How ‘solution stacking’ can rein in pharmacy benefit costs

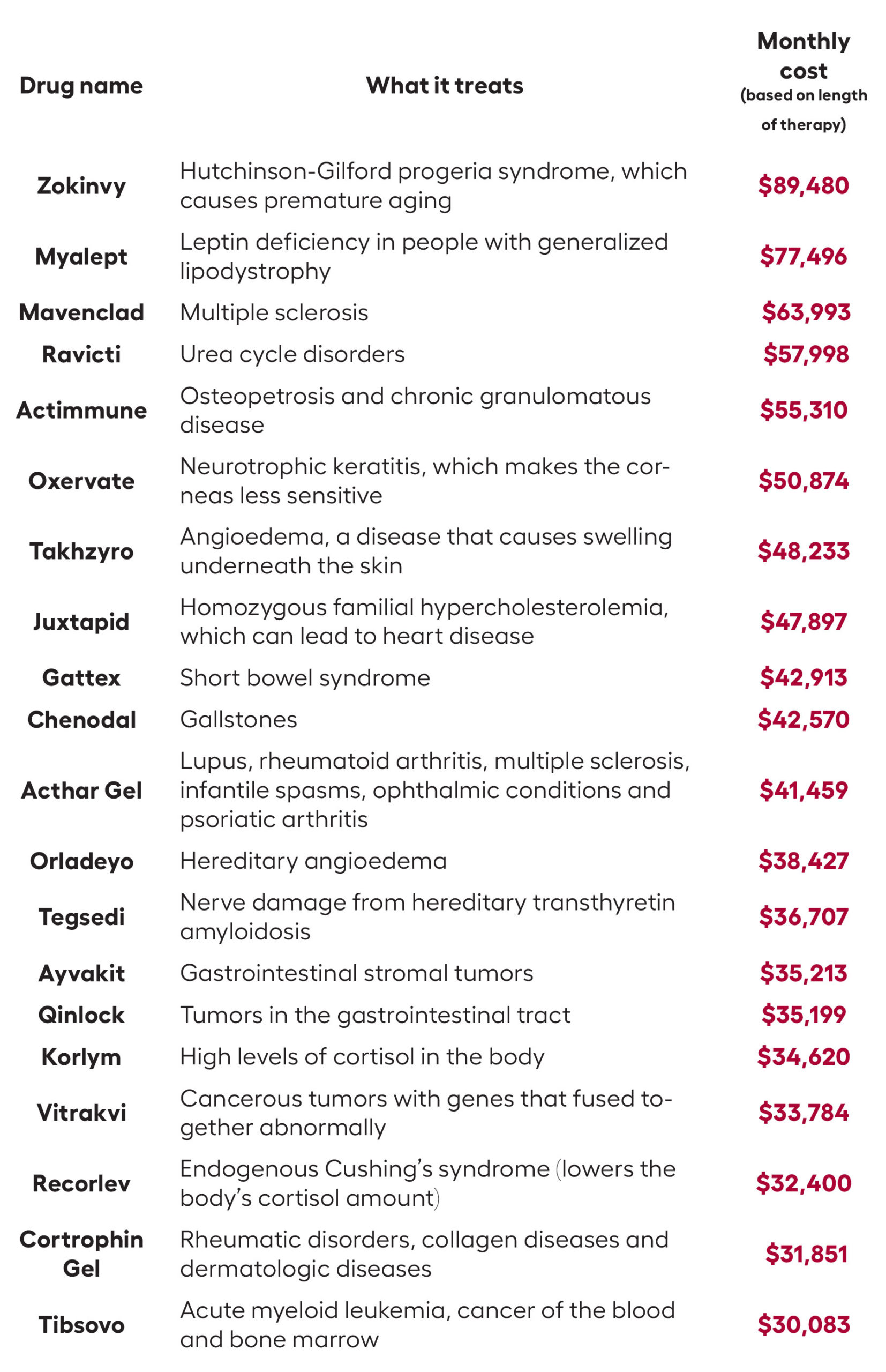

Brokers and employer groups alike know that 5% to 10% of insured workers and their dependents drive 50% to 60% of the cost of pharmacy claims. A few members with prescriptions for a specialty drug with a five-figure price tag can easily represent the majority of an entire group’s pharmacy spend.

These drugs are often lifesaving or provide a dramatic quality of life improvement for those who take them. No one would question the necessity of using them. But when a group can mitigate some of the cost without affecting the clinical outcome, it can be a game changer. The broker who unlocks these savings becomes a trusted ally.

Typically, plan sponsors believe they don’t have many options for specialty drug claims and simply end up paying them. But that’s not the case. When one solution doesn’t work, there are likely several more options to try. A little ingenuity can make a significant impact on drug spend and trends. This is a technique I describe as “solution stacking,” which cycles through multiple specialty drug programs and often leads to a major cost reduction. Here’s how solution stacking works.

Step 1: Select the right pharmacy benefit management partner.

The foundation of this solution is selecting a pharmacy benefit manager that is willing to work with outside solutions. Since the profit margins of most PBMs are inversely tied to the number of programs they allow, this can be a challenge. But there are PBMs out there that highlight their flexibility as a differentiator.

Step 2: Build flexibility into the PBM contract.

Solution stacking is possible only if the PBM allows it. When structuring a PBM contract, make sure it allows the client to bring in third-party solutions. This must be specified in the contract to ensure access to these programs. This includes a commitment from the PBM to support any required data feeds at no cost and stipulates that implementing these programs will not affect pricing terms.

Step 3: Identify the greatest potential savings.

Most drug manufacturers provide income-based manufacturer assistance programs (MAPs) for high-cost specialty drugs. If the member with a high-cost pharmacy claim qualifies for one of these programs, it typically results in the group paying only about 30% of the cost of the original claim.

Imagine a member — let’s call her Cindy — has a prescription with an annual cost of $100,000. If her income is low enough to qualify for a MAP, the plan sponsor would pay only $30,000, a savings of 70%.

Plan sponsors and members must be proactive about MAPs. These programs aren’t triggered automatically. If the member doesn’t apply and provide income documentation, the plan sponsor is still responsible for the entire cost of the drug.

Step 4: Try multiple international filling solutions.

If the member’s income is too high to be eligible for a MAP, a good Plan B is typically international mail order. These programs source drugs from other countries with health care systems on par with the U.S., such as Canada and New Zealand. The savings average around 50%, so Cindy’s plan sponsor would be paying $50,000 instead of the full $100,000.

Each international mail-order solution may source from a different country, so it can take more than one attempt to source the drug. For example, only two of the three formulations of Humira are available in Canada. If the member needs that third formulation, an international filling partner sourcing from Canada will come up empty and you’ll have to shop around.

Step 5: Try domestic filling, specialty copay and dosage optimization.

Now, let’s assume that the drug is not available internationally. Plan C is likely going to be sourcing it through another specialty pharmacy outside of your PBM. The savings here are more modest, maybe 20%. But that $20,000 reduction on Cindy’s claims is still significant.

This option is usually paired with a specialty copay program to ensure the group can take advantage of any specialty copay dollars. Specialty copay programs do not require income thresholds, so everyone qualifies.

One factor to consider here is rebates. Although the price could be lower at an outsourced specialty pharmacy, the rebate from the PBM could be higher. It’s also possible that the outsourced specialty pharmacy gets a better rebate as well as a better price.

Outsourcing to another specialty pharmacy can work well in conjunction with dosage optimization, where outreach to the provider ascertains if it might be possible to swap in a generic or switch to a different form of dosage. For example, the prostate cancer drug abiraterone costs $10,000 for 500 mg tablets. But two 250 mg tablets? That’s only $500, decreasing the cost by 95%.

Step 6: Member engagement.

In order to get the most out of the program, there must be tight coordination between the broker, the group and the vendor. Getting members enrolled requires a bit of legwork on their end, so engaging the members early is key to success.

Worth the effort

It may seem odd to devote so much attention to managing a handful of specific claims. But even a savings of 10% on claims of this size is significant. Most employers spend 50% of their pharmacy costs on a very small amount of specialty users. So this additional work can have a significant return on investment. By exploring multiple solutions, you increase the likelihood that the member and their drug will fit one of those solutions

Americans think about death, but won’t plan for it

A simple strategy to use life insurance for income protection

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

More Annuity NewsHealth/Employee Benefits News

- 'Welcome to the movement': Whitman College staff seek to form union

- Red and blue states want to limit AI in insurance. Trump wants to limit the states

- NABIP asks Congress to stabilize ACA market, address affordability

- Expired federal subsidies leave fewer Walla Walla residents with health insurance

- Red and blue states alike want to limit AI in insurance. Trump wants to limit the states.

More Health/Employee Benefits NewsLife Insurance News