47% Of Women Saved Less For Retirement In The Wake Of COVID-19

Add saving for retirement to the list of things that COVID-19 has impacted, according to a new survey from the personal finance website The Penny Hoarder.

The survey of more than 1,000 people in October found disparities in age groups, gender and even geographic areas in the way people are approaching retirement savings during the pandemic era. While overall a majority of those surveyed, 67%, said they’ve made no change in how much they’re saving, the rest of the survey was split almost equally between those who said they were saving less (17%) and those who said they were saving more (16%).

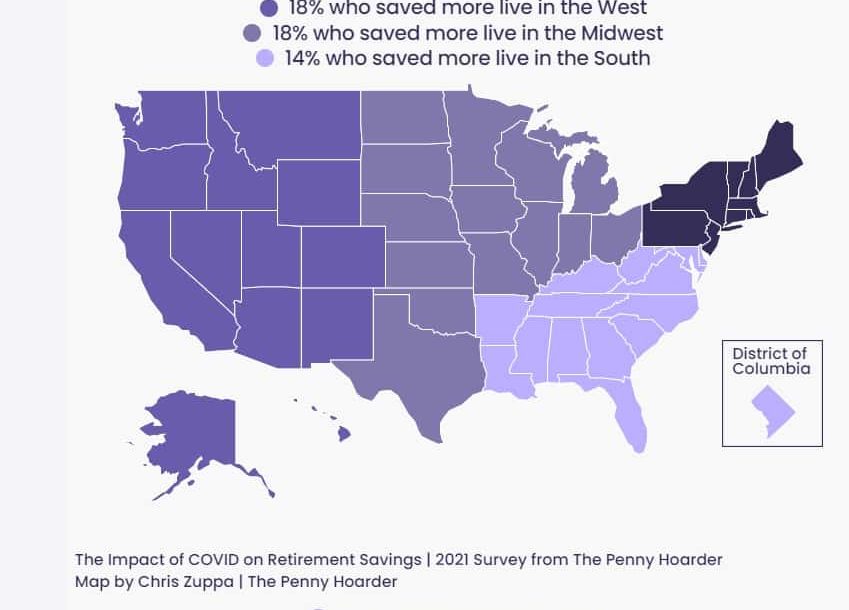

The biggest disparities in the data occurred geographically with 44% of residents in the Northeast saying they were saving more for retirement, while only 18% in the West and Midwest saved more.

About 14% of respondents in the South said they were saving more while 31% said they were saving less. The Penny Hoarder attributed the small showing from residents in the South to disruptions in the tourism industry and lower median wages in Southern states compared with Northeastern states.

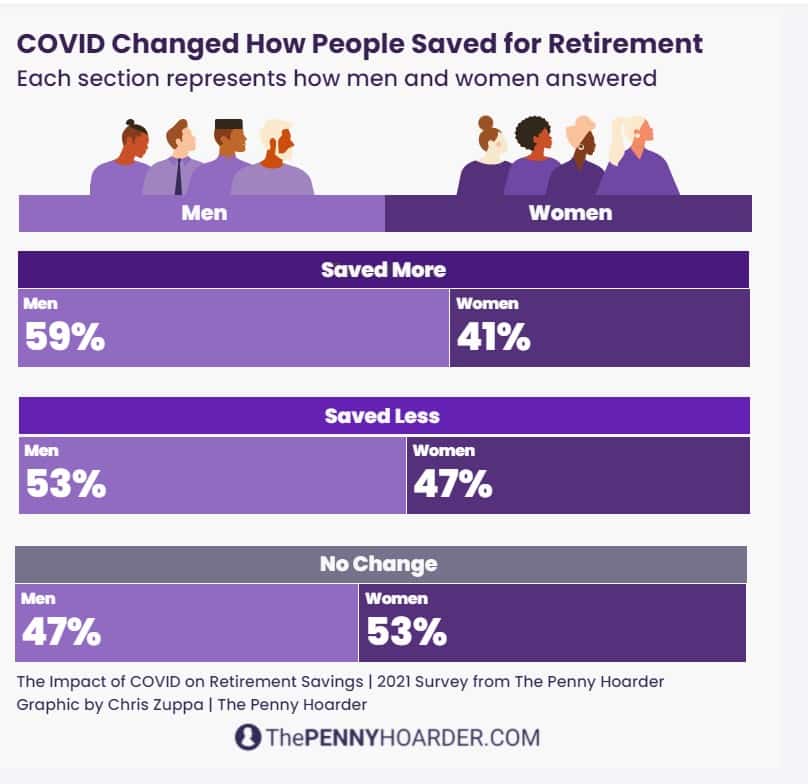

Gender differences were also revealed as 59% of men said they are putting more away for retirement compared with only 41% of women saying they were. Perhaps that’s not surprising given that women were more likely to work in sectors hardest hit by pandemic closings, such as retail and hospitality.

Unemployment rates for women were higher than men during the pandemic, according to the Bureau of Labor Statistics, and since most people save for retirement through employer-sponsored vehicles, participation rates faltered.

“Less workforce participation, makes it particularly challenging for women to boost their savings,” the survey concluded.

A similar survey in September of 2,000 parents found that nearly one in five said they had to quit a job due to high child care costs — “finding it made more sense to leave the workforce entirely than to pay for daycare or babysitters.”

Millennials were the age group saving more for retirement in response to the pandemic, the survey showed. Thirty-five percent of those saving more were between the ages of 25 and 34. Meanwhile, of those who said they were saving less nearly one fourth were members of Generation X, those between the ages of 45 and 54.

The website concluded its survey showing how Americans are struggling to save enough money, and were already having difficulties in saving before the pandemic hit. But also it shows how uneven the recovery has been.

“The economic turmoil of the pandemic underscored some critical investing for the long term, including keeping calm during turbulent markets and using market slumps as an opportunity to invest when prices are low,” The Penny Hoarder said.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Western & Southern Completes Accelerates Digital Expansion Through Fabric Acquisition

Building a Winning Talent Strategy – with Alison Salka

Advisor News

- Study: Do most affluent investors prefer a single financial services provider?

- Why haven’t some friends asked to become clients?

- Is a Roth IRA conversion key to strategic tax planning?

- Regulator group aims for reinsurance asset testing guideline by June

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Moody’s 2025 health insurance outlook is negative

- Securian Financial Launches Accident and Critical Illness Insurance Products for Affinity Market

- Health plans facing Ozempic-type drug coverage, AI adoption in 2025

- Many died in sober living homes due to fumbled fraud response

- Let's talk about Long Term Care insurance

More Health/Employee Benefits NewsLife Insurance News

- More Older Adults Can Access Innovative Medicare Supplement Insurance

- How Technology Can Help to Transform the Insurance Industry

- Securian Financial Launches Accident and Critical Illness Insurance Products for Affinity Market

- Legals for January, 31 2025

- Automatic Shelf Registration Statement (Form S-3ASR)

More Life Insurance News