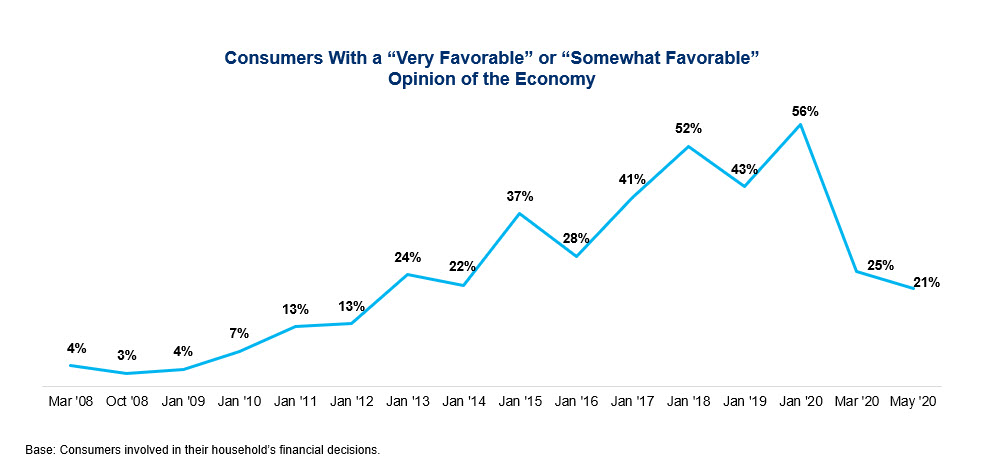

That increase occurred even while confidence in the economy overall plummeted from its post-2008 high notched this January, with 56% of consumers having “extreme/quite a bit” of confidence in the economy. That number slid to 21% in May, a 62.5% drop in just a few months.

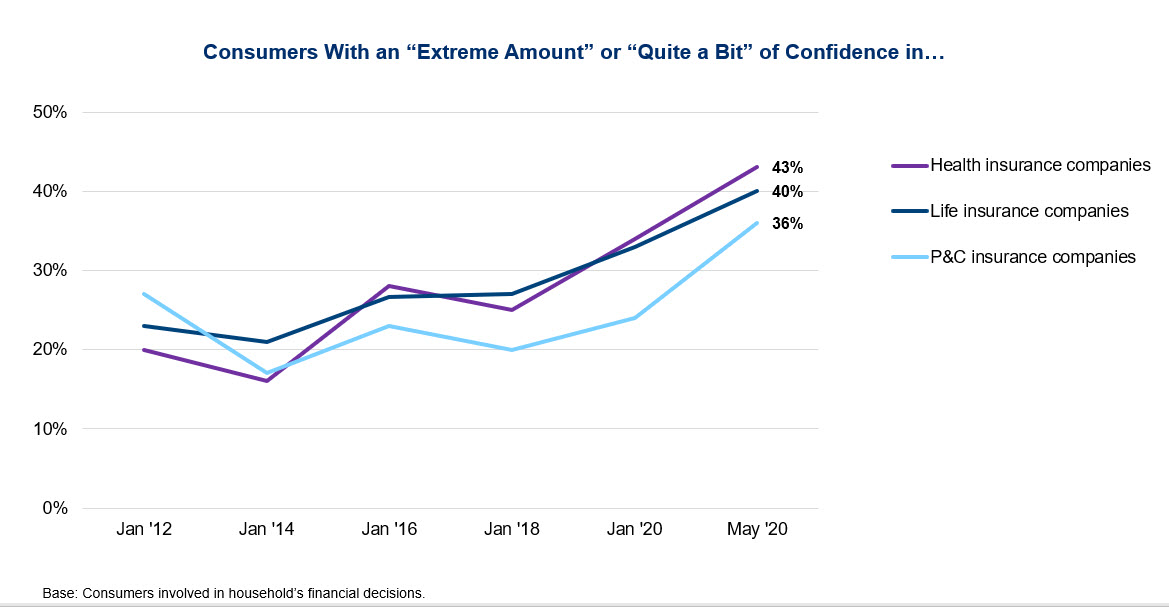

Consumer confidence also increased in insurance companies, with 40% of consumers saying they had “extreme” or “quite a bit” of confidence in life carriers.

Jennifer Douglas, LIMRA Research Quality and Performance research director, said consumer contact with their carriers was an important factor.

“One of the factors that may have contributed to consumers’ increased confidence in life insurers was contact with one’s carrier during the pandemic,” Douglas said. “A third of life insurance policyholders had heard from or reached out to their carrier since March. Of those, seven in 10 were satisfied with the customer service they received. These individuals report very high levels of confidence in life insurance companies. It is important to note, however, that these satisfied policyholders with recent contact represents just over 10% of those surveyed. So, this is not what’s solely driving the increased confidence. In fact, we see a boost in confidence among owners and non-owners alike.”

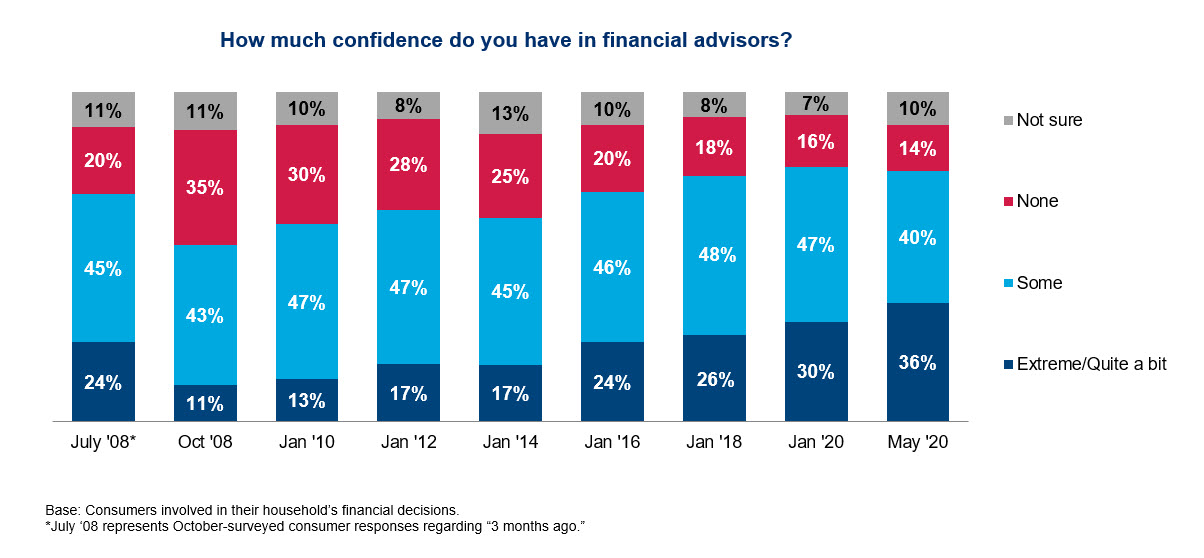

Financial advisors saw a similar increase in their esteem among consumers. In October 2008, 11% of consumers had “extreme” or “quite a bit” of confidence in financial advisors. That grew to 36% by this May.

Methodology

First initiated in early 2008 to gauge consumer opinion of the economy and the financial services industry, LIMRA’s Consumer Sentiment Survey has continued to monitor Americans' sentiment about the economy and confidence in industries since 2008. The latest results are based on responses from 2,000 Americans ages 18+, weighted to the U.S. general population. The most recent survey was fielded May 19-20, 2020.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

LIMRA: Fraud Is On The Rise In Financial Services

How HSAs Help Employees Realize Better 2020 Tax Breaks

Advisor News

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

More Advisor NewsAnnuity News

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

More Annuity NewsHealth/Employee Benefits News

- Medicare Advantage shifts focus to quality

- How to discuss higher deductibles without losing client trust

- HARNESSING THE TAF ANALYSIS REPORTING CHECKLIST TO ELEVATE TRANSPARENCY IN MEDICAID RESEARCH

- AHCCCS DIRECTOR VIRGINIA "GINNY" ROUNTREE RESIGNS FOR PERSONAL HEALTH CONCERNS

- Florida Blue expands cancer support for Medicare Advantage members

More Health/Employee Benefits NewsLife Insurance News