Less Than 50% Of Employers Offer Benefits To Gig Workers: LIMRA

Gig work, like being an Uber driver or freelance writer, has become more commonplace.

LIMRA research shows 26% of all U.S. workers participate in gig work either as their primary job or as a secondary source of income and almost three-quarters of these workers believe they will continue working in this capacity over the next five years. Eight in 10 of these workers choose to be nontraditional workers and enjoy the freedoms presented by independent work.

There are some risks and challenges that come with not being a traditional worker however. Lack of access to benefits that are usually offered to traditional workers is one of them. LIMRA finds almost half (47%) of gig workers say obtaining benefits is a challenge.

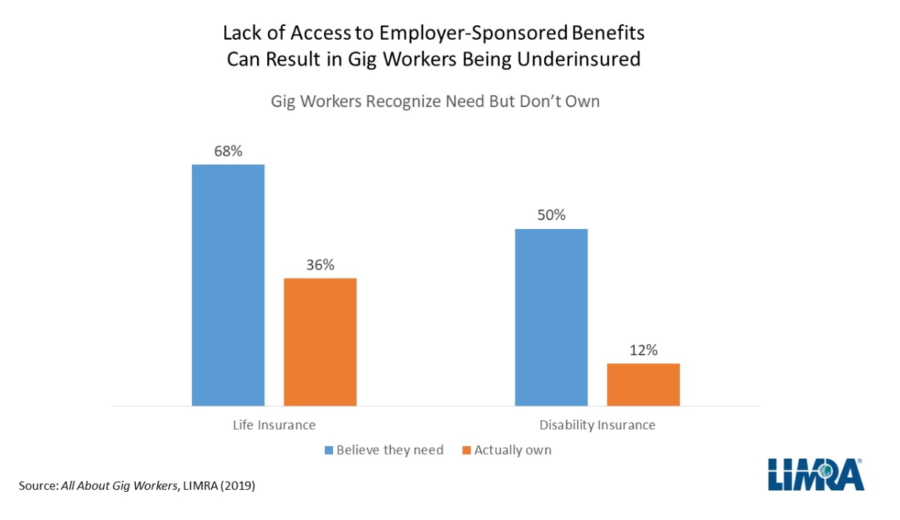

This lack of access to employer-sponsored benefits can result in gig workers being underinsured. While 68% of gig workers believe they should have life insurance, just 36% have life insurance.

Half of gig workers believe they should have disability insurance but only 1 in 10 do. More than 7 in 10 gig workers are at least somewhat worried about becoming disabled and being unable to work.

Employers categorize gig workers into three groups: part-time (file a W-2 form), contract (file a 1099 form) and seasonal. LIMRA research finds employers are most likely to offer benefits to part-time workers (46%). While only 29% offer them to seasonal workers and just 16% to contract workers.

When offering benefits to contingent workers, employers can choose to simply expand eligibility for the benefits they already offer full-time employees or they can choose to bring in distinct offerings just for their nontraditional workers. The majority of employers tend to opt for consistency, offering the same level of coverage for specific benefits that are offered to both.

However, LIMRA finds companies tend to offer fewer benefits to gig workers than full-time workers. On average employers are offering 2-3 fewer benefits to part-time and contract workers than to their full-time employees, and 4-5 fewer benefits to seasonal workers.

Different Reasons

Employers thinking about adding benefits for contingent workers generally want to offer a different overall benefit package than they offer full-time employees.

This probably indicates a desire to offer gig workers a different combination of benefits or to fund those benefits differently. This is stronger for contract workers (66%) than part-time (53%) and seasonal workers (50%).

LIMRA research finds employers who don’t offer benefits to gig workers give different reasons depending on the type of gig worker. Half of employers say it would be too expensive to offer benefits for part-time workers.

More than 2 in 5 employers say high turnover is why they don’t offer benefits to seasonal employees. And when it comes to contract workers, 38% of employers say benefits are not needed to attract and retain these workers.

As far as what would change the minds of employers who don’t want to offer nontraditional workers benefits, LIMRA finds that regardless of the type of contingent worker, the top motivator was the same – there would need to be a legal or regulatory requirement to make them to offer benefits to gig workers.

In A Monumental Shift, Investors Make Index Funds Top Dog

SEC Faces Reg BI Tough Questions At House Committee Hearing

Advisor News

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- More cancer coverage for firefighters clears hurdle

- AG files suit against Syracuse claiming misappropriated funds

- Legislation for more cancer coverage for firefighters clears the Iowa Senate

- Gentry Mountain Mining Under Fire Due to Recent Allegations

- Rural Hospitals Question Whether They Can Afford Medicare Advantage Contracts

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- AM Best Revises Issuer Credit Rating Outlook to Stable for Life Insurance Company of Alabama

More Life Insurance News