Jackson National overcomes annuity sales decline in strong third quarter

Jackson National overcame declining annuity sales to finish the third quarter with strong revenue growth that won over Wall Street.

Jackson reported net income of $1.5 billion, compared to net income of $206 million for the third quarter 2021. The net income gains "primarily reflects improved net hedge results, mainly due to a benefit from a larger comparative increase in interest rates in the third quarter of 2022 relative to the prior year period," Jackson said in a news release.

Additionally, net income in the quarter reflects $868 million of income from business reinsured to third parties, the insurer noted. Jackson National shares were up nearly 18% at the close of the markets Thursday.

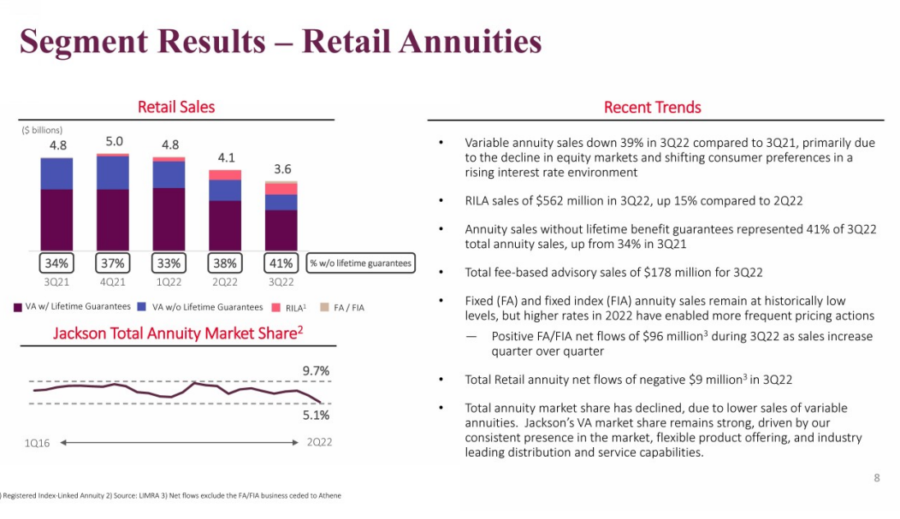

Jackson ranked No. 1 in overall annuity sales in LIMRA's year-end 2021 rankings with $19.3 billion in sales. The company's historic strength is in variable annuities, which have been in a sales slide due to market conditions. Jackson's sales have declined proportionally, forcing the company to adjust its product mix.

"Jackson's variable annuity sales of $2.9 billion represent a quarterly decline that is consistent with industry trends," said Laura Prieskorn, president and CEO of Jackson. "We remain committed to traditional variable annuities as a valuable consumer option that provides choice and customization. Our fixed and fixed index annuity sales are growing while continuing to reflect our pricing discipline."

The insurer noted an increase in its annuity sales without lifetime guarantees:

Jackson came late to the registered indexed-linked market one year ago with the introduction of launch of Jackson Market Link Pro and Jackson Market Link Pro Advisory. The company is pleased with the early sales results of the products, Prieskorn told analysts.

Likewise, Jackson is pushing growth to the registered investment advisor channel through its growing relationship with Halo, a platform that provides advisors with fee-based annuity options.

"After a successful first year of offering fee-based FIA and RILA through Halo, we expanded our array access to retirement solutions by adding variable annuities to the Halo platform," Prieskorn said. "RIAs remain an underserved channel and annuities provide a long-term retirement income and savings solution that can complement existing portfolios."

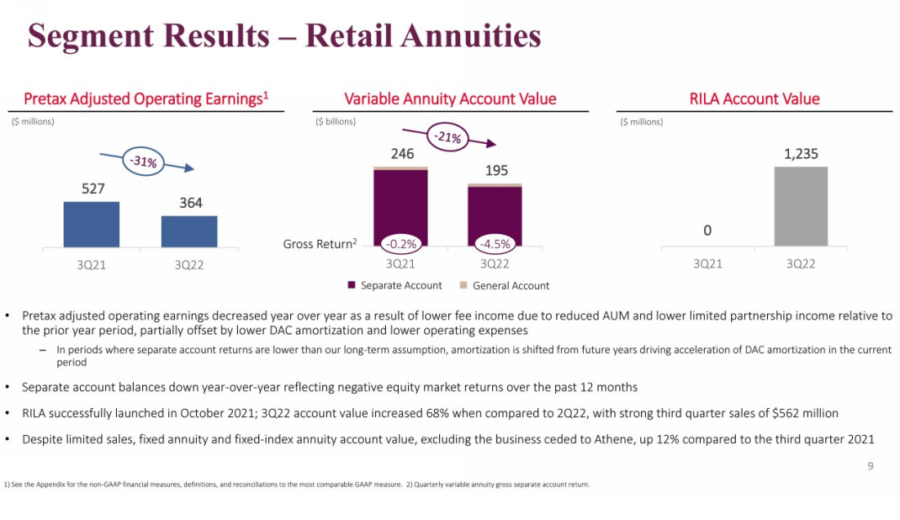

In its overall annuity segment, Jackson reported pretax adjusted operating earnings of $364 million in the third quarter, compared to $527 million in the year-ago quarter. "The current quarter was negatively impacted by lower fee income due to reduced AUM, lower limited partnership income relative to the prior year period, partially offset by lower DAC amortization and lower operating expenses," the release said.

LIMRA is forecasting continued strong market share for protection products, such as fixed and fixed-indexed annuities. In response to an analyst's question, Prieskorn said Jackson is keeping one eye on interest rates going forward.

"We certainly have been paying attention to the rising interest rates and have taken the opportunity for pricing actions across our entire annuity spectrum, which does include fixed and our fixed indexed annuity offerings," she said. "So we have seen an increase in sales in those products. But our proven pricing certainly looks to strike a balance between our profitability targets and good consumer values."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

How big data can combine with AI to insure older vehicles

Medicare beneficiaries have more Medicare Advantage and Part D plans available for 2023

Advisor News

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

- CFP Board reports record growth in professionals and exam candidates

- GRASSLEY: WORKING FAMILIES TAX CUTS LAW SUPPORTS IOWA'S FAMILIES, FARMERS AND MORE

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- People needing health care coverage have until Thursday to sign up for Obamacare

- HEALTH CARE COSTS 101: WHAT'S DRIVING PREMIUMS HIGHER AND HOW TO MAKE COVERAGE MORE AFFORDABLE

- FINAL DAY OF OPEN ENROLLMENT ON COVERME.GOV FOR 2026 COVERAGE

- What the ACA marketplace could mean for your health insurance premiums

- Harshbarger hopes bill will reduce red tape for those with a terminal illness

More Health/Employee Benefits NewsLife Insurance News