Life Insurance Combination Product Premium Falls 2% in 2018

After three consecutive years of growth, total new premium for individual life combination products dropped 2% to $4.3 billion in 2018, according to LIMRA’s 2018 Individual Life Combination Products Annual Review.

There were 404,000 policies sold in 2018, a 2% increase compared to 2017.

Life combination products provide life insurance coverage with long-term care or chronic illness coverage, an attractive value proposition to consumers, according to LIMRA consumer research. In 2018, combination products represented 27 percent of the overall U.S. individual life insurance market.

“The decline in total premium is a result of more companies shifting to introduce recurring premium options. To put this into perspective, 61% of policies were sold on a recurring premium basis in 2011. By 2018, 93 percent of policies sold were recurring premium,” said Daniel McAllen, associate analyst, LIMRA Insurance Research. “This shift suggests a growing movement to attract mass-affluent buyers who may not have the financial wherewithal to invest a large lump sum all at once but still want the dual protection these products offer.”

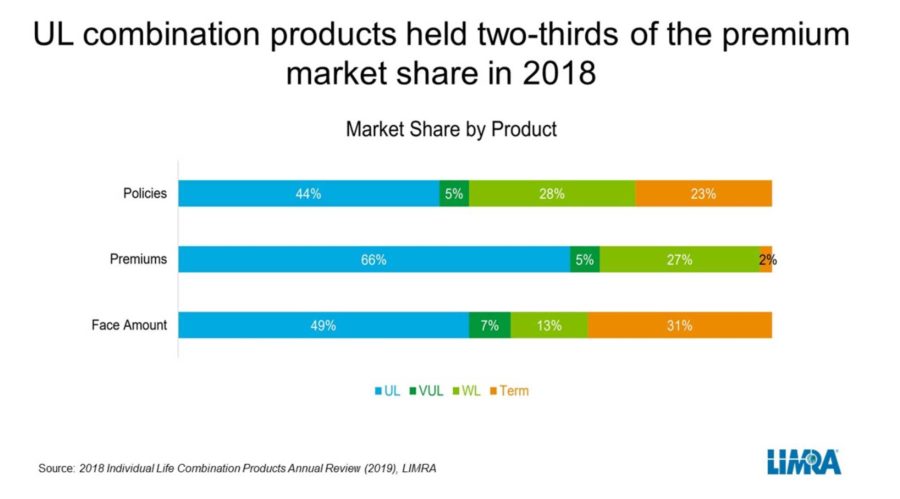

On a product level, whole life (WL) combination premium experienced the largest growth in 2018, up 34%, compared with 2017 results. WL held 27 percent of the combination market in 2018, up 7 percentage points from 2017. Variable universal life (VUL) combination premium also improved, growing 5% in 2018. VUL’s market share remained steady at 5%.

Universal life (UL) combination premium and term combination premium both declined 11%, compared with prior year. UL combination premium continues to dominate the market, with 66% market share, but that is down 7 percentage points from 2017. Term combination premium held 2% of the combination product market.

Long-term care (LTC) acceleration riders and chronic illness (CI) acceleration riders equally held 41% of the premium market share in 2018. LTC extension products held the remaining 18% of the market by premium but continued to hold the largest portion of policies at 64%.

According to LIMRA data, more than half of Americans (53%) are worried about affording long-term care services if needed. Six in 10 consumers would consider purchasing a combination product to offset long-term care costs they may face in retirement.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

California Threatens NAIC With N.Y. Annuity Standard

Regulators Face Harsh Critics On Indexed Annuity Illustration Rules

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Wellmark still worries over lowered projections of Iowa tax hike

- Families defend disability services amid health cuts

- RANDALL LEADS 43 DEMOCRATS IN DEMANDING ANSWERS FROM OPM OVER DECISION TO ELIMINATE COVERAGE FOR MEDICALLY NECESSARY TRANS HEALTH CARE

- Trump's Medicaid work mandate could kick thousands of homeless Californians off coverageTrump's Medicaid work mandate could kick thousands of homeless Californians off coverage

- Senator Alvord pushes back on constant cost increases of health insurance with full bipartisan support

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News