Life Insurance Sales Battle Through Tough 1Q, Wink Reports

First-quarter non-variable universal life sales totaled $770.3 million, down 2.5% over the first quarter 2019, according to Wink’s Sales & Market Report.

In addition to the COVID-19 pandemic, which interrupted sales near the end of the quarter, insurers had to deal with new mortality tables and principle-based reserving formulas. The new regulations forced a repricing of many products, said Sheryl Moore, president and CEO of both Moore Market Intelligence and Wink, Inc.

“As with any product, it takes salespeople about a full quarter to learn new products, and get up-and-running where they left-off with sales," she added.

Non-variable universal life (UL) sales include both indexed UL and fixed UL product sales. Sales of these products were down 28.4% over the fourth quarter 2019, when many insurers rushed product sales under old mortality and PBR regulations.

Noteworthy highlights for total non-variable universal life sales in the first quarter included Pacific Life Companies retaining the No. 1 ranking overall for non-variable universal life sales, with a market share of 11.6%.

Pacific Life Pacific Discovery Xelerator IUL 2 was the No. 1 selling product for non-variable universal life sales, for all channels combined, for the 3rd consecutive quarter.

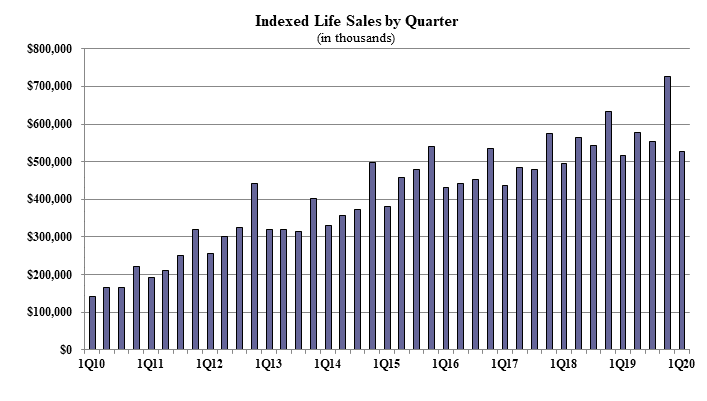

Indexed life sales for the first quarter were $526.9 million, down 27.3% when compared with the previous quarter, and up 2.1% as compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

“Everyone was expecting that indexed life sales would be down because of the recent repricing for 2017 CSO and PBR,” exclaimed Moore

Items of interest in the indexed life market included Pacific Life Companies retaining the No. 1 ranking in indexed life sales, with a 16.3% market share. National Life Group, Transamerica, John Hancock, and Nationwide rounded-out the top five, respectively.

Pacific Life Pacific Discovery Xelerator IUL 2 was the No. 1 selling indexed life insurance product, for all channels combined, for the 3rd consecutive quarter. The top pricing objective for sales this quarter was Cash Accumulation, capturing 71.8% of sales. The average indexed life target premium for the quarter was $9,314, a decline of more than 28% from the prior quarter.

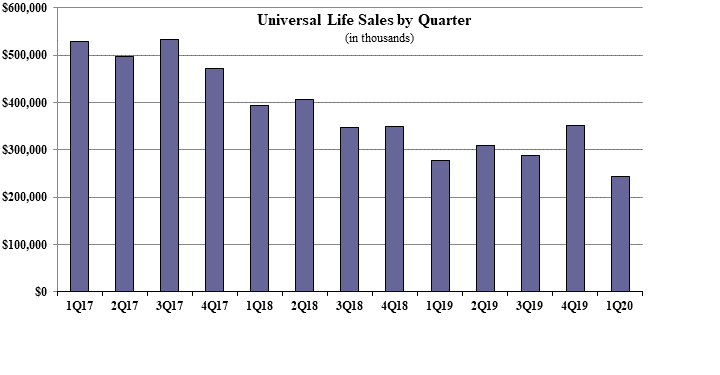

Fixed UL first quarter sales were $244.2 million, down 30.5% when compared with the previous quarter and down 11.8% as compared to the same period last year.

Noteworthy highlights for fixed universal life in the first quarter included the top pricing objective of No Lapse Guarantee capturing 61.3% of sales. The average UL target premium for the quarter was $6,425, a decline of 6% from the prior quarter.

“The pain from the forced repricings also hit traditional UL, with more than a third of sales going up in smoke," Moore said. "It is going to get worse here, as additional rounds of GUL repricing have already occurred this year.”

Whole life first quarter sales were $1 billion, down 28.5% when compared with the previous quarter, and up 3% as compared to the same period last year.

Items of interest in the whole life market included the top pricing objective of Final Expense capturing 58.10% of sales. The average premium per whole life policy for the quarter was $4,196, an increase of more than 17% from the prior quarter.

“Like other lines of life insurance sales, whole life was hit hard due to the mandated repricing,” Moore said.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Workers Report More Stress, Greater Appreciation For Benefits

OneAmerica Reports Strong Sales Growth For 2019

Advisor News

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

More Life Insurance News