IRI pushes for funding boost to SEC’s Reg BI enforcement

A month after the SEC’s first substantive Regulation Best Interest enforcement action, the Insured Retirement Institute is pushing for more funding to boost the agency’s enforcement power.

The IRI sent a letter to the congressional financial services appropriations subcommittee in support of the Securities and Exchange Commission’s request for more enforcement muscle in its 2023 budget request. The institute said it supported Reg BI and Form CRS as products of cooperation between agencies and stakeholders to develop guardrails protecting investors.

“Specifically, we believe it is critical for Congress to provide adequate funding to ensure that the SEC’s examinations and enforcement programs can effectively oversee the industry’s ongoing implementation of and compliance with Regulation Best Interest (Reg BI) and Form CRS (Client or Customer Relationship Summary),” according to the letter sent last week.

Although Reg BI went into effect in June 2020, the SEC did not have its first substantial case until last month when it charged broker-dealer Western International Securities and five of its brokers, accusing them of selling risk-averse clients $13.3 million in high-risk bonds without their awareness of the actual risk.

Congress is reviewing the SEC’s 2023 budget request of $2.15 billion, about $240 million more than it asked for this year’s budget. The plan includes an addition of 90 positions in its Division of Examinations (EXAMS), with 84 dedicated to oversight and exam activities: 34 to monitor investment advisors, 25 for broker-dealer Reg BI compliance, 20 for new registrants in swap markets and five for cybersecurity and market infrastructure. The remaining six positions are to support FINRA and MSRB oversight, data analytics, outreach and industry education.

“During FY 2023, EXAMS will continue to emphasize the protection of working families, particularly seniors and individuals saving for retirement,” according to the SEC’s budget request. “The division will focus on key issues including cyber and information security and compliance with recently adopted rules related to standards of care (including Regulation Best Interest), as well as additional practices that represent significant risks to retail investors such as deceptive sales practices, conflicts of interest, and elder abuse.”

The EXAMS division expects in 2023 to have about 1,000 exam staff responsible for overseeing more than 15,000 investment advisers with approximately $125 trillion in assets under management, 750 investment company complexes managing nearly 15,000 investment company portfolios, 3,500 broker-dealers with more than 150,000 branch offices, 520 municipal advisors and 400 transfer agents.

The agency said it needs the significant increase in headcount to:

- Address the challenges identified with overseeing and examining newly registered swap market participants.

- Increase oversight and examinations of broker-dealers with a focus on the implementation of Regulation Best Interest and other risks such as those associated with the rise of financial technology and information security.

- Increase oversight and examinations of entities responsible for critical market infrastructure with a focus on examining entities for compliance with Regulation SCI and cybersecurity preparedness.

- Increase the capacity of the program to examine and keep pace with the growing number of registered investment advisers, including those that advise private equity funds.

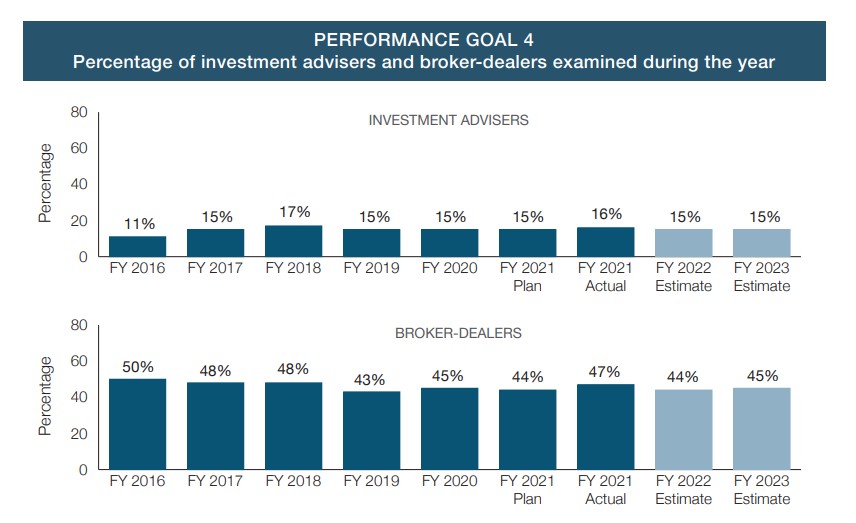

Last year, the SEC examined 16% of RIAs and 47% of broker-dealers. Although the agency said it wants to increase scrutiny, it does not plan to increase the percentage of RIAs and B-Ds it examines.

Associations Differ On SEC

In the IRI’s letter to the subcommittee, it said the institute’s 2022 Federal Retirement Security Blueprint called for “federal policymakers to ‘objectively assess how the regulatory framework is working in practice to ensure that America’s workers and retirees are protected by a clear, consistent, and workable best interest standard without depriving them of access to valuable financial products and advice.’ With this in mind, IRI respectfully encourages you to provide funding so that the SEC has sufficient staffing and resources to carry out its important work on Reg BI and Form CRS.”

The Financial Services Institute is not as gung-ho on SEC enforcement, cautioning against “regulation by enforcement,” according to its 2022 advocacy priorities, which said financial services firms, advisors and investors “rely on consistent, predictable rules governing the regulatory road.”

“Enforcement activity must not be used to establish new regulatory requirements, or what we deem ‘regulation by enforcement,’” according to the priorities. “This includes new or evolving interpretations of existing obligations, which should be appropriately done through Notice-and-Comment rulemaking. The rulemaking process provides stakeholders with an opportunity to engage in the process and firms and advisors with the transparency and certainty needed to operate their business and protect their investors.”

FSI Executive Vice President David Bellaire last month noted caution on the SEC’s Reg BI enforcement after what the FSI said was the agency’s overreach in establishing new disclosure standards on mutual funds through enforcement directives rather than by rulemaking. The association is wary of the same thing happening with Reg BI, according to an InvestmentNews article.

“We do expect to see some changes [to Reg BI] and for that to happen through examinations and enforcement and guidance to expand the regulatory expectations,” Bellaire said in an on-demand session of the BNY Mellon Pershing Insite conference, InvestmentNews reported.

The law firm Ballard Spahr said in a post that firms should get ready for intense scrutiny.

“SEC enforcement activity already has been active under Chair Gary Gensler, and the request for an increased budget is a clear sign that it will continue,” the firm said. “Given the increased regulatory activity on the horizon, it’s a good time for financial advisers, broker-dealers, private funds and publicly-traded companies to examine their risk and compliance functions and prepare for increased scrutiny.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Effective cybersecurity requires more than an insurance plan

How specialty drug ‘solution stacking’ can rein in pharmacy benefit costs

Advisor News

- Wall Street executives warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

- Tax implications under the One Big Beautiful Bill Act

- FPA launches FPAi Authority to support members with AI education and tools

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- How Will New York Pay for Hochul's State of the State Promises?

- As the January health insurance deadline looms

- Illinois extends enrollment deadline for health insurance plans beginning Feb. 1

- Virginia Republicans split over extending health care subsidies

- Illinois uses state-run ACA exchange to extend deadline

More Health/Employee Benefits NewsLife Insurance News