Keeping our readers IN the Know

In our effort to keep our readers informed about all the big issues of the day, we’re adding a new section called IN the Know to starting this month. This new section allows our editorial team to broaden our coverage in the magazine, tackling some of the big issues of the day that we can’t accommodate easily in the magazine’s current scope and layout. IN the Know launches this month with an in-depth piece on the history and current state of the fiduciary rule.

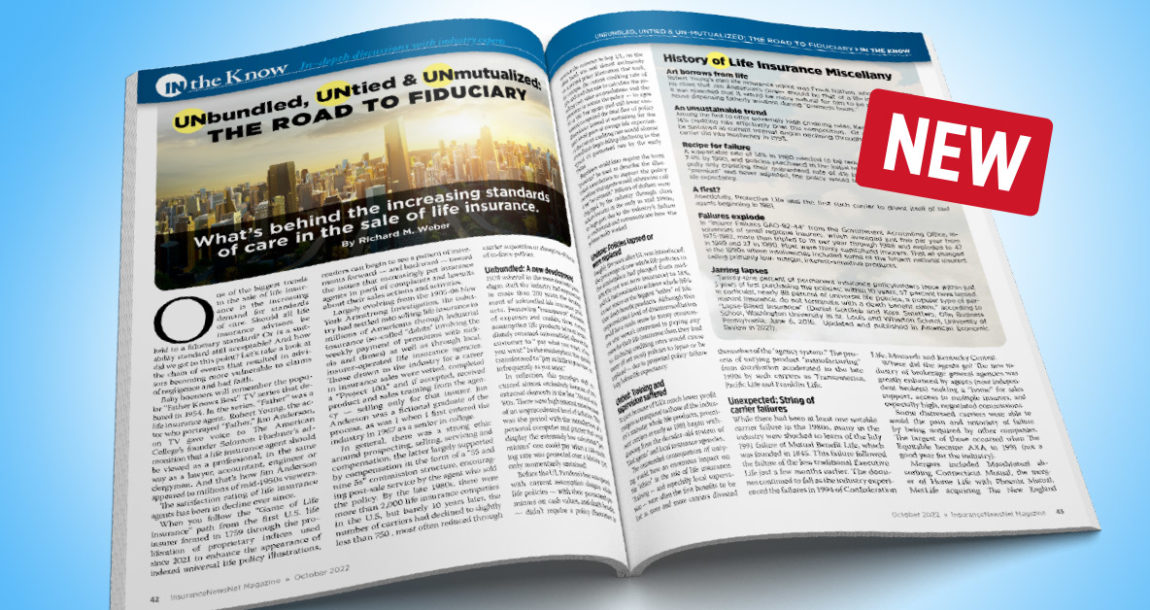

The October feature will begin a series on the history of and need for fiduciary relationships. One of the biggest trends in the sale of life insurance is the increasing demand for standards of care. Should all life insurance advisors be held to a fiduciary standard? Or is a suitability standard still acceptable? And how did we get to this point? Richard M. Weber, founder of The Ethical Edge — as well as a 25-year life insurance advisor, a 20-year member of Million Dollar Round Table and a former adjunct professor of ethics at The American College — provides an in-depth look at the issue.

This type of in-depth look at an important issue of the day is what our readers can expect to find in our new IN the Know section.

Can we learn something from insurtech?

Investment in insurance technology firms has been sliding and is down sharply in Q1. But even funding in Q2, which increased in comparison to Q1 and totaled $2.41 billion, was down 50% compared to the same quarter a year earlier.

While pundits have many opinions about why the funding has dropped, it’s clear that the insurance industry is a tough market for the technology startups to crack. Even the more promising companies have a long road to profitability and face the same current economic headwinds as all other companies, making the startup journey more challenging. More consolidation and acquisitions are sure to come, as is the folding of some of these companies.

But at the end of the day, we’re likely to see the technology that is now on the cutting edge become standard across the industry.

Why? Because many of these technologies promise better risk management, lower pricing and faster, easier service for the consumer. Those all are good things.

Some insurtechs, such as Lemonade, Bright Health, Hippo and Policygenius, are seen as holding a lot of promise. Metromile was one of the pioneers of usage-based insurance based on its telematics-driven pricing. Metromile was recently snapped up by Lemonade to strengthen Lemonade’s insured base and to break into new states.

One difference between traditional insurers and Lemonade, for example, is most insurers have about 4% of their insured base using telematics. Lemonade, on the other hand, claims a very high percentage of its auto policyholders use telematics.

This means Lemonade has very accurate information on its policyholders’ driving habits and risk. Traditional insurers often find that even those who sign up to use telematics drop out quickly. This is one illustration of the differences between insurance companies and insurtechs — those who are going with insurtech companies are willing to accept new parameters and risk assessment requirements.

This may be because many of those using insurtech may skew younger and have less fear of both the technological implications and the possibility that the data will be used against them in some way. Social media usage has steeled them against data collection concerns.

In addition to having a better bond with younger consumers, insurtechs also are being creative in building their insured base. Lemonade, for example, is creating additional lines of insurance intended to attract new customers.

Pet insurance is one area where the company is angling to attract new — especially young — customers who not only are not a current Lemonade customer but also may not have insurance of any kind. Lemonade’s game, of course, is to attract the pet owner to sign up for their first insurance policy and then eventually upsell them on the normal policies life will demand as they age into families, homes and other aspects of life that demand coverage and protection. So

Lemonade is adopting powerful client adoption strategies as well as attracting younger consumers.

Some may see insurtechs as being on the ropes in the short term, but don’t count them out. They are certain to impact the industry significantly.

John Forcucci

Editor-in-chief

ACLI conference wraps up with a look at 2023’s regulatory landscape

Financially empower your female clients

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Lowering the cost of insurance in Colorado – a new analysis of the Peak Health Alliance

- University of Toronto Reports Findings in Alopecia [The Dermatologist Is Out? Assessment of Dermatologists In Ontario Accepting Ontario Health Insurance Plan (Ohip) Referrals for Hair Loss Evaluation]: Skin Diseases and Conditions – Alopecia

- Studies from New York University (NYU) Further Understanding of Managed Care (Public Health Insurance Coverage for Immigrants During Pregnancy, Childhood, and Adulthood: a Discussion of Relevant Policies and Evidence): Managed Care

- UCare ‘doing everything possible’ to avoid layoffs after $504M operating loss

- UnitedHealth Group sues tech giant Broadcom over ‘exorbitant’ price hikes

More Health/Employee Benefits NewsLife Insurance News

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- AM Best Affirms Credit Ratings of CMB Wing Lung Insurance Company Limited

- Council agrees to settlement for animal welfare division

More Life Insurance News