Life premium up in Q1, LIMRA reports; Pacific Life takes over as No. 1

Pacific Life, Nationwide, and Prudential made big moves up the life insurance new premium charts during the first quarter, LIMRA reported Wednesday.

Overall, individual life insurance new annualized premium improved 8% year over year to $3.94 billion in the first quarter, according to LIMRA’s U.S. Life Insurance Sales Survey, which represents 80% of the U.S. life insurance market.

The total number of policies sold increased 1% in the first quarter of 2025, compared with the prior year’s results.

The new premium was not distributed evenly, however. Pacific Life made one of the biggest moves, with a 38% year-over-year increase in new premium to take over the top spot. PacLife finished 2024 in third place for the year.

Likewise, Nationwide (up 47%) and Prudential (up 25%) saw big year-over-year increases during the first quarter. Northwestern Mutual, which finished the first quarter 2024 and the full year 2024 as the leader in life premium, slipped to second in Q1 with a year-over-year decrease of 4%.

Economic conditions are driving increasing interest in the stability and flexibility of life insurance, said John Carroll, senior vice president, head of Life and Annuities, LIMRA and LOMA.

“Retail life insurance premium growth, driven by indexed and variable universal life product sales, was extremely strong in the first quarter. Persistent inflation and higher equity market volatility drove interest in permanent life insurance," he said. “Amid the increased availability of capital through private equity investment and reinsurance, coupled with advanced technologies and product innovation, LIMRA predicts continued growth for the life insurance industry in 2025.”

LIMRA provided a breakdown of new premium by life insurance category:

Indexed universal life

In the first quarter of 2025, indexed universal life increased 11% to $959 million. About 75% of IUL carriers reported gains in the first quarter with half experiencing double-digit growth. The number of policies sold jumped 7% in the first quarter, with the majority of carriers posting positive growth. IUL premium represented 24% of overall new annualized premium in the first quarter.

“Carriers reporting the strongest sales growth cited an elevated demand for high face amount solutions as well as expanding middle-market success, fueled by new or more competitive products, simplified sales solutions and expanded distribution,” said Karen Terry, corporate vice president and head of LIMRA Insurance Product Research. “Although our research shows consumers’ concerns about the economy has spiked in recent months, LIMRA is forecasting IUL sales to experience moderate growth in 2025.”

Variable universal life

Variable universal life new premium surged 41% year-over-year in the first quarter to $533 million. Seven in ten VUL carriers reported double- or triple-digit sales growth. Policy count rose 6% in the quarter, compared with first quarter 2024. VUL premium held 14% of the total U.S. life insurance market in the first quarter.

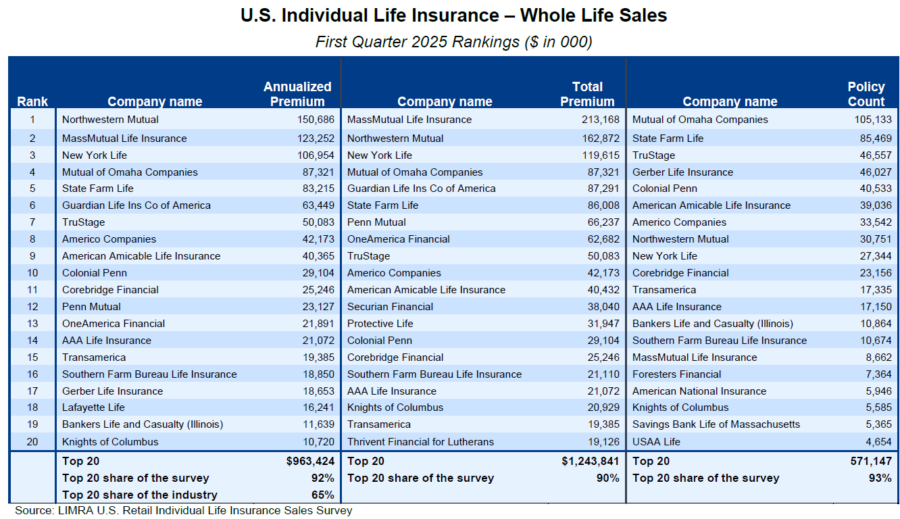

Whole life

Whole life new premium totaled $1.48 billion in the first quarter, slightly above results from first quarter 2024. The number of whole life policies sold inched up 2% in the first quarter, compared with first quarter of 2024, due to an increase in final expense/small policy sales. Whole life insurance new premium held 37% of the total new annualized premium sold in the first quarter.

Term life

Term new premium slipped 1% in the first quarter to $738 million, with more than half of carriers reporting declines. Policy count fell 2% in the quarter. In the first quarter, term new annualized premium held 19% market share of the U.S. individual life insurance market.

“The very consumers who are most affected by heightened inflation and increased economic uncertainty — often middle-income and younger adults — are the target market for term products,” Terry said. “Historically, weaker economic conditions and recessions often depress sales of these products.”

Fixed universal life

Fixed universal life new premium dropped 4% to $235 million. This is the lowest quarterly premium collected for the product line since third quarter of 2023. Although accumulation-focused products and fixed hybrid life/long-term care insurance products posted growth, overall premium growth fell because of lower current assumption and lifetime guarantee sales.

The number of fixed UL policies sold tumbled 13% from first quarter 2024 results. Fixed UL premium represented 6% of the total new annualized premium in the first quarter.

For more details on the sales results, go to First Quarter 2025 U.S. Life Insurance Industry Estimates in LIMRA’s Fact Tank.

Impact of ‘big, beautiful bill’ to advisors may be a shift in client behavior

MIB Index reports life insurance application growth in May

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Tea Party to learn about Medicare changes

- Richard French: Social Security cuts

- New Evidence on the Growing Generosity (and Instability) of Medicare Drug Coverage

- Why drug prices will keep rising through Trump’s second term

- Rising health costs could mean a shift in making premium payments

More Health/Employee Benefits NewsLife Insurance News