How will Roe v. Wade reversal impact employee health plans?

Employers are trying to assess the effect of the U.S. Supreme Court’s latest ruling on abortion on workplace benefit plans.

On June 24, the high court overturned Roe v. Wade, ruling that no federal constitutional right to abortion exists, and that establishing that abortion can be regulated by the states at all stages of pregnancy.

At a webinar on Thursday, consultants from Mercer discussed the impact the court’s decision will have on the workforce and employee benefits.

The most immediate impacts on employee benefits will be that many employees may have limited or no access to surgical abortion in their state, and that restrictions on medications commonly used in pregnancy terminations and miscarriages are likely to increase. That was the word from Katherine Marshall of Mercer’s law and policy group.

Employers should determine what their medical and pharmacy plans cover today, and consult with legal counsel on the implications of the court decision and newly effective state abortion laws for covered benefits, Marshall said. In addition, she advised that employers determine what changes will be made to their benefit plans and to stay apprised of emerging federal and state legislation and court challenges.

“Many employers are thinking through the options,” Marshall said. “The goal is to provide consistent benefits regardless of where the employee lives.”

She said employers who want to provide consistent access across all states may consider the following:

- Implementing or expanding travel and lodging benefits.

- Exploring options through telemedicine, women’s health services or health care navigation.

- Communicating and promoting time-off and leave policies for workers who must travel to access services.

Common options for covering travel and lodging expenses related to out-of-state abortions, Marshall said, include group health plans, health reimbursement arrangements integrated with the group health plan, employee assistance programs and taxable reimbursement.

Travel and lodging policies

Many employers already provide coverage for travel and lodging an employee incurs when undergoing an organ transplant or some other procedure not readily available in a worker’s home community, said Julie Campbell, principal, U.S. heath and benefits, with Mercer. How will those travel and lodging policies change to assist workers who travel out of state to obtain an abortion?

Employers already have enacted travel and lodging policies and are offering reimbursement for travel from a state with no abortion services to a state with services, she said. Employers who want to provide consistent access to abortion across all state may consider issues such as expected benefit use and the impacted population, existing plan design and coverage, pharmacy coverage and access, the role of telemedicine or on-site clinics, taxation considerations and legal exposure.

Some health insurers and third party administrators may continue to pay abortion claims received, regardless of where the abortion provider is located, Campbell said. Some employers and carriers are adding legal language to expressly exclude coverage where abortion is illegal. National medical carriers can administer a travel and lodging benefit for self-insured plans.

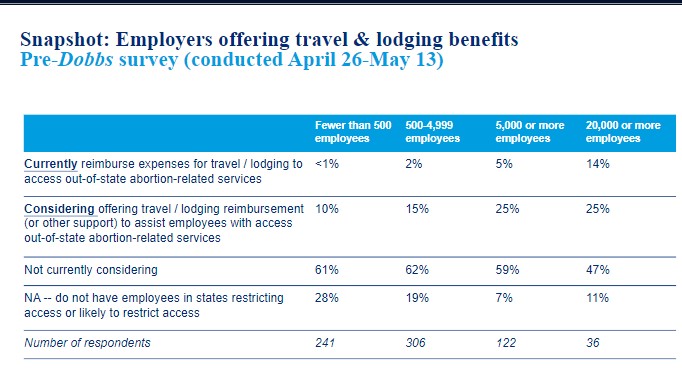

Even before the Supreme Court ruling was handed down, some employers already offered travel and lodging benefits to help workers access out-of-state abortion-related services, and others considered it, a Mercer survey taken between April 26 and May 13 indicated.

Fourteen percent of employers with 20,000 or more workers said they current reimburse expenses for traveling and lodging while 25% of employers with 20,000 or more workers said they are considering offering reimbursement.

The majority of employers surveyed – ranging from 62% of those with fewer than 4,999 employees to 47% of those with 20,000 employees – said they were not considering such a benefit.

Pharmacy plan coverage

Pharmacy plan coverage also may be impacted by the court ruling, said Raymond Brown of MercerRx.

A large percentage of elective pregnancy terminations are supported through medications, he said, the most common of which is mifoprostone taken in combination misoprostol. Distribution of mifoprostone traditionally has been through certified physicians. The Food and Drug Administration is working through certifying pharmacies for distribution of the drug.

Brown said most pharmacy benefit managers will not distribute mifoprostone through the mail even if the drug is covered under the plan. He said pharmacies may be able to dispense the drug by late 2022 in addition to continuing its access through certified providers. A number of states restrict access to these medications.

Meanwhile, emergency contraception continues to be available at retail stores and some mail order pharmacies also may ship it to patients.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Kings of the Hill: Indexed products spur life, annuity sales

Nationwide adds death benefit features to Defined Protection RILA

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

More Annuity NewsHealth/Employee Benefits News

- The Health Care Cost Curve Is Bending up Again

- Republicans can make healthcare affordable by focusing on insurance reforms

- Governor Stitt strengthens regulations for Medicare Advantage Plans

- Health insurance CEO can't commit to safe AI practices in Congressional hearing

- Harshbarger presses insurance CEOs on market control, vertical integration, conflict of interest

More Health/Employee Benefits NewsLife Insurance News