Life sales review: a 2023 sales dip should reverse in 2024, LIMRA says

Life insurance jumped into the spotlight with the COVID-19 pandemic. Converting that mortality awareness into life sales proved to be largely disappointing once the initial buying surge faded.

But the momentum is not entirely lost, LIMRA says. In fact, the combination of a strong economy and positive regulatory landscape should push life sales up 5% in 2024 and 2025.

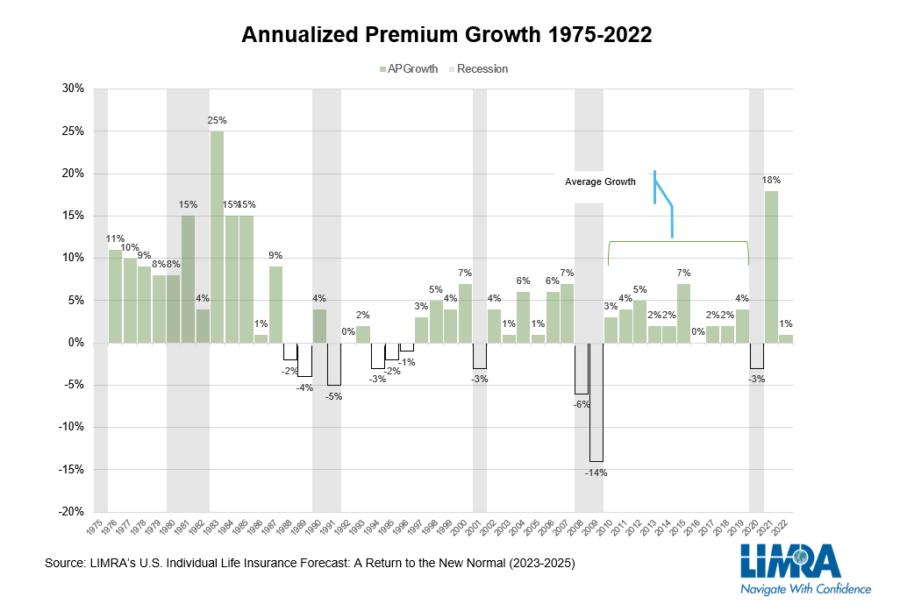

After a 2020 sales decline during the pandemic, life insurance premium jumped 18% in 2021, LIMRA said. Increased consumer demand, and the regulatory effects of IRS Section 7702 changes and the Washington Cares Act provided the boost.

The pendulum swung back in 2022, erasing the 2021 growth when concern about the pandemic fell (down by half) and worries about the economy grew. Life insurance premium growth was just 1% year over year in 2022 and fell 3% in the first half of 2023. Sales trends have improved thus far in the second half of 2023, LIMRA said.

Setting aside regulatory disruption, which is not expected over the next few years, economic conditions have played a pivotal role in life insurance sales historically. Market downturns tend to suppress life insurance sales as consumers tighten their discretionary spending and periods of economic growth spur life insurance sales.

Premium grew approximately 3% annually during the most recent expansion prior to the pandemic. LIMRA expects similar growth rates over the next few years.

Strong LIMRA projections

LIMRA provided a product-by-product update for the months and years ahead:

Whole life. Whole life insurance premium represents nearly 40% of the total market and is a favored product by both middle-income and mass affluent consumers. IRS Code 7702 fueled the 20% growth in late 2021 and early 2022, but sales normalized in the latter half of 2022 and 2023. LIMRA is predicting whole life sales to grow as much as 5% in 2024 and 6% in 2025, especially if inflation continues to improve and consumer confidence grows.

Section 7702 defines what the federal government considers to be a legitimate life insurance contract and is used to determine how the proceeds the policy generates are taxed.

Indexed universal life. Indexed universal life premium holds about a quarter of the life insurance market but has struggled following the implementation of AG 49-B. Over the next few years, interest rates will play a significant role in this product line’s performance, impacting IUL cap rates and profitability. While sales are expected to drop in 2023, LIMRA is forecasting IUL premium to grow as much as 4% in both 2024 and 2025.

AG 49-B amends AG 49-A and is the most-recent attempt by regulators to rein in illustrations, particularly around uncapped volatility-controlled indexes with a fixed bonus.

Term life insurance. A mainstay for the middle-income market, term outperformed historical growth trends in 2021 when consumer concerns about the pandemic and heightened interest in protection drove premium growth to 5%. These gains were reversed in 2022. Historically, annual term life sales averaged about 1% over the past two decades.

While inflation and unemployment pose a greater risk to term sales, both have been trending in the right direction. As a result, LIMRA is forecasting term life to grow as much as 3% in both 2024 and 2025.

Variable universal life. IRS Code 7702 changes, implemented in 2021, boosted accumulation-focused variable universal life sales and drove its overall market share from 7% in 2020 to 12% today. VUL sales tempered in 2022, as the effect of the regulation change diminished. Driven by a handful of carriers selling this product, premium growth continued in 2023. LIMRA is forecasting double-digit growth in 2024 and 2025, depending on equity market growth.

Fixed universal life. Once representing a quarter of the life insurance market (in 2012), demand for fixed universal life has faltered after nearly a decade of ultra-low interest rates. Today, fixed UL premium represents just 6% of the U.S. retail life insurance market. While interest rates have risen over the past 24 months, fixed UL sales have not yet improved.

LIMRA notes that many life insurers have pivoted to focus on other product lines such as IUL and VUL products. As a result, LIMRA predicts fixed UL sales to continue to struggle in 2024 and 2025. In 2024, LIMRA forecasts fixed UL sales will fall more than 12%; in 2025, LIMRA expects sales to fall as much as 8%.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Weight loss drug trends for employers to know in 2024

Insurers look at challenges, efficiencies for 2024

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- PLAINFIELD, VERMONT MAN SENTENCED TO 2 YEARS OF PROBATION FOR SOCIAL SECURITY DISABILITY FRAUD

- Broward schools cut coverage of weight-loss drugs to save $12 million

- WA small businesses struggle to keep up with health insurance hikes

- OID announces state-based health insurance exchange

- Cigna plans to lay off 2,000 employees worldwide

More Health/Employee Benefits NewsLife Insurance News