Medicare beneficiaries have more Medicare Advantage and Part D plans available for 2023

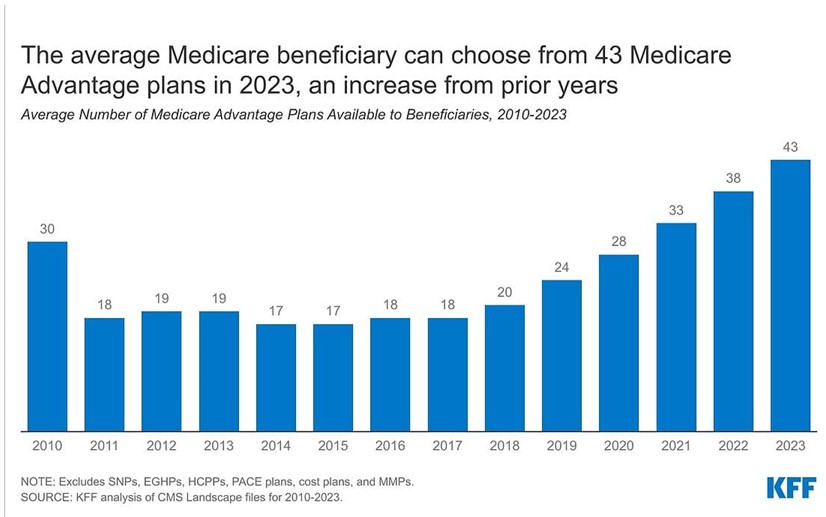

For 2023, the typical beneficiary has a choice of 43 Medicare Advantage plans as an alternative to traditional Medicare, a new KFF analysis finds. That’s an increase of 5 plans on average from 2022, adding even more choices to the Medicare Advantage marketplace, which is poised to become the dominant way Medicare beneficiaries get their health coverage and care.

In addition, the typical beneficiary has a choice of 24 Medicare Part D stand-alone prescription drug plans for 2023, a second KFF analysis finds, one more than in 2022.

These findings are featured in two briefs released by KFF that provide an overview of the Medicare Advantage and Medicare Part D marketplace for 2023, including the latest data and key trends. Medicare’s open enrollment period began Oct. 15 and runs through Dec. 7.

Medicare Advantage

More than 28 million Medicare beneficiaries – 48 percent of all eligible beneficiaries – are enrolled in Medicare Advantage plans, which are mostly HMOs and PPOs offered by private insurers. Enrollment is projected to cross the 50 percent threshold as soon as next year.

For 2023, a typical beneficiary has 43 Medicare Advantage plans to choose from in their local market, including 35 plans that offer Part D drug coverage. In total, 3,998 Medicare Advantage plans will be available across the country.

The average Medicare beneficiary can choose from plans offered by nine firms in 2023, the same number as in 2022. Even so, Medicare Advantage enrollment is concentrated in plans operated by UnitedHealthcare and Humana, which together account for 46 percent of Medicare Advantage enrollment in 2022.

Two thirds (66%) of Medicare Advantage plans do not charge an additional premium beyond Medicare’s standard Part B premium, up from 59 percent in 2022. In 2023, nearly all plans (97% or more) offer some vision, fitness, telehealth, hearing, or dental benefits, though the scope of coverage for these services varies.

Part D

The average Medicare beneficiary has a choice of 24 stand-alone Part D drug plans for 2023, one more than in 2022. The total number of Medicare Part D stand-alone prescription drug plans that will be offered in 2023 is rising by 5 percent to 801 plans. Fifteen firms offer the plans, the lowest number in any year since Part D started.

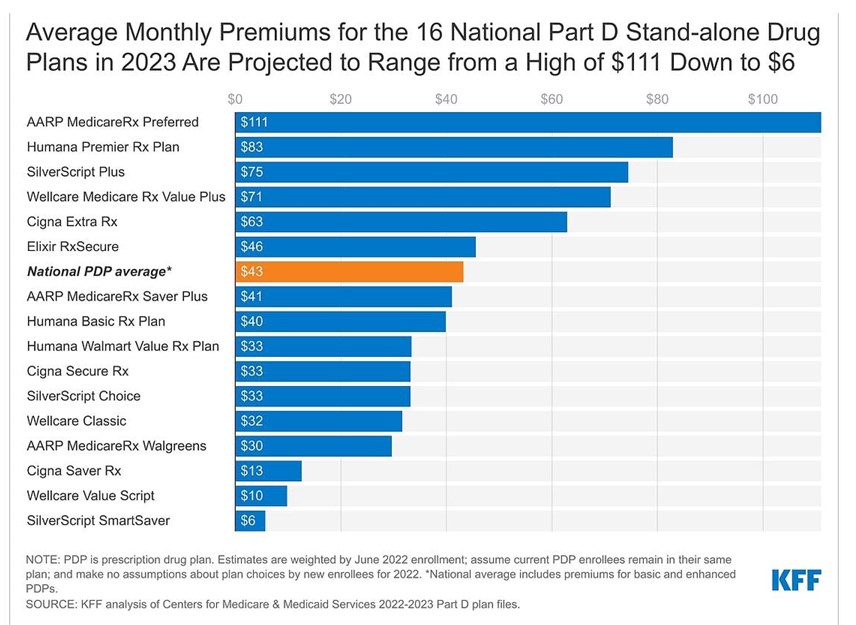

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2023, based on current enrollment, a 10 percent increase from $39 in 2022. This rate of increase outpaces both inflation and the Social Security cost-of-living adjustment for 2023. In the stand-alone drug plan market, more than 8 out of 10 enrollees next year are projected to be in stand-alone plans operated by just four firms: CVS Health, Centene, UnitedHealth, and Humana.

Average monthly premiums for the 16 national stand-alone drug plans available in 2023 are projected to range from $6 to $111. Premiums are rising for 12 of the 16 plans, including four plans with increases exceeding $10.

Inflation Reduction Act

Beginning in 2023, under a provision in the Inflation Reduction Act (IRA), Part D enrollees will pay no more than $35 per month for covered insulin products in all Part D plans, and will pay no cost sharing for adult vaccines covered under Part D. Also, beginning in 2023, drug manufacturers will be required to pay rebates for drug prices that rise faster than the rate of inflation, which could help to dampen cost increases for Part D enrollees.

The new law also caps enrollees’ out-of-pocket drug spending under Part D, as of 2024, and requires Medicare to negotiate prices for some drugs, with negotiated prices first available for some Part D drugs in 2026. A recent KFF explainer summarizes these and other prescription drug provisions in the Inflation Reduction Act.

Jackson National overcomes annuity sales decline in strong third quarter

Unleash the power of the metaverse

Advisor News

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

More Advisor NewsAnnuity News

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

More Annuity NewsLife Insurance News

Property and Casualty News

- State Farm, Travelers, and Progressive Homeowners Insurance Customers Have Opportunity to Join Schall Law Firm Investigation into Insurers’ Decision to Change Insurance Deductibles and Terms Without Homeowners’ Knowledge

- AI Neo-Insurer MGT Partners with Amwins to Modernize E&S Underwriting

- MGIC: Q4 Earnings Snapshot

- PREPARE FOR SPRING AND SUMMER STORMS WITH FLOOD INSURANCE FLOOD INSURANCE AWARENESS WEEK IS FEB. 1-7, 2026

- Radian Completes Acquisition of Inigo, Becoming a Global Multi-Line Specialty Insurer

More Property and Casualty News