Lessons In Adapting To Change

Although I have been in practice now for 35 years, my objective from the beginning was to make sure I did not repeat one year’s experience 35 times. My business has completely changed over time — from what I sell to how I sell and from what I say to how I say it. Personal life experiences as well as larger industry and global changes, such as the evolution of technology, influence me, my family and my clients. Staying in tune with changes and actively servicing clients helps set the stage for necessary adaptations to thrive in the industry.

Technology Is No Longer A Choice

If the rate of change outside your business is greater than that inside your business, you are out of business. When I started in the profession, I was given an office and worked with someone to type letters. No one had computers in their office or on their desk — let alone in their pocket.

Operating without email, we had six telephone lines that everyone had to share. If all six lights were on, you waited and grabbed a line when one of the lights went out. When meeting clients in person, we carried a rate book so that we could calculate their premium.

Today, I have a 65-inch smart monitor hanging on the wall for presentations, files are 100% electronic and I can access my customer relationship management system anywhere in the world. Since consumers can easily leverage robo-advisors or find advice-free online sales of mutual funds, technology is no longer a choice. In fact, most millennials do their own research online for significant purchases — they are the biggest group who buys cars online. Technology will not replace advisors; however, advisors who use technology will win over those who don’t.

Stay Ahead Of The Curve

Another key lesson is that successful companies are the ones that focus not what clients need, but on what clients need next.

For example, I was in an advisory meeting with one of our mutual fund companies, and they discussed how to sell to millennials. The following question was posed: “Why don’t you build a mutual fund designed specifically for millennials and populate it with companies they already know and buy from?” A week later, it was announced that they were creating such a fund.

If a fund company can create a product almost instantly, advisors need to be adaptable too. The bottom line is that you need to stay ahead of the curve to be a leader, no matter what you are selling.

Prompting Continuous Communications

To succeed in this business, you must be able to build and foster relationships. You want clients to stay loyal to you over the years even if there are gaps in communication. In some cases, policy owners may feel that meetings are unnecessary even with term renewals.

One simple way to reconnect and offer additional services is by sending an email with a foolproof formula. I have had great success using the following email template, which shows that I understand my client has been busy and can get a larger conversation started.

Subject: Reconnecting

Email: Michael, it’s been quite a while since we talked about your insurance coverage. I’m sure you are very busy, and I know the coverage is important to you. If it might help, I can send you a summary of your coverage to refresh you with the amounts. If anything else is on your mind, just let me know. Regardless, it would be great to confirm things are well.

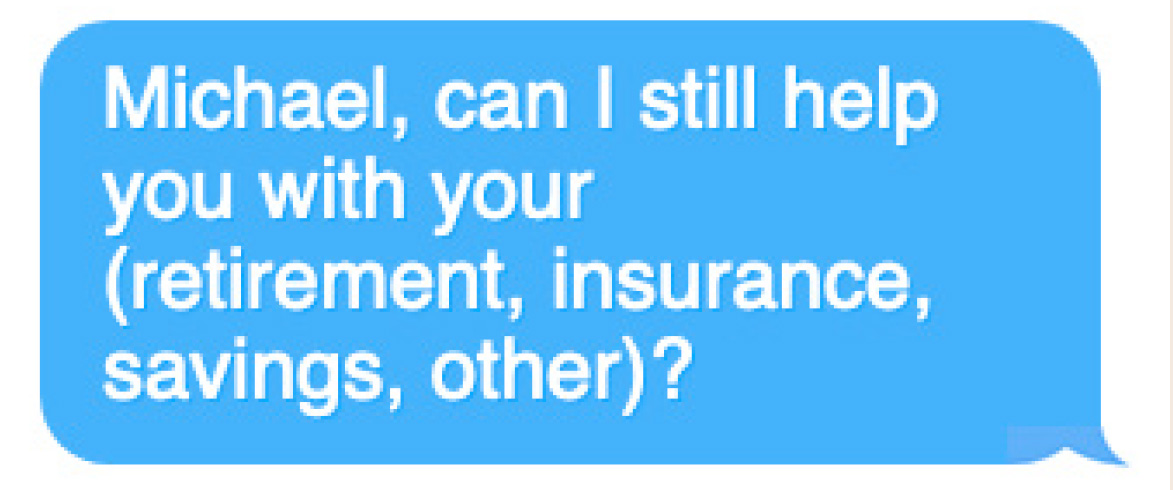

A short, nine-word text is another method to prompt a response from a client or current prospect. Consider the following example, which is personal, inquisitive and easy to answer:

Overall, the goal is to receive a response and start, or restart, a line of communication. The response itself may vary, but the conversation will create necessary activity. Both of these methods have been tested with impressive results.

Intentional Evolution

Despite external factors such as increased technology or economic uncertainty, client service must always remain at the forefront. As you learn to adapt to change and push your practice forward in a positive direction, take the necessary time to listen to individual clients.

I have found that I can often tell what a client is thinking by listening to the questions they ask. If you learn to listen so you can understand instead of listening so that you can reply, you’ll find great success in intentionally evolving relationships and your business

Enrollment Support Is Critical For Workers, EBRI Says

Assumptions Vs. Reality: Considering Income Riders

Advisor News

- Selling long-term-care insurance in a group setting

- How to overcome the fear of calling prospects

- Advisor gives students a lesson in financial reality

- How life’s milestones can play a role in selling financial services

- Digitize your estate plan for peace of mind

More Advisor NewsAnnuity News

- Augustar generates industry buzz with 24% premium bonus on its FIA

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

More Annuity NewsHealth/Employee Benefits News

- Low-income diabetes patients more likely to be uninsured

- UnitedHealth execs bemoan ‘unusual and unacceptable’ Q1 financials

- LTCi proves its value beyond peace of mind

- Governor signs ban on drug middlemen owning pharmacies

- The lighter side of The News: Political theater; A bone to pick with a Yankee; Health insurers have mascots?

More Health/Employee Benefits NewsLife Insurance News

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

- IUL sales: How to overcome ‘it’s too complicated’

- LIMRA: Record workplace life insurance sales up for 4th consecutive year

More Life Insurance News