Insurers Working Quickly To Address Employee Shortage Crisis

Like most industries, insurance is struggling to add employees. In fact, the talent shortage is approaching crisis levels.

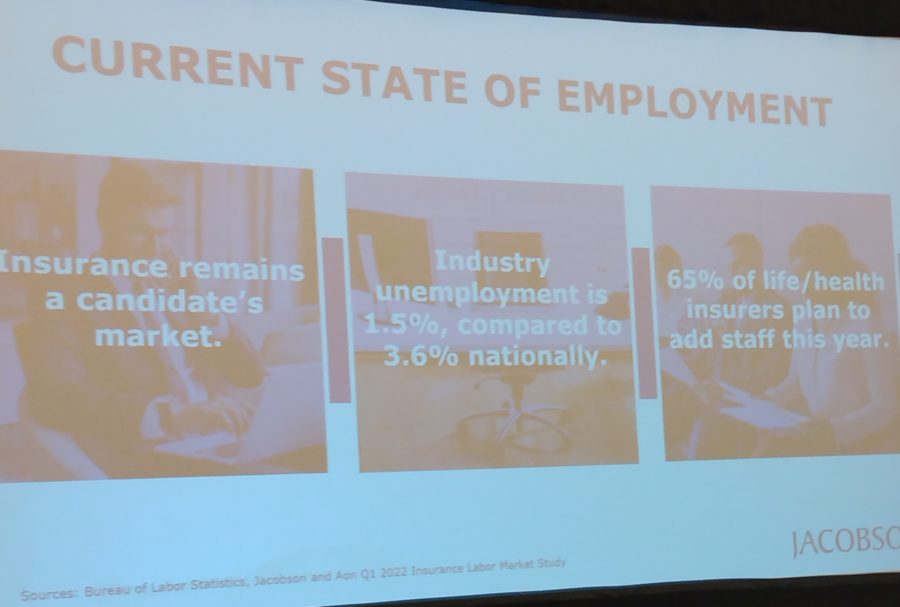

Insurance unemployment is at 1.5%, said Brad Whatley, managing director of The Jacobson Group, compared to the national 3.6% unemployment rate for all industries. Whatley hosted a session during the annual 2022 Life Insurance Conference last week, hosted by LIMRA, LOMA, ACLI and SOA.

Retention is a key issue in the insurance industry, Whatley said, The cost to replace an employee is estimated at one-half to two times the salary that employee made, he said.

"So, if you're paying somebody $100,000 in salary, that's $50,000 to $200,000 it's going to cost you to replace them," he added.

Effective recruiting is the next hurdle. Nearly two out of three life/health insurers plan to add staff in 2022, Whatley noted. The question is, where will those additional employees come from?

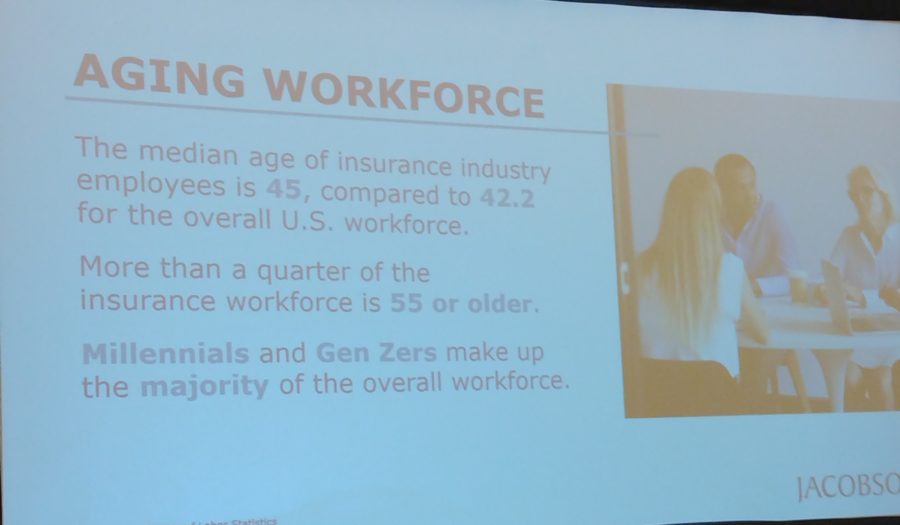

Adding to the crisis nature of the talent issue is the age of insurance agents. While millennial and Generation Z workers make up the majority of the entire workforce, the insurance industry trends older, Whatley noted.

"Insurance, it is no secret, is one of the most aged workforces in the industry," he said.

The median age of the insurance industry employees is 45, compared to 42.2 for the overall U.S. workforce. However, "where that number gets a bit skewed is the insurance industry is much more dominated by the boomer section than any other industry out there," Whatley explained.

In fact, one-quarter of the insurance workforce is 55 or older.

The COVID-19 pandemic did not help the insurance industry personnel problem. Studies show that older workers are more likely to just retire early rather than press on through adversity, such as job loss, or a pandemic interruption.

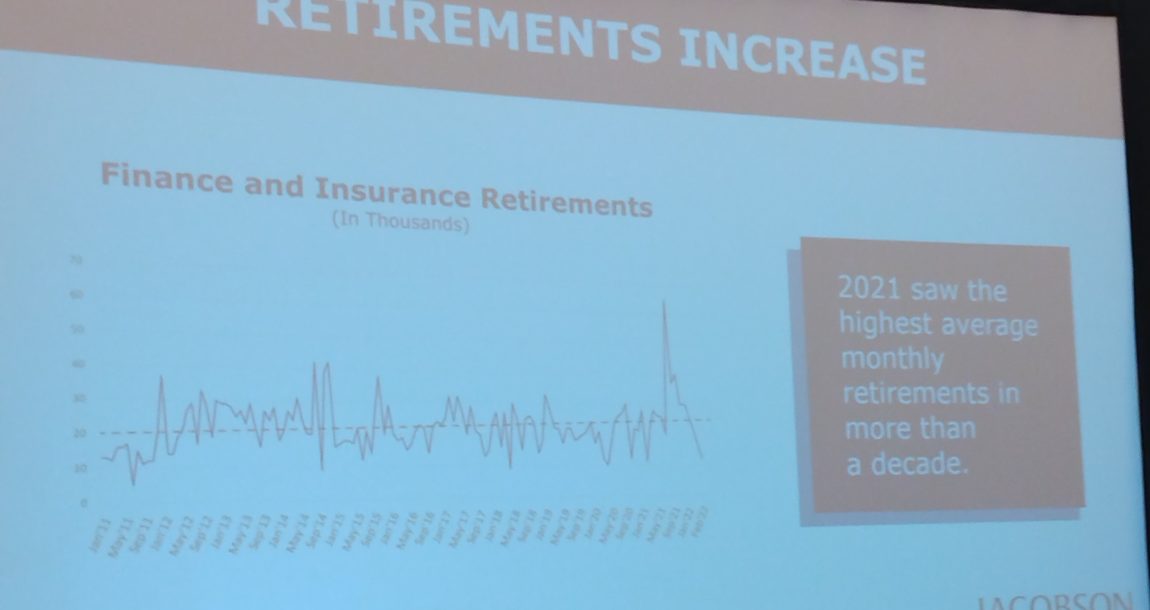

Data from the past two years proves that to be true, as insurance workforce retirements rose dramatically.

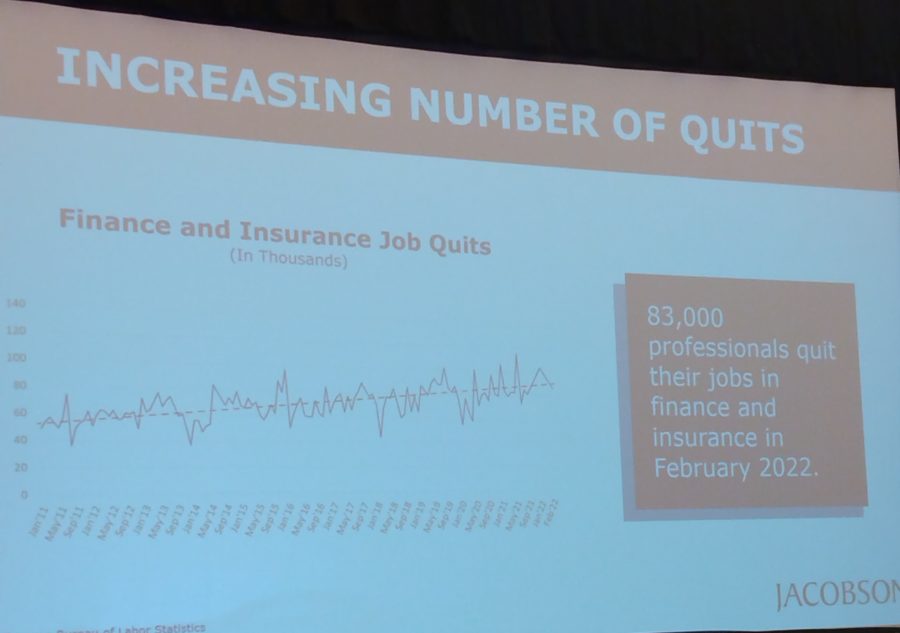

However, the pandemic only exacerbated a problem that began long before. At least since 2011, the financial services industry has seen an increasing level of "quits." It is an alarming trend, Whatley noted.

Searching For Answers

When the job market is weak, it is up to employers to adapt, Whatley noted, and insurers are doing plenty of adapting. For starters, the pandemic-inspired work flexibility is likely to become a permanent perk for insurance employees. Nearly nine out of 10 carriers plan to offer a "hybrid approach," that is, the ability to work from home and/or office, in the future, Whatley reported.

Insurers are open minded about allowing employees to work some set day hours, and perhaps deferring a couple hours to the evening, he added.

"Thirty-nine percent of carriers do plan to offer flexible hours, which is something that I think is up dramatically from years past," he said.

Likewise, thoughtful retention plans can be extremely effective at limiting employee turnover and boosting bottom-line performance, Whatley explained. Components of an effective retention plan include communication, exposure, compensation, intellectual stimulation, professional challenges and career path projection, he said.

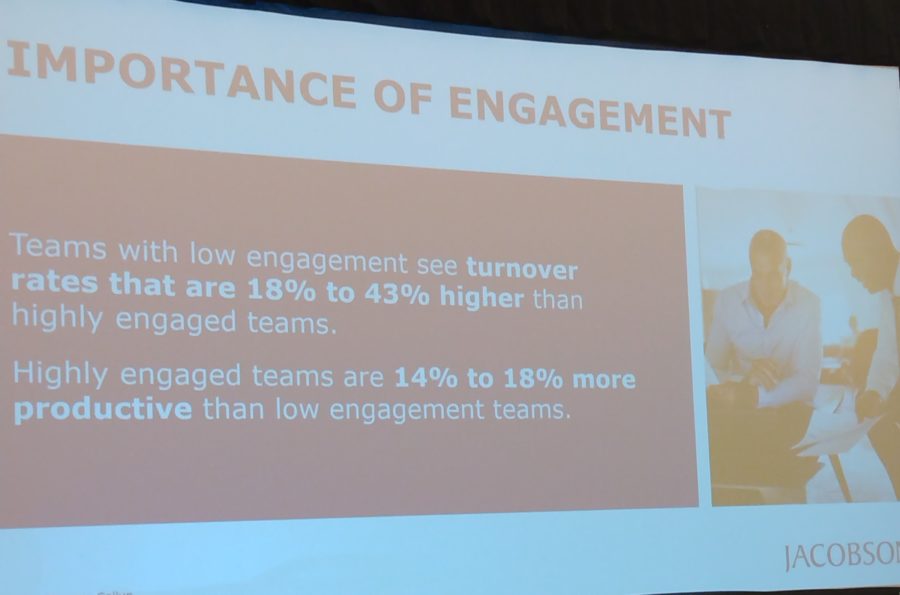

Engagement is a major theme across several of those categories. It is an investment that pays off handsomely for employers.

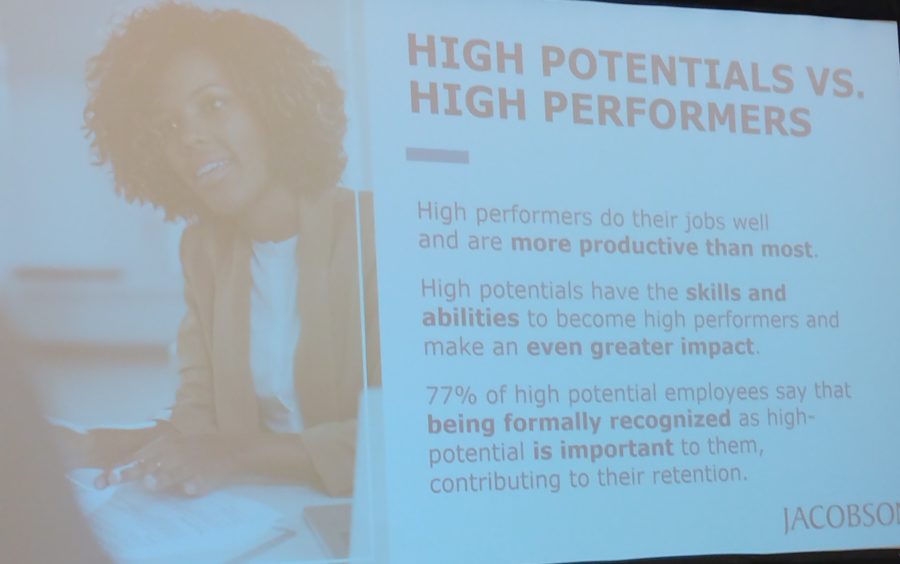

Identifying "high potentials" is just as important as the focus on high performers, Whatley explained. Both are crucial strategies for maintaining the consistency of a business.

"What we've found is that's just as important as maintaining those high performers in your organization," Whatley said of the high potentials. "You want to keep the people like that so when you have that next wave of retirements, you're keeping that full intellectual ability in your organization. That could be your next wave of leaders."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Integrity Marketing Group To Acquire Ash Brokerage In Massive Deal

Iowa Man Pleads Guilty To Insurance Fraud In Auto Accident

Advisor News

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Reed: 2026 changes ABLE accounts benefit potential beneficiaries

- Sickest patients face insurance denials despite policy fixes

- Far fewer people buy Obamacare coverage as insurance premiums spike

- MARKETPLACE 2026 OPEN ENROLLMENT PERIOD REPORT: NATIONAL SNAPSHOT, JANUARY 12, 2026

- Trump wants Congress to take up health plan

More Health/Employee Benefits NewsLife Insurance News