Life insurance coverage among Hispanics lowest in U.S., study finds

Life insurance coverage among Hispanics is lower than that of any other race or ethnicity in the U.S., according to a 2022 study by Life Happens and LIMRA.

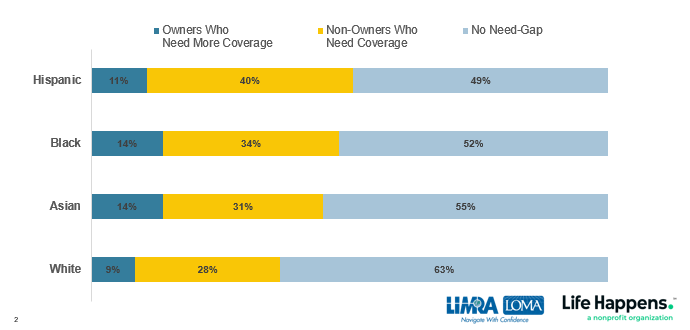

Of the 43.4 million Hispanic American adults, 40% are uninsured and say they need it; 11 % are underinsured and say they need more, according to the 2022 Insurance Barometer Study by Life Happens and LIMRA, which examined the life insurance needs of U.S. consumers, including 1,400 Hispanic Americans. A total of 22.2 million have a life-insurance-need gap, the study found.

During a recent LinkedIn Live event, two industry executives shared some useful information on Hispanics’ ownership of life insurance and offered a few tips on helping them get the coverage they need.

The potential for serving the Hispanic market is huge.

— Faisa Stafford, president and CEO of Life Happens

The potential for serving the Hispanic market is huge, said Faisa Stafford, president and CEO of Life Happens. Forty-one percent of Hispanic Americans own life insurance, the lowest among all races and ethnicities.

Hispanics surveyed cited several reasons for not buying any life insurance or for not buying more life insurance. For example, many think it is too expensive although this is not necessarily true, said Alison Salka, senior vice president and director of research, LIMRA and LOMA. Most people tend to overestimate the cost of life insurance, and Hispanics overestimate the cost five times more than the actual cost, according to the research.

Other reasons cited included:

- Having other financial priorities

- Not sure how much insurance they need or what type to buy

- Haven’t gotten around to buying it

- Do not feel they need any

- Do not like to think about death.

Benefits of life insurance

Salka then offered some benefits of life insurance, including:

- Consumers who own life insurance are more likely than those who do not own the product to say they feel more financially secure.

- Eighty percent of consumers who own both workplace life insurance and private life insurance said they feel more financially secure.

Life Insurance Awareness Month (LIAM), which will take place in September, will provide a major opportunity for agents and other stakeholders to talk about the benefits of life insurance, promote it and build consumer trust, Stafford said.

LIAM is a public awareness campaign created 19 years ago by Life Happens to make sure Americans are reminded of the need for life insurance in their financial plans. The program is now in its 19th year.

The spokesperson for this year’s campaign is Roselyn Sanchez, a Puerto Rican actress, singer, author, dancer, producer, wife and mother. “We hope her message will resonate with you,” Stafford told the attendees.

Reaching Hispanic buyers

In addition to participating in LIAM, advisors can take note of how Hispanics buy life insurance as they seek to reach more of them. When looking to buy life insurance, many Hispanics often go online, said Salka. However, she added, “the key is to use different types of media to reach them. Go where they are, and make your information easy for them to access,” she said.

Other buying methods used by Hispanics include:

- In person (outside the workplace) through an agent or a financial advisor

- Through the workplace

- Over the telephone

- Complete an offline application and email it to an insurance company or professional

- Complete an application and mail it to an insurance company/professional.

Hispanic Americans use social medial for information about financial products/services more than other ethnicities (66% of Hispanics vs. 53% of other ethnicities), according to the research. Platforms like Twitter, Instagram, and TikTok are more popular among Hispanics than in other communities.

Ayo Mseka has more than 30 years of experience reporting on the financial-services industry. She formerly served as Editor-In-Chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

Thanks! It has pockets! — Understanding the needs of our insurance clients

Why a life insurance policy appraisal should be part of your toolkit

Advisor News

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

- Most Americans surveyed cut or stopped retirement savings due to the current economy

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

More Advisor NewsAnnuity News

- Life and annuity sales to continue ‘pretty remarkable growth’ in 2026

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

More Annuity NewsHealth/Employee Benefits News

- New Findings from Brown University School of Public Health in the Area of Managed Care Reported (Site-neutral payment for routine services could save commercial purchasers and patients billions): Managed Care

- Researchers from University of Pittsburgh Describe Findings in Electronic Medical Records [Partnerships With Health Plans to Link Data From Electronic Health Records to Claims for Research Using PCORnet®]: Information Technology – Electronic Medical Records

- Studies from University of North Carolina Chapel Hill Add New Findings in the Area of Managed Care (Integrating Policy Advocacy and Systems Change Into Dental Education: A Framework for Preparing Future Oral Health Leaders): Managed Care

- Medicare telehealth coverage is again under threat. Here’s how it affects elderly patients

- Illinois Medicaid program faces funding crisis

More Health/Employee Benefits NewsLife Insurance News