Helping the public get an A+ in financial literacy

According to the most recent available Federal Reserve SCF data, the average retirement savings for Americans who are between the ages of 65 and 69 is $206,819. The highest average was among those 55-59 years old at $223,493. According to the Government Accountability Office, however, only about half of households age 55 or older have any retirement savings. About a third have no defined benefit plan or retirement savings, and about 20% have a defined benefit plan but no retirement savings. The remaining 52% have some retirement savings.

Those numbers are alarming.

There are some signs of hope, however. A recent BlackRock study found that Generation Z workers, ages 18-25, are saving an average of 14% of their income. So one might assume that financial literacy is improving among the younger generations. Among the older generations — millennials, Generation X and baby boomers — the average is 12%.

However, with nearly half the population having little or no retirement savings, there is definitely a shortfall when it comes to financial literacy.

A savvy advisor I recently had a conversation with suggested that financial literacy education should start in middle school. My wife, Lisa, is a middle school engineering teacher. If we’re teaching engineering in middle school, why not financial literacy? The advisor went on to say that in terms of retirement planning, even people who work in other aspects of the financial industry are not educated in what is needed to plan for their financial future and retirement. It’s a different set of skills.

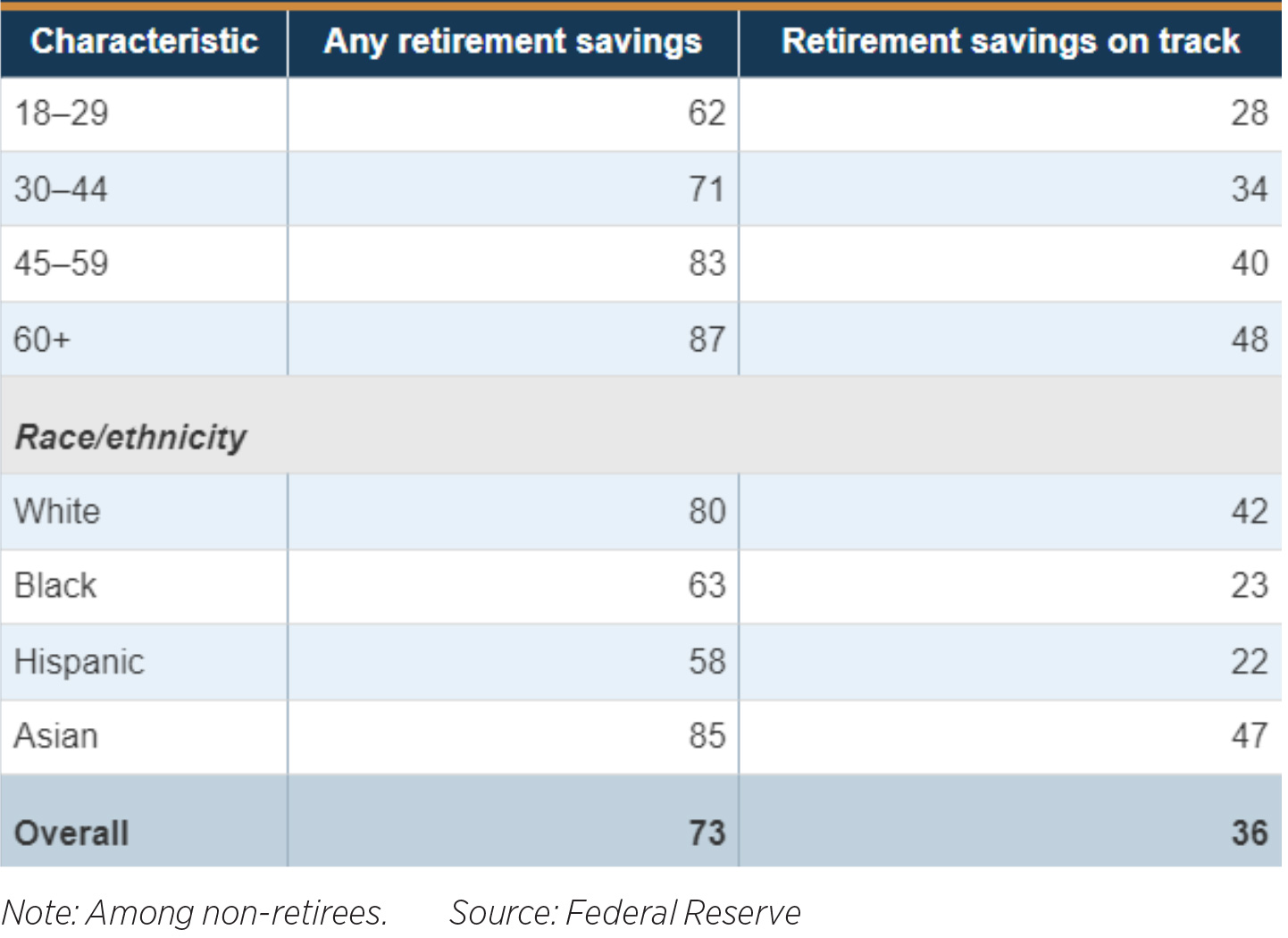

About one-fourth of non-retirees have no retirement savings at all, according to the Federal Reserve. And only about one-third of non-retirees believe their saving plan is on track. And the breakdown by race/ethnicity shows an even greater disparity.

While 42% of white people believe their retirement savings is on track, that percentage drops to 23% for Blacks and 22% for Hispanics. And while 80% of whites have at least some retirement savings, that percentage drops to 63% for Blacks and 58% for Hispanics. (See chart.) So there is also a disparity in financial literacy across racial and ethnic groups, and, in fact, a more intense need for financial literacy.

While it’s alarming that only 40% of those ages 45-59 believe their retirement savings are on track, according to the Federal Reserve, it’s also alarming that only 34% of those ages 30-44 believe they are on track. As we know, the earlier people start saving for retirement, the greater chance they have at meeting their retirement savings goals.

Obviously, improved financial literacy is better for all: those who are managing their budgets and planning effectively for retirement, and for the financial advisor community, since improved literacy would provide a greater pool of the public seeking financial assistance.

It’s also clear that there is a large percentage of the public in the middle-aged demographic who need financial advice and help steering their retirement planning onto a better course. For them, the need is more urgent.

I noticed recently that Schwab MoneyWise has a feature on its site called “Ask Carrie.” Certified financial planner Carrie Schwab-Pomerantz offers the kind of advice that the public needs in order to become financially literate.

She does so in a format that we’ve all come to recognize and be comfortable with — the advice column — and which doesn’t reek of making an overt sales pitch, but only offers sound advice. This type of approach is one of many possible methods of addressing the need for financial literacy. There is no right or wrong way, but more outreach is needed. There are many ways to connect — through advice columns or blogs on your website, a regular podcast, newsletters — maybe even offering a seminar at your local high school. Letting the public know that you are there to offer help and advice is a crucial step in helping to turn the tide and improve financial literacy.

Welcome to FPA

As we strive to broaden the voices in the magazine, we are working to expand the number of professional associations providing useful information and discussion for our readers.

With this issue, we welcome the Financial Planning Association to our pages with their first article, “Pro bono financial planning benefits society and advisors,” which takes a look at how offering your time and guidance can make you a better financial planner. FPA is the leading membership organization for Certified Financial Planner professionals and those engaged in the financial planning process, and we know the association will add to the valuable discussions and provide actionable information for our readers. Welcome to FPA!

John Forcucci

Editor-in-chief

The how and when of texting clients

Helping clients navigate difficult estate-planning conversations

Advisor News

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

More Advisor NewsAnnuity News

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

- 2024 Letter to Shareholders

- Fortitude Re Announces $4 Billion Annuity Reinsurance Agreement with Taiyo Life Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Investigators from University of Pennsylvania Have Reported New Data on Managed Care (Emergency Medicaid Enrollment After Traumatic Injury Predicts Long-term Health Care Utilization): Managed Care

- New Findings on Managed Care and Specialty Pharmacy Described by Investigators at University of Minnesota (Potential Benefits of Incorporating Social Determinants of Health Screening On Comprehensive Medication Management Effectiveness): Drugs and Therapies – Managed Care and Specialty Pharmacy

- Health Notes

- Medicare Advantage marketing driving up costs; fiduciary role recommended

- Latest state Dem hospital cost reform skips Econ 101 | HUDSON

More Health/Employee Benefits NewsLife Insurance News

- Global Atlantic 2025 Retirement Outlook Survey: Majority of Investors Worried about Outliving Assets

- Aegon announces changes to its Board of Directors

- Proxy Statement (Form DEF 14A)

- A-CAP Counters Desperate Attempt by Utah Insurance Department to Distance Itself from its Faulty Allegations

- AM Best Affirms Credit Ratings of Nan Shan General Insurance Co., Ltd.

More Life Insurance News